Initial Coverage Report

Supreme Industries Ltd. | Initiating Coverage Report

Supreme Industries Ltd.

20th July 2022

Volumes to rally while realizations may correct

Supreme Industries Ltd. (SIL) is India’s most prominent plastic product

manufacturer, with a presence across multiple plastic businesses. SIL holds

leading positions in all four business segments (plastic pipes, packaging,

industrial, and consumer products). The company generates most of its

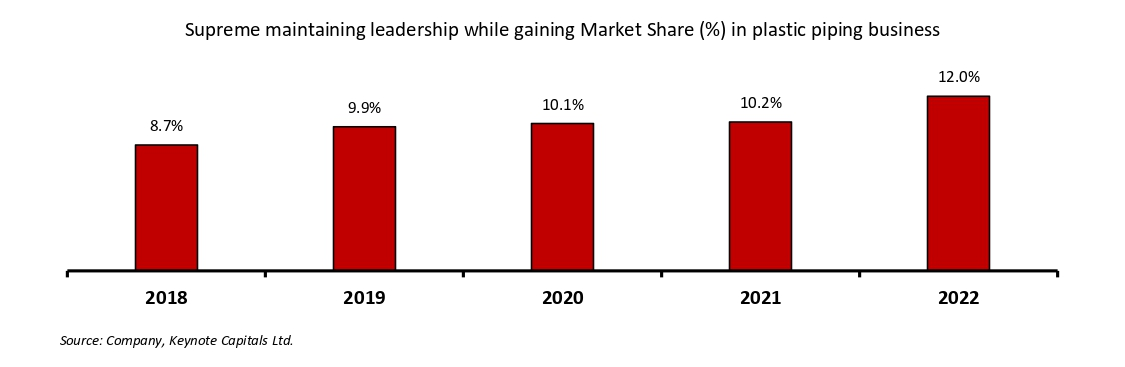

business from the plastic piping business, where it has the pole position with

an approximately 12% market share of the plastic piping industry. We

initiate coverage on Supreme Industries Ltd. with a NEUTRAL rating and a

target price of Rs. 1,958.

NEUTRAL

CMP Rs. 1,893

TARGET Rs. 1,958 (+3.4%)

Company Data

| MCAP (Rs. Mn) | 2,40,475 |

|---|---|

| O/S Shares (Mn) | 127 |

| 52w High/Low | 2694 / 1669 |

| Face Value (in Rs.) | 2 |

| Liquidity (3M) (Rs. Mn) |

107 |

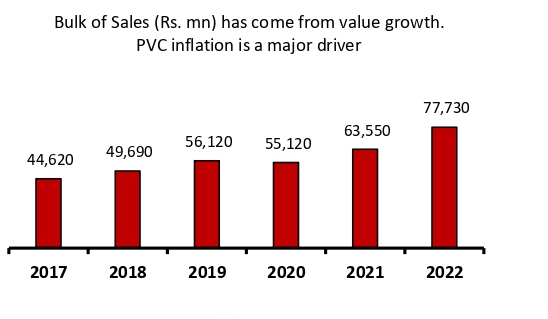

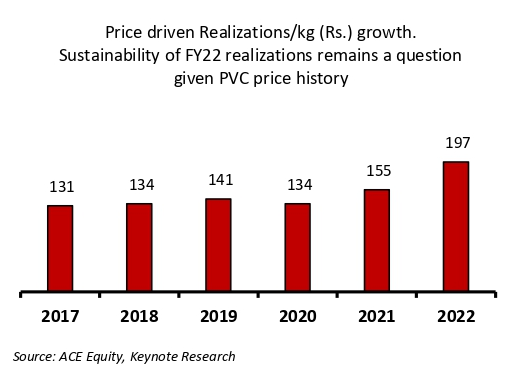

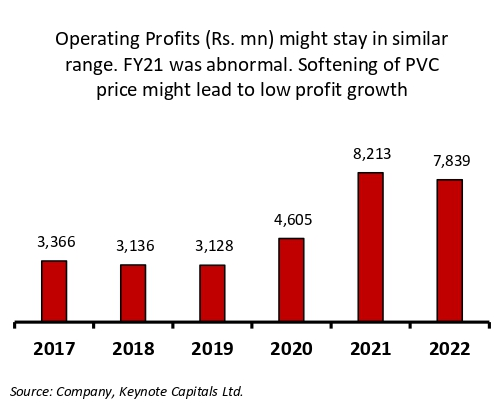

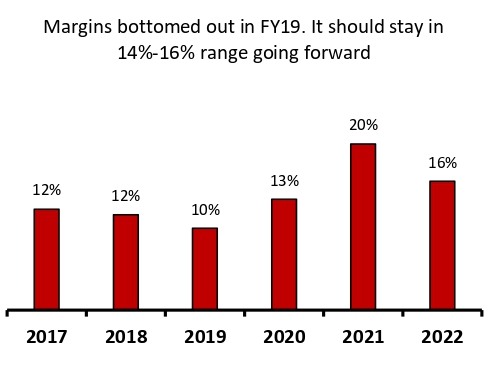

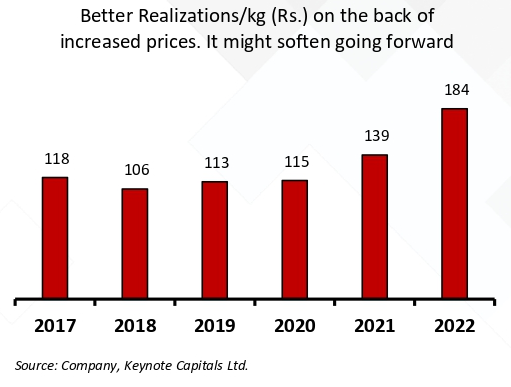

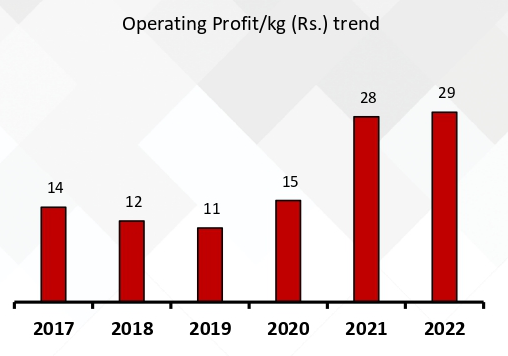

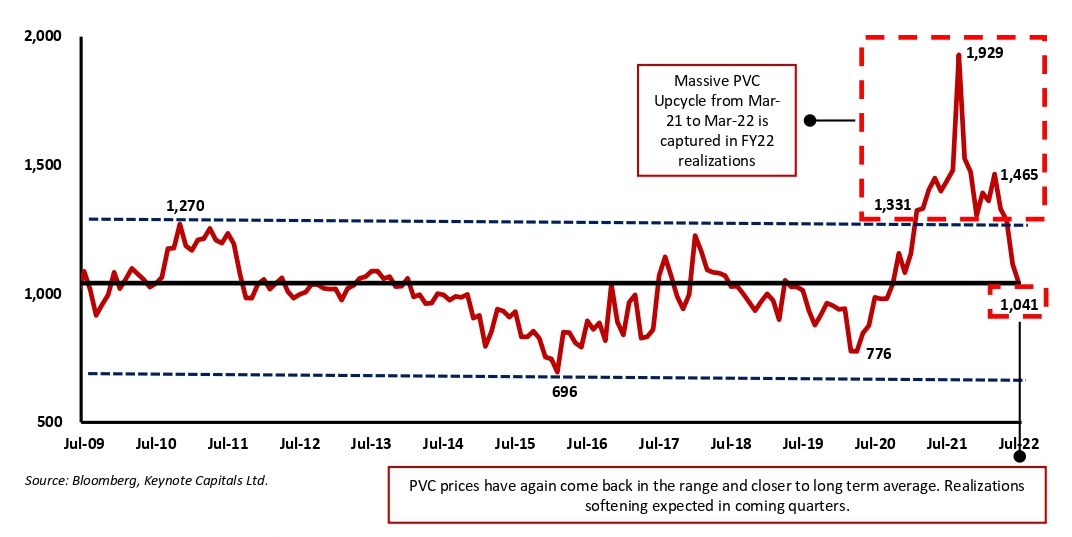

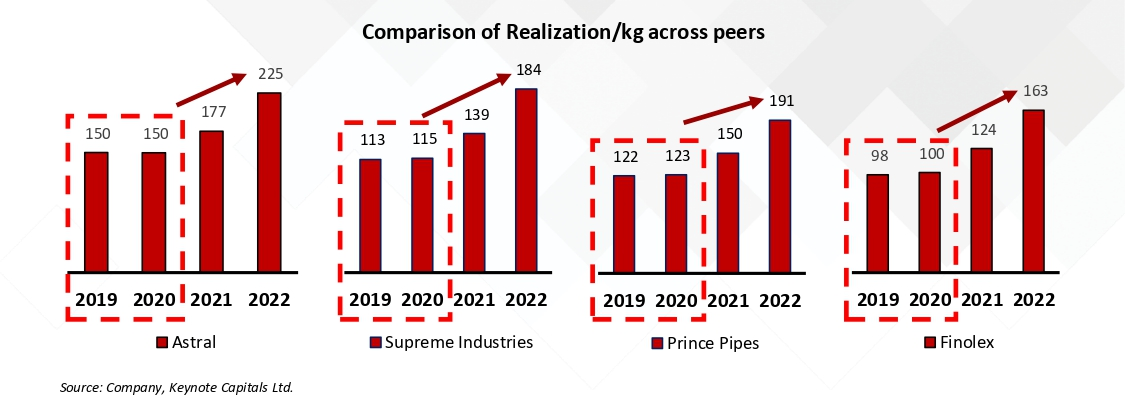

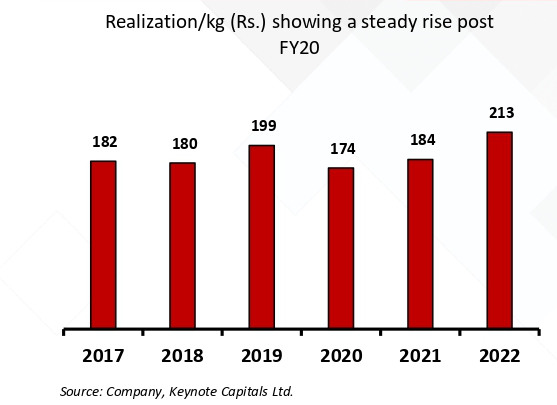

Elevated PVC prices led growth may not sustain for long

Overall realization/kg for SIL has shot up abnormally from Rs. 141 in FY19 to

Rs. 197 in FY22. This spike has come because of the elevated PVC prices.

Material price cooling has already taken place, and it looks like some softening

will be seen in coming quarters. This fall in PVC prices will result in inventory

losses and dent profitability. Though realization levels might not come down to

historically low levels, FY22 levels are challenging to sustain, given the supply,

situation continues to normalize.

Shareholding Pattern %

| Mar 22 | Dec 21 | Sep 21 | |

|---|---|---|---|

| Promoters | 48.85 | 48.85 | 48.85 |

| FIIs | 16.16 | 16.16 | 10.38 |

| DIIs | 19.65 | 19.70 | 25.30 |

| Non-Institutional | 15.34 | 15.29 | 15.47 |

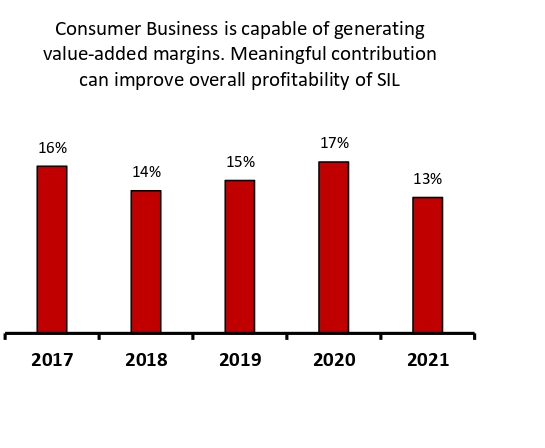

Breakthrough efforts are needed to increase the contribution of Valueadded products

The company has put in considerable efforts since FY12 to increase the share

of Value-Added Products (VAP) to its sales. From FY17 onwards, the

contribution of VAP to total sales has stagnated in the 38-40% range. The

company needs to accelerate efforts to be able to breach this range.

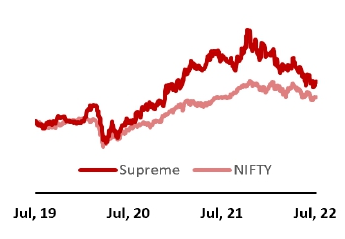

Supreme vs Nifty

Source: Keynote Capitals Ltd.

Optionalities have started performing

The company achieved a much-needed breakthrough with its composite LPG

cylinders in FY22. SIL received an order for Indian Oil Corporation Ltd., which

marks the introduction of this product in the domestic market. Currently, the

scale is very small to move the needle, but SIL can benefit immensely if this

becomes widely acceptable. Another positive is that this product falls under

the VAP category. More considerable success can increase the VAP

contribution to total sales and might result in valuation re-rating.

Key Financial Data

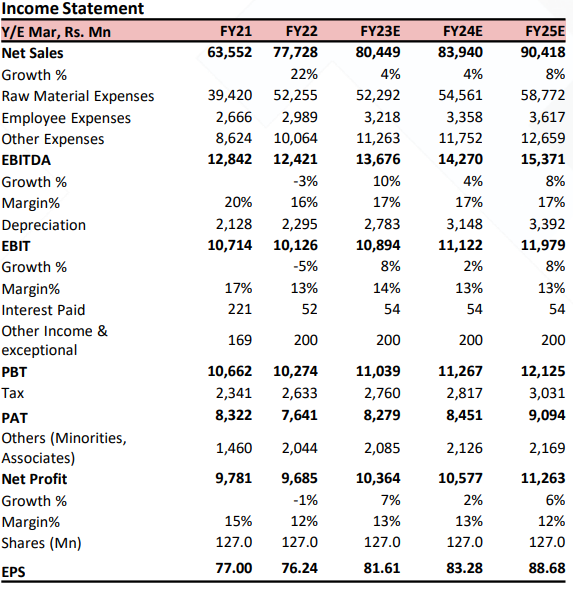

| (Rs mn) | FY22 | FY23E | FY24E |

|---|---|---|---|

| Revenue | 77,728 | 80,449 | 83,940 |

| EBITDA | 12,421 | 13,676 | 14,270 |

| Net Profit | 7,641 | 8,279 | 8,451 |

| Total Assets | 52,607 | 59,601 | 67,585 |

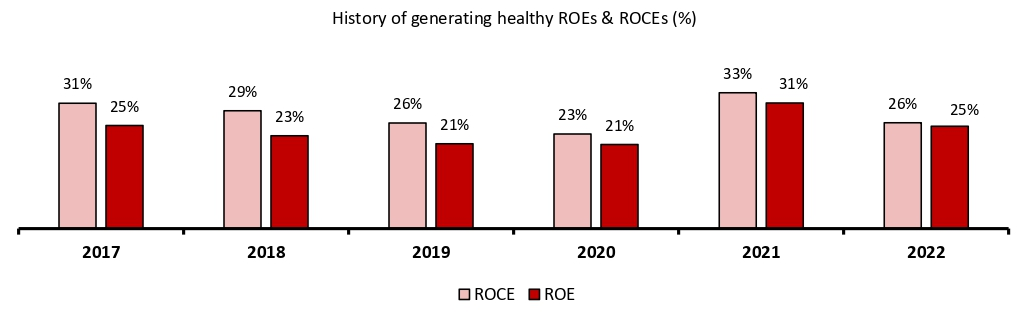

| ROCE (%) | 27% | 25% | 22% |

| ROE (%) | 28% | 25% | 21% |

Source: Company, Keynote Capitals Ltd.

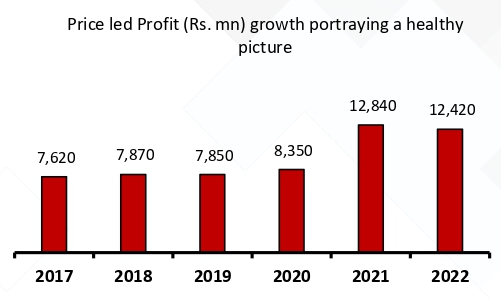

View & Valuation

We initiate coverage on Supreme Industries with a NEUTRAL rating and a

target of Rs. 1,958 (24x FY23 earnings). Over the last two years, sales and

operating profit has grown based on rising PVC prices and exceptional

performance from Supreme Petrochem. Sustainability of such performance

looks difficult therefore SIL is expected to give mid to high single-digit growth

at both levels. Strong performance can sustain/correct moderately if PVC

prices start moving up from current levels.

Supreme Industries Ltd. | Initiating Coverage Report

About Supreme Industries

Incorporated in 1942 at Wadala Mumbai, Supreme Industries Ltd. (SIL) was

promoted by the family of Kantilal K Mody. In 1996, the Taparia family took

control of the company by outright purchasing shares. Supreme Industries Ltd.

is one of the largest plastic processors in India. In FY22 alone, SIL processed

more than 400,000 MT of polymers.

The company operates in 4 different segments in the plastic processing space

where they manufacture a plethora of plastic products starting from PVC

Pipes, CPVC Pipes, Plastic Furniture, Packaging Films, Yoga Mats, Plastic LPG

Cylinders, Dustbins, Crates, etc. This makes SIL the most diversified plastic

player in India. Apart from this, Supreme Industries Ltd. also holds a 30.78%

stake in an associate company called “Supreme Petrochemicals Ltd.”

| Segment | Product | Application |

|---|---|---|

| Plastic Piping System | UPVC, CPVC, PPR, Overhead Tanks, Septic Tanks, Bath Fittings, Solvents, Drainage Systems, Sprinkler Irrigation Systems, Casing Pipes, Column Pipes, Screen Slotted Pipes, Double Wall Corrugated Pipes, etc |

These products find application in Building Plumbing, Building Drainage, Civil & Infra projects, Pressure Piping Systems, Bore Wells, Underground Drainage & Sewerage for Civil Projects and Infrastructure. |

| Packaging Products | Protective Packaging Films, Performance Packaging Films, Multilayered Cross Laminated Films |

Used for cushioning/protection, Insulation, Toys, Protection from water, rain, and making packages containing edible items. |

| Industry-Specific Crates, Bins, Pallets, ROTO Moulded Crates, Bins, and Pallets. |

Products are used in various manufacturing setups for material handling, Waste management, etc. |

|

| Consumer Products | Moulded Plastic Furniture | Various indoor and outdoor setups like houses, offices, restaurants, gardens, etc. |

Source: Company, Keynote Capitals Ltd.

Supreme Industries Ltd. | Initiating Coverage Report

“Most Diversified Plastic Player” a plethora of plastic products manufactured and sold by

Supreme

Industries Ltd.

Products – Plastic Piping System

Products – Packaging Products

Products – Industrial Products

Crates & Bins

Products – Consumer Products

Furniture

Supreme Industries Ltd. | Initiating Coverage Report

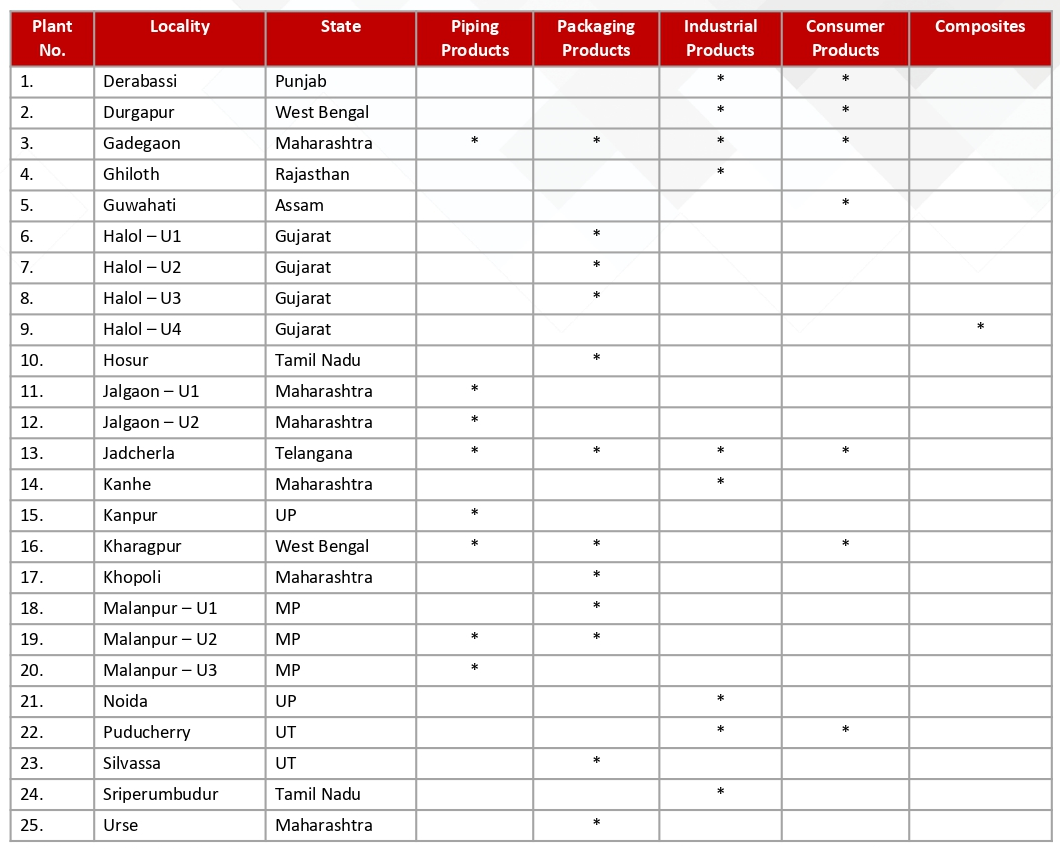

Not only products, but the company is well diversified in terms of production units also. SIL has 25

production units spread across 10 states of India.

Source: Company, Keynote Capitals Ltd.

Supreme Industries ltd. has a vast pan India network of production units

where the company manufactures products for single/multiple segments at

each production unit. Supreme Industries Ltd. has taken up three new

projects primarily for Plastic Piping Systems in the states of Assam, Odisha,

and Tamil Nadu. These facilities will come on stream during the first half of

the current year.

| Segment | Capacity (in MT) |

|---|---|

| Plastic Piping | 525,000 |

| Plastic Packaging | 90,000 |

| Industrial Products | 80,000 |

| Consumer Products | 30,000 |

Source: Company, Keynote Capitals Ltd.

Supreme Industries Ltd. – Business Progression in Numbers

Supreme Industries Ltd. | Initiating Coverage Report

Constantly improving Net Working Capital (Days)

Supreme Industries Ltd. | Initiating Coverage Report

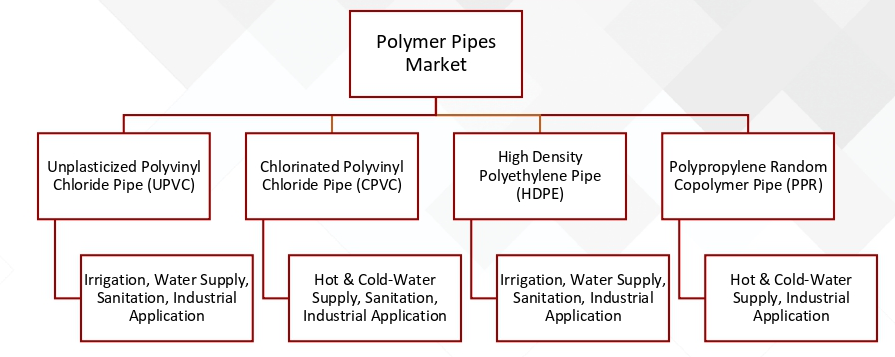

Understanding The Piping Business

Indian Polymer Piping Industry Overview

Indian polymer piping industry is currently pegged at ~Rs.400-450 bn.

Significant demand for piping comes from irrigation, residential, and

infrastructure segments. These segments can be housed under public and

private projects undertaken by various institutes, companies, and the

government at multiple levels. This demand is generated from areas like

irrigation, WSS (water supply and sanitation), and real estate (mainly

replacing traditional steel pipes with plastic pipes and new projects). In the

coming years, the industry is poised to grow at 10%-12% p.a. and can reach

550-600 bn in size

This kind of growth will be driven due to i) the government’s infrastructure

thrust ii) various government schemes like “Nal Se Jal,” “Housing for All,”

“Pradhan Mantri Awas Yojna,” etc. iii) replacement of steel pipes with

plastic pipes iv) discovery of novel applications. Over the years, the plastic

piping industry has evolved from an unorganized segment-dominated

industry to an industry which organized players now dominate. This can be

attributed to multiple factors, including regulatory changes (GST, RERA, etc.)

and private players’ efforts on marketing, innovation, and distribution.

Four leading listed private players have managed to take away market share

from unorganized players. The list includes Supreme Industries Ltd, Astral

Ltd, Finolex Industries Ltd, and Prince Pipes & Fittings Ltd.

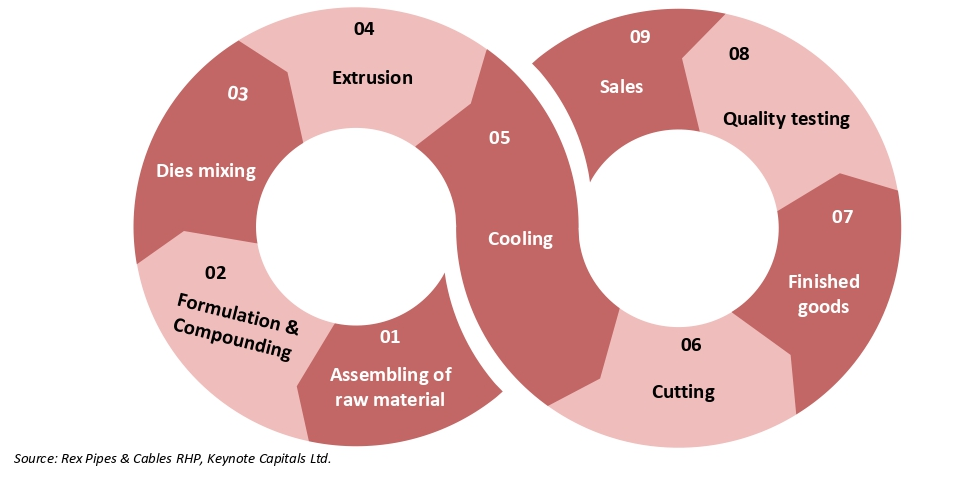

Market Structure

Polymer piping is a vast and the largest segment in the building material

space, offering significantly higher growth than other building material

industries. The industry is expected to grow at a double-digit rate and can

reach Rs. 550-600 bn. by FY25. The entire piping market can be divided into

various types of pipes with multiple uses based on the characteristics of

different pipes.

Supreme Industries Ltd. | Initiating Coverage Report

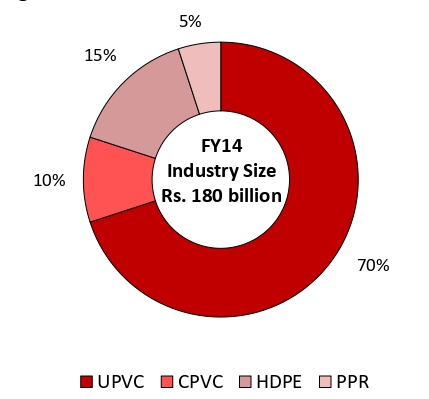

Comparison of Various Types of Pipes

| Pipe Type | Industry contribution % as of FY19 |

Brief Detail |

|---|---|---|

| UPVC | ~65% | These pipes find application in irrigation and plumbing for potable water supply. Demand for UPVC has grown mainly because of the constant replacement of GI pipes as these pipes have higher durability and affordability compared to GI. According to CRISIL, this segment can register a low double digit growth of around 10%-12% in the coming few years. |

| CPVC | ~15% | These pipes are mainly used in plumbing systems as well as the distribution of hot and cold water. This has been and is expected to be the fastest-growing sub-segment because these pipes are corrosion, fire, and lead-free. Another peculiarity of CPVC pipes is that they can withstand high temperatures. According to CRISIL, CPVC pipes can grow at a 20% rate in the coming few years. |

| HDPE | ~15% | These pipes find application in sectors like city gas distribution, chemicals, etc. Apart from traditional applications like irrigation and drainage, HDPE pipes gained prominence over metal pipes due to their durability and longevity. As per CRISIL, the segment is expected to grow in the low double digits. |

| PPR | ~5% | The contribution of PPR pipes to the industry is very small and is used for industrial purposes. These pipes are relatively costly compared to other plastic pipes. This acts as a growth damper. According to CRISIL, this segment is expected to clock a 6%-7% growth in the coming years. |

Source: Prince Pipes & Fittings RHP, Keynote Capitals Ltd.

Piping Demand Mix FY14 vs FY19

Supreme Industries Ltd. | Initiating Coverage Report

UPVC pipes continue to dominate the mix, but the contribution of CPVC has

gone up in the past few years. Its contribution is likely to increase given the

growth these pipes sub-segment is witnessing. The contribution of UPVC has

come down from ~70% in FY14 to ~65% in FY19, whereas the contribution

of CPVC has gone up from ~10% in FY14 to ~15% in FY19. It looks hight likely

that the contribution of CPVC will only head north from here based on the

demand scenario.

| Comparing Parameters | UPVC | CPVC | HDPE | PPR | GI |

|---|---|---|---|---|---|

| Life (Years) | 20-25 | 30-35 | 50 | 50 | 15-20 |

| Max Temp (Degree C) | 60-70 | 90-100 | 90-100 | 90-100 | 200-250 |

| Cost | Cheaper than GI | Cheaper than GI but costlier than UPVC | Cheaper than GI but costlier than UPVC | Cheaper than GI but costlier than UPVC | Costlier than plastic pipes |

| Corrosion | No effect due to chemical resistance | Has anticorrosiveproperties | Excellent anti-corrosion and chemical resistance | Good chemical and corrosion resistance | Corrodes Faster |

| Chance of Leakage | Leakage free | Leakage free for life | Leakage free | Leakage free but requires installation by skilled manpower | Vulnerable to Leakage |

| Installation | Done through cold welding | Done throughcold welding | Done through cold welding but these pipes are more tolerant to poor installation | Fusion welded system which requires specialized training & equipments |

Time and energy consuming |

| Expected Growth | – | 11%-12% | 20%+ | 12%-13% | 6%-7% |

Source: Prince Pipes & Fittings RHP, Keynote Capitals Ltd.

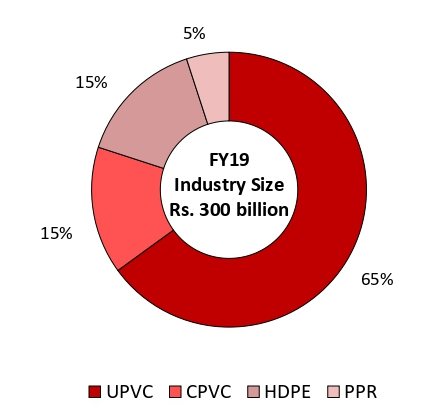

Manufacturing Process

Supreme Industries Ltd. | Initiating Coverage Report

Supply Chain Structure

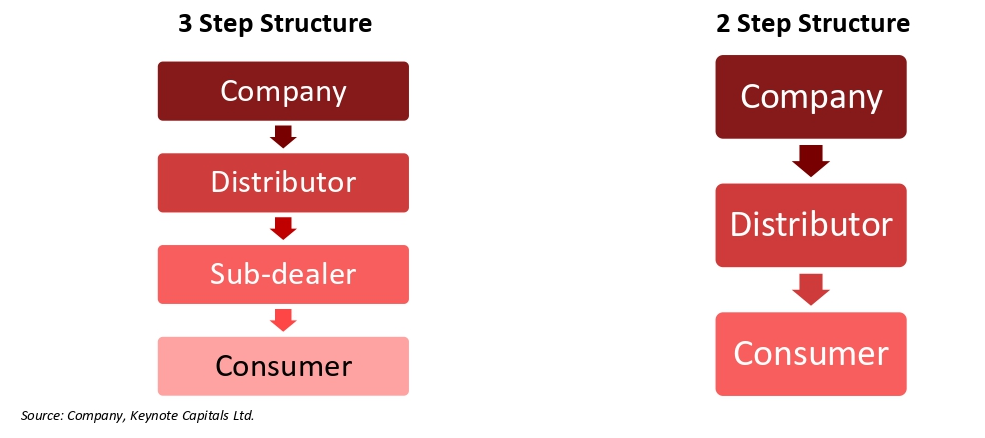

The piping industry generally follows a two or three-step distribution chain

where the company supplies to the distributor, who goes ahead and either

sells to a sub-dealer or directly to the end consumer. For large projects,

piping companies go through the distributor route or directly deal with the

end customer.

Plastic pipe is a bulky product; hence, distribution/manufacturing network

diversification plays a vital role for a plastic pipe manufacturing company.

Freight cost is a material cost component for pipe manufacturing players.

This cost can be significantly controlled by strengthening the distribution

chain and localizing production.

Major Raw Materials and their Sources

PVC – Roughly half of India’s PVC demand is indigenously met and the rest is

met collectively by countries like China, Japan, Korea, etc.

CPVC – Most of India’s demand for CPVC is met by imports. India heavily

relies on countries like Korea, China, Japan, etc for its CPVC material. There

are very few CPVC resin suppliers globally and local pipe majors have already

tied up with these CVPC suppliers as CPVC pipes are expected to grow the

fastest.

ADD on CPVC – GOI in August 2019 imposed an “anti-dumping duty” on

imports of CPVC from China and Korea for a term of 5 years. As per data

shared by GOI, these two countries account for 32% of India’s CPVC resin

imports.

PPR – Almost 90% of PPR’s demand in India is domestically met

PE – For PE, roughly 60% of demand is internally met, and the rest is

imported from countries like UAE, Saudi, Singapore, and USA. These

countries account for the biggest import share of PE in India.

PVC Resin

Supreme Industries Ltd. | Initiating Coverage Report

Tailwinds for the Industry and Especially for Organized Players

GOI’s Focus on Improving Infrastructure – The government of India has

rolled out many initiatives to improve the overall infrastructure of the

country. They are putting immense focus right on building bridges, roads,

houses, water transport, etc. Pipes have an important role to play in almost

all infrastructure projects. Apart from this, large organized players have a

better chance to cater to the demand coming out of these projects as

smaller players will not be able to fulfill such huge demands within time and

of the right quality. Therefore, organized private players with an established

presence will have a better chance against unorganized smaller players to

cater to this growing demand.

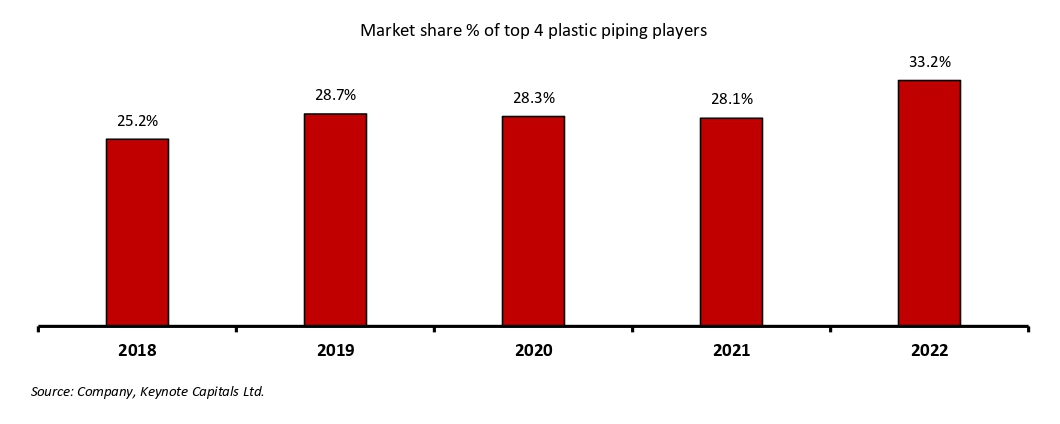

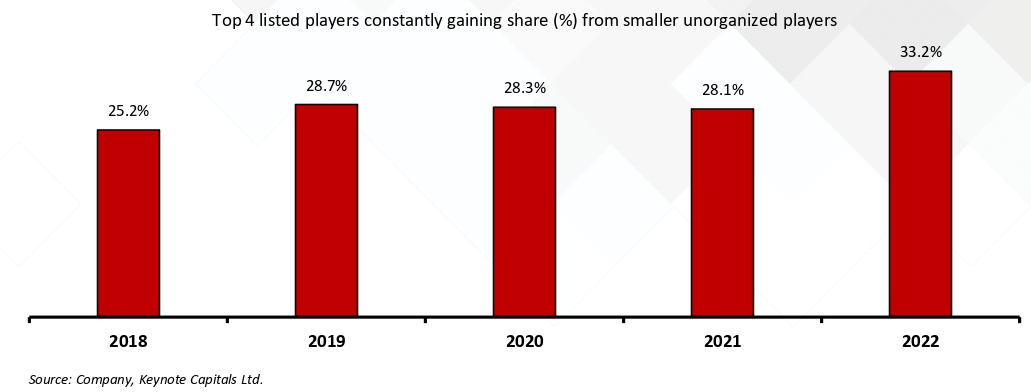

Market Consolidation – Plastic piping industry, like many other industries, is

increasingly being dominated by organized and well-managed players.

Market share in the hands of the top 4 organized players has gone from 25%

in FY18 to 33% in FY22. This has been possible because small players are

squeezed from two sides, on one side, government reforms around imports,

the introduction of GST, etc have made life difficult for these players and on

the other hand, strong organized players are continuing to invest behind the

right things such as production, branding, distribution, and innovation,

unlike small unorganized players who lack the muscle power to invest

behind these initiatives. The combination of these two has forced and will

force a lot of small players out of the industry.

Development of Private Infrastructure – Along with the government, there

are a lot of private sector investments in infrastructure which will propel

India’s future growth. Piping as a construction material doesn’t contribute

more than 5% to the overall project cost therefore it won’t take a lot of

mind share from customers. Private players are constantly positioning

themselves as the best pipe manufacturers with the help of advertising at

multiple platforms and events. Also, organized private players have a lot to

offer in terms of the product range. These two factors offer them an

advantage to tap the private infra growth over smaller unorganized players.

Plastic pipes will continue to replace GI pipes – Plastic pipes are much

more cost-effective compared to traditional GI pipes. Apart from this, plastic

pipes offer several other benefits like low chances of leakage, less/not prone

to corrosion, less/no impact of chemicals, etc. Due to this, there is a

replacement wave, customers across the country are replacing GI pipes with

plastic ones.

Major Players in Plastic Piping Industry

Supreme Industries Ltd. | Initiating Coverage Report

1. Plastic Piping Business – Supreme’s Supremacy

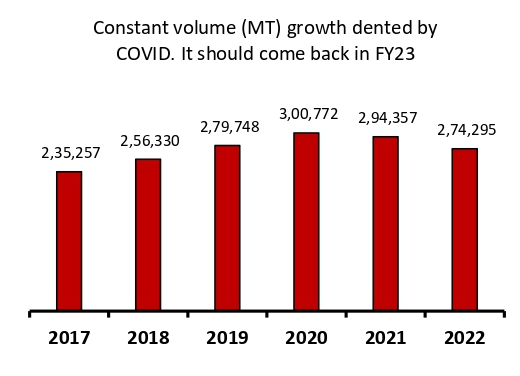

Supreme Industries is India’s largest plastic pipe manufacturer and seller.

The company roughly sold ~275,000 MT pipes in FY22 alone. This scale is

slightly lower than Astral Ltd, and Prince Pipes and Fittings Ltd put together.

Both these leading companies in FY22 managed to sell ~288,000 MT pipes at

a combined level.

In the piping business, SIL clocked a more than 50bn turnover in FY22. The

company enjoys leadership with an 11%-12% market share of a 400-450 bn

piping market. A good chunk of the sales for SIL comes from the sale of PVC

pipes, the demand for which is generated by both the irrigation and the

housing and infrastructure sectors. Currently, the company has a pipe

manufacturing capacity of 525,000 MT, which is expected to go up to

585,000 by the end of FY23.

The company has talked a lot about the potential of the export market. Also,

the company has been sharing growth numbers from time to time, but

exports as % of total sales are not encouraging.

Plastic Piping Business Progression in Numbers

Supreme Industries Ltd. | Initiating Coverage Report

Plastic Piping Business Progression

Over the years, Supreme Industries Ltd. has made relentless efforts in

building and improving its plastic piping business. As a result, the

company has not only managed to maintain leadership but also gain

market share from weaker players and become even more dominant in

the industry.

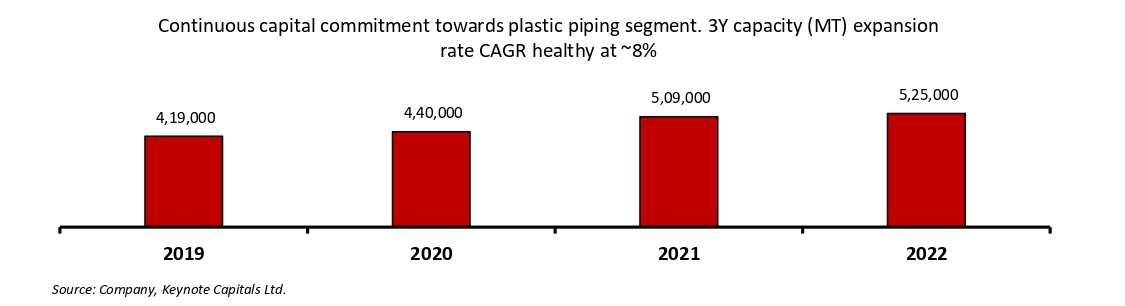

Continuous Investments in Building Production Capabilities – Over the

years, the company has continued to invest in its piping business which has

turned into a powerhouse of growth for the company. The company has

increased its production capacity year after year which now stands at more

than 5 lakh MT. This capacity will further go up to 5.9 lakh by the end of FY23

as the company has planned to put up 3 new plants driven by the Plastic

Piping segment.

Supreme Industries Ltd. | Initiating Coverage Report

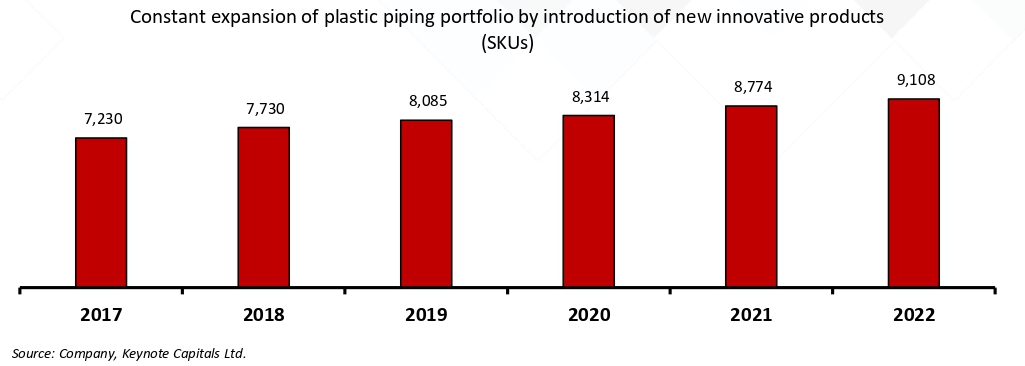

Constant Addition of New VA Products – Supreme Industries Ltd. has

constantly worked on improving its piping and allied product portfolio. The

company from being a PVC pipe manufacturer has developed competencies

in manufacturing all types of pipes. Not only this, SIL has introduced a

plethora of bath fitting products which fetch the company a healthy ~20%

margin. These efforts are still going on, and SIL continues to innovate and

expand its product portfolio by introducing new products every year. Piping

product portfolio has grown at a CAGR of ~5% in the last 5 years.

Entry into Segments where SIL has High Winning Probability like Water

Tanks – Plastic Overhead Water Tanks have emerged as an emerging

opportunity that provides potential to big players like SIL for increasing

market share. SIL has been at the forefront of taking this opportunity and has

set up multiple manufacturing facilities to tap Rs.50-60 bn plastic tanks

market.

If executed properly, this segment can generate meaningful sales for SIL. In

the latest annual report, the company highlighted that they would be

producing tanks at eight different locations. This will enable the company to

service customers more economically. SIL has a robust expansion plan to

increase the tank business through a distribution strategy of directly serving

retailers from production units

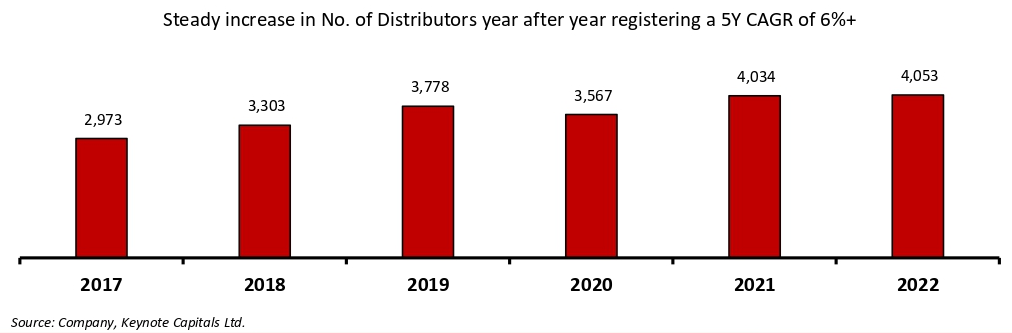

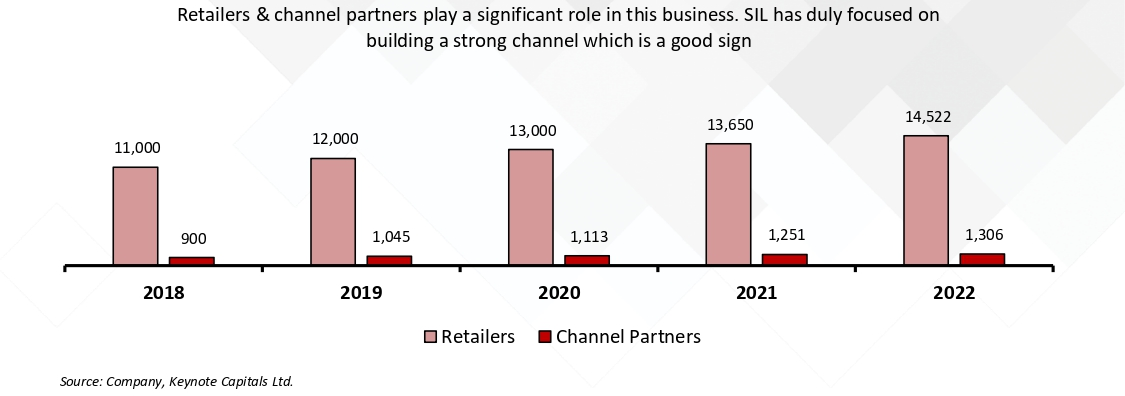

Expansion of Distribution Network – Plastic pipe is a bulky product. It

becomes extremely important for a company like SIL to diversify and

increase its production and distribution reach. Along with increasing its

production capacity over years, the company has also been cognizant of

strengthening its distribution network. SIL has nearly doubled its distribution

reach in the past 7-8 years.

Supreme Industries Ltd. | Initiating Coverage Report

Plastic Piping Peer Analysis

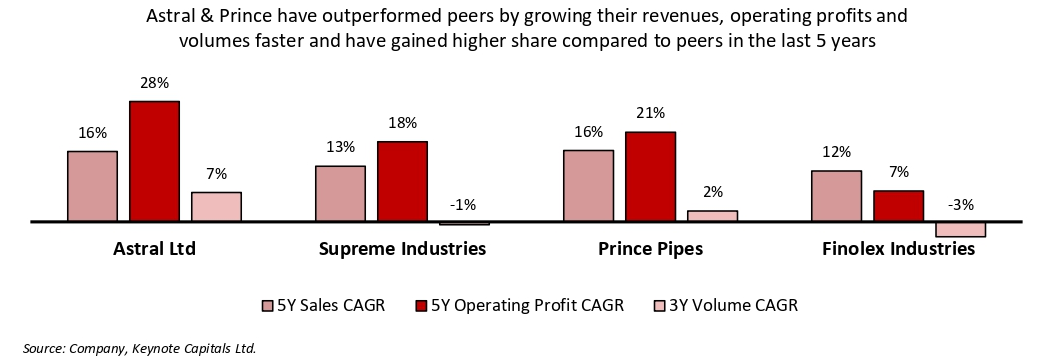

Market share gain by leading listed players can be attributed to 3 key

strategies the prominent private players followed over the years.

Brand Creation – Private players have changed how marketing is done in this

commoditized industry by roping Bollywood superstars and building a brand

presence at prestigious sports tournaments and other events. Unlike

traditional trends, industry players are willing to spend 2-3% of their revenue

on marketing activities.

Expanding Production & Distribution – This is another area where all

prominent private players have made significant strides. The leading players

have diversified their production by putting up plants at various locations

across India and have also strengthened their distribution network year after

year. This helped them immensely as the plastic pipe is a bulky product and

proximity to customers makes it increasingly viable to supply goods at lesser

freight cost, which is a material cost component for all plastic piping players.

Product Innovation & Portfolio expansion – Over the last few years,

prominent private players have demonstrated their capabilities of producing

innovative (new to market) products and received encouraging customer

responses. Having created a strong foundation of innovation enables them

to spend significantly on marketing while constantly increasing their

capacity.

These areas continue to be on the focus list of leading private players who

are trying to improve in these areas each passing day. Players who will

continue to excel in these three areas will continue to gain

disproportionately over smaller players who don’t have the operational and

financial bandwidth to focus on these areas

Supreme Industries Ltd. | Initiating Coverage Report

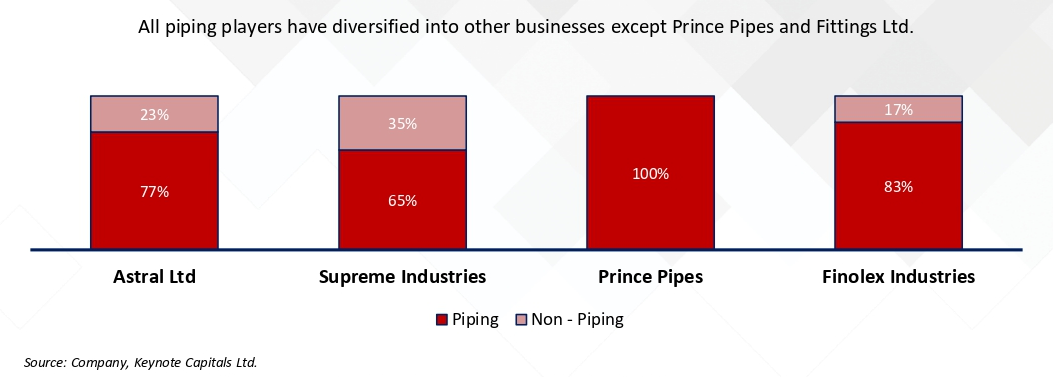

Except for Prince Pipes & Fittings Ltd, all the piping players have diversified

into other businesses. All of them have followed a different path. Astral has

chosen to get into businesses like adhesives, paints, and faucets, which are

not complimenting the existing business. Supreme Industries Ltd. has

chosen to get into adjacent plastic segments, whereas Finolex has chosen

to integrate + diversify by dabbling in the PVC business.

Long term PVC price (in USD/Ton) analysis

Supreme Industries Ltd. | Initiating Coverage Report

All the major players have seen significant jumps in realization due to the

recent spike in PVC prices. Astral Ltd. has the best realizations/kg because

of its higher sales contribution from CPVC pipes which is a premium

product compared to PVC. Prince Pipes & Fittings Ltd. has also shown

considerable improvement over the last few years and has surpassed SIL.

Realizations for SIL and Finolex are lower because of the higher

contribution from UPVC pipes. All players will have increased focus on

CPVC in the future as it is the fastest-growing sub-segment with healthy

margins.

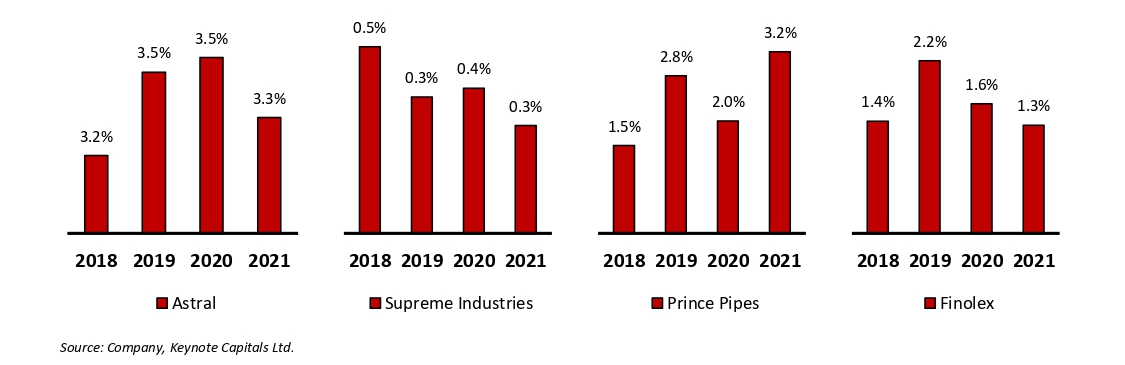

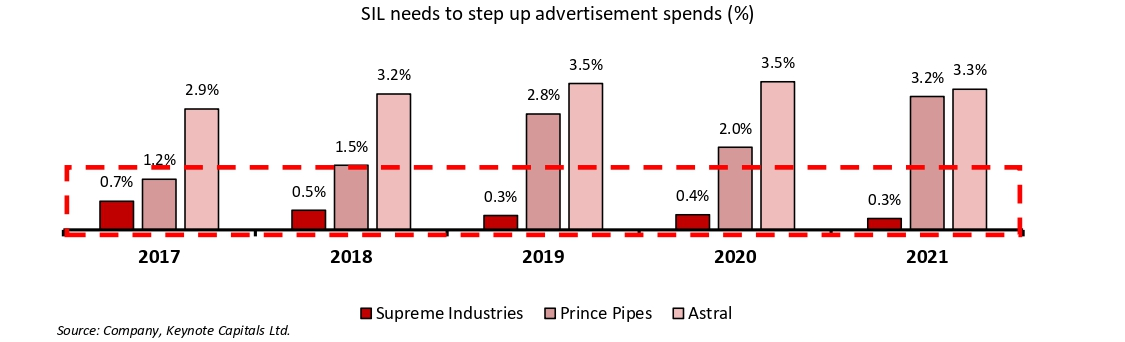

SIL will have to catch up in comparison to peers in terms of Advertisement

spending as % of Sales

Supreme Industries Ltd. has been on the backfoot for years even though

other players in the industry have turned pro marketing. So far, SIL has

come out unscathed without spending heavily on advertising. If SIL doesn’t

step up ad-spends, it can result in market share loss for the company in the

long run.

Supreme Industries Ltd. | Initiating Coverage Report

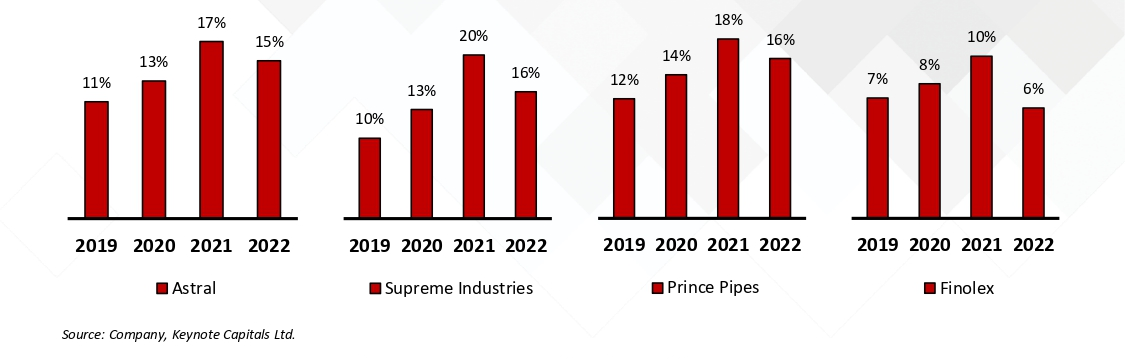

Operating margin in the plastic piping business for all the players are in

line except Finolex

Peer comparison on other financial parameters

| Particular | Astral | Supreme Industries | Prince Pipes & Fitting | Finolex Industries |

|---|---|---|---|---|

| FY22 Total Installed Capacity (MT) | 3,74,882 | 7,25,000 | 3,05,000 | 6,42,000 |

| FY22 Total Sales Volume (MT) | 149,569 | 393,908 | 139,034 | 461,819 |

| FY22 Debt/Equity (x) | 0.04 | 0.01 | 0.12 | 0.07 |

| 6Y Cumulative CFO/EBITDA | 84.2% | 66.4% | 56.8% | 64.4% |

| FY22 Piping Market Share (Based on Revenue) | 8.0% | 12.0% | 6.3% | 9.2% |

| Current PE | 70.7 | 24.5 | 26.4 | 8.22 |

| FY22 Receivable Days | 26 | 24 | 67 | 30 |

| FY22 Net Working Capital Days | 22 | 44 | 86 | 99 |

| 5Y Avg. ROE | 18.4% | 24.1% | 19.6% | 18.1% |

| 5Y Avg. ROCE | 22.7% | 27.5% | 21.2% | 20.2% |

Source: Company, Keynote Capitals Ltd.

Supreme Industries Ltd. | Initiating Coverage Report

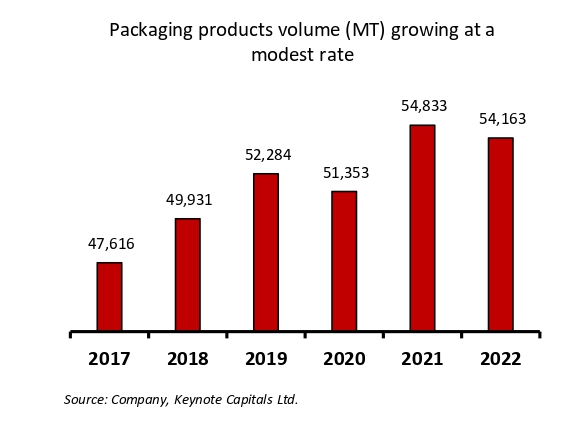

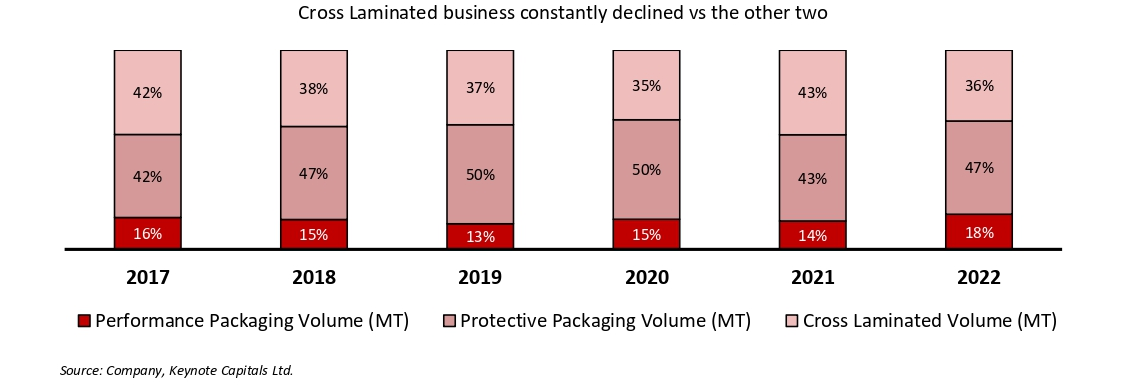

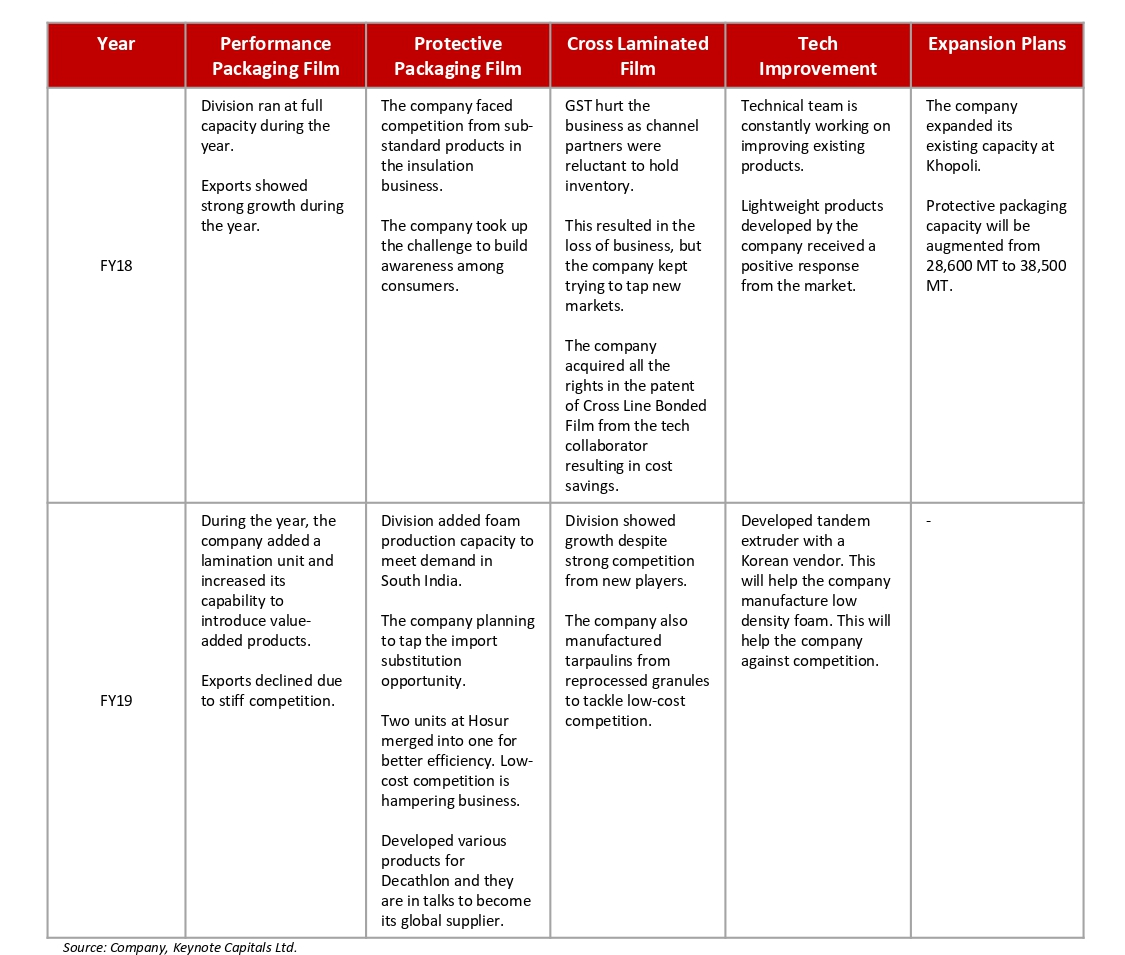

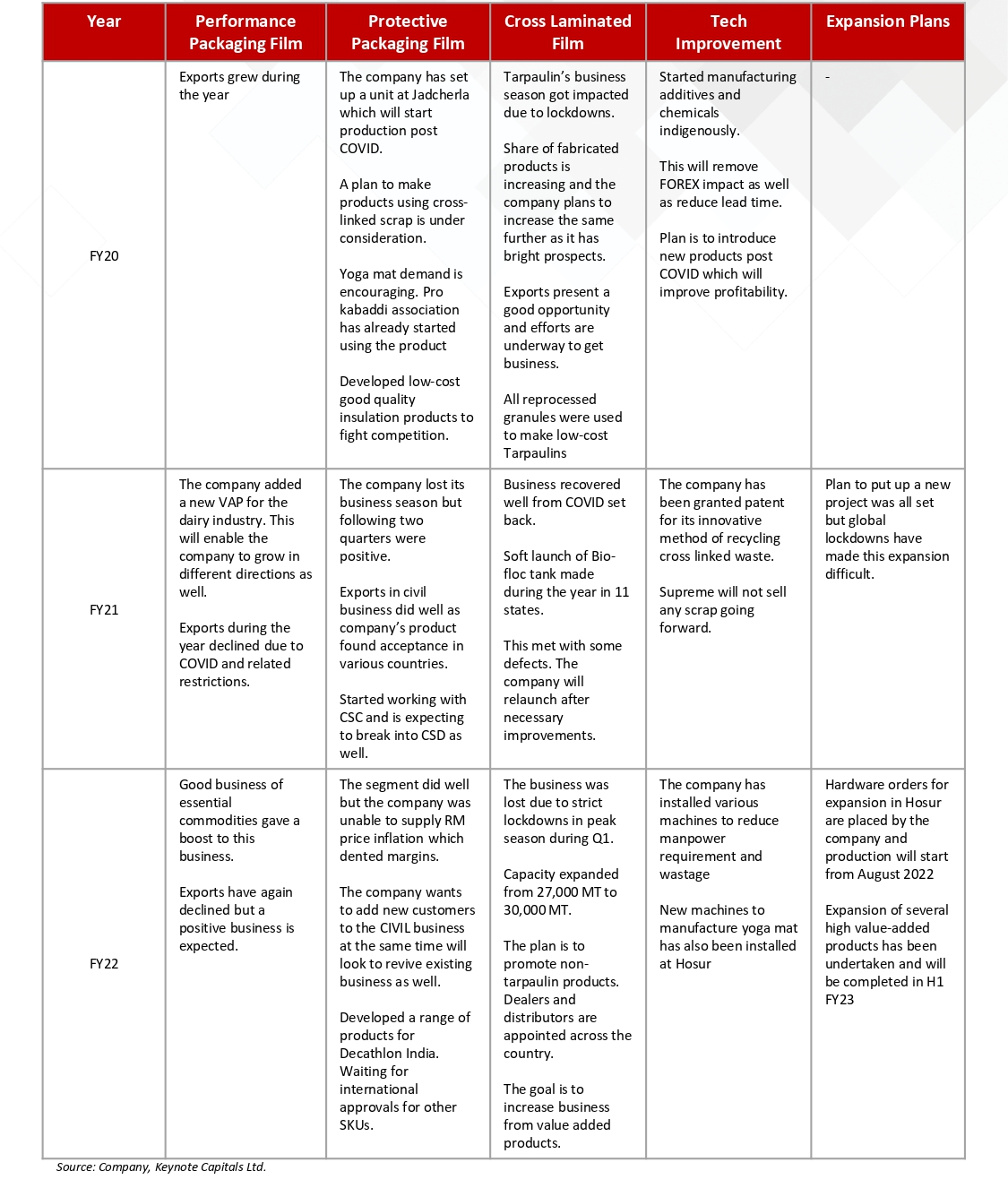

2. SIL’s Packaging Business – Competition Questioning

Dominance

Supreme Industries Ltd. is a significant packaging player in the Indian

packaging industry. In FY22, the company sold 54,000 MT worth of

packaging products. SIL’s packaging product business can be divided into

three broad categories.

Performance Packaging Product

SIL is among India’s largest manufacturers of co-extruded multi-layer barrier

films and is the only company that has two imported 7-layer blown film lines

from Windmoller & Holscher, Germany which are world leaders in multilayer blown films. The company also has

a bag and

pouch-making machines

for critical vacuum packing.

Protective Packaging Products

SIL’s protective packaging division offers solutions for a diverse set of

industries like sports goods, healthcare, toys, white goods, etc. The

company has prepared custom-designed solutions which can prevent dents,

breakages, and scratches during transit. SIL has a strong blue-chip clientele

both in India and overseas.

Cross Laminated Products

SIL is a leader in the plastic Tarpaulin Industry. For many years, the company

has been manufacturing multi-layered Cross Laminated UV Stabilized Films

which are used in various agricultural and industrial applications. Supreme

has a technical collaboration with Rasmussen Polymer Development AG,

Switzerland. Technology to manufacture SILPAULIN is a patented one and is

limited to only 6 countries in the world. These products are lightweight but

are extremely strong and have gained acceptance in geographies like

Europe, America, the Middle East, etc

Packaging Business Progression in Numbers (Rs. mn)

Supreme Industries Ltd. | Initiating Coverage Report

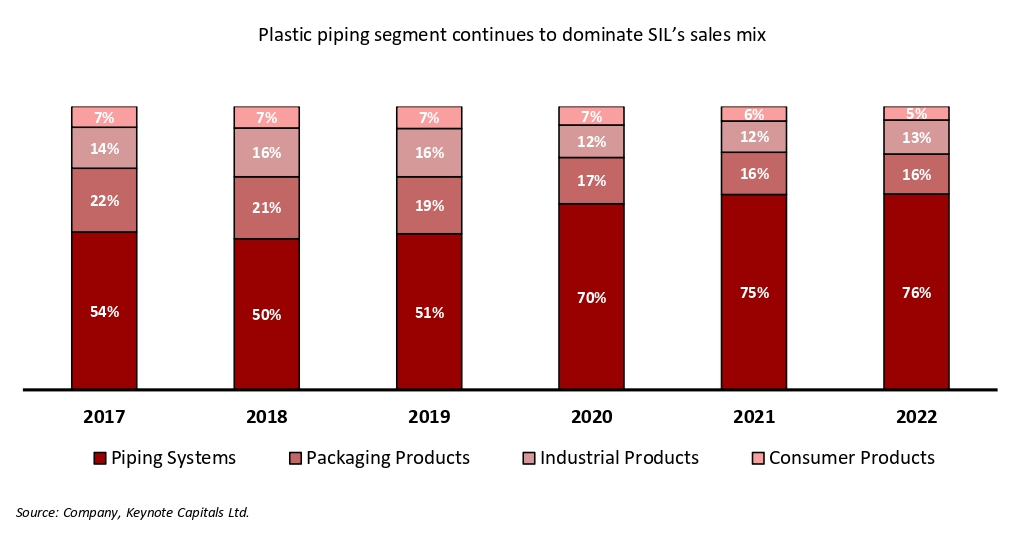

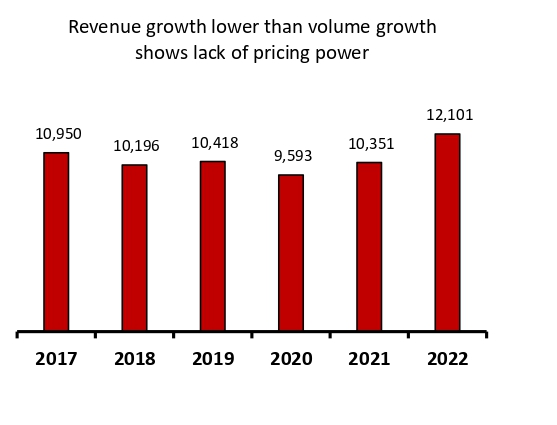

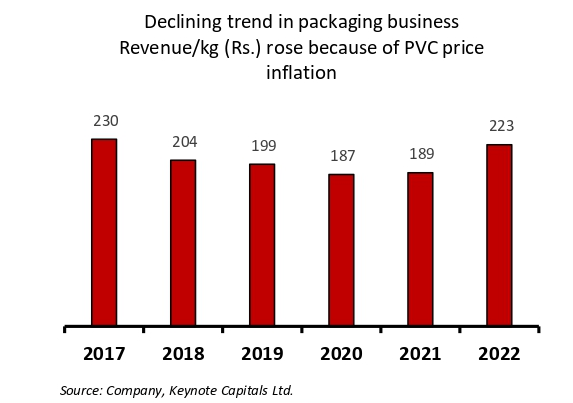

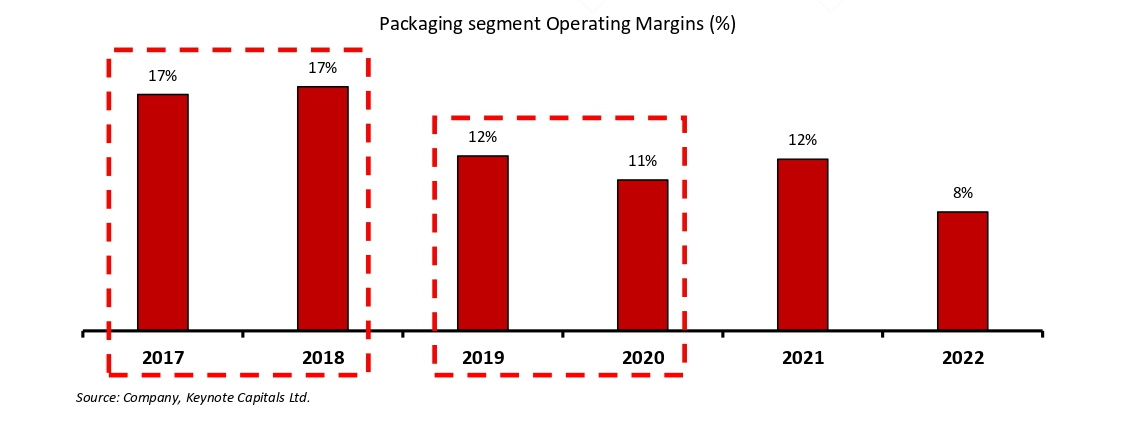

The revenue share of the plastic packaging segment in the overall revenue

pie has significantly reduced from 23% in FY16 to 16% in FY22. This is a

cause of concern for the company as most of the products in the plastic

packaging segment belong to the value-added category where operating

margins are greater than 17%. It seems like the trend is playing out because

of increased competition from local players who are manufacturing substandard and cheaper products. Based on

realization

& margin trend, it

looks like SIL is unable to exercise pricing power in this segment, unlike

other businesses.

Supreme Industries Ltd. | Initiating Coverage Report

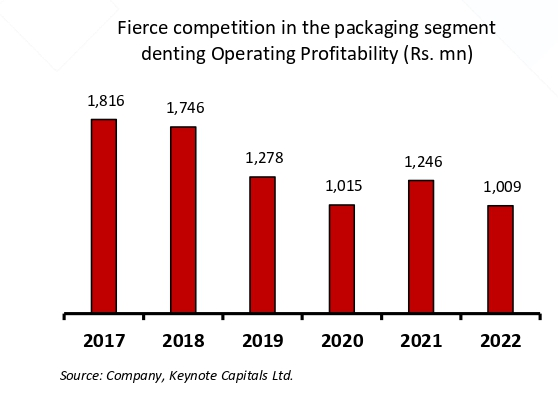

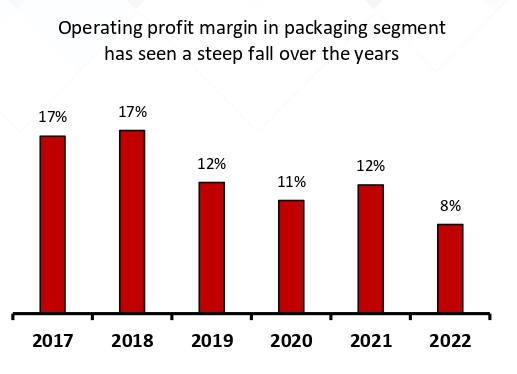

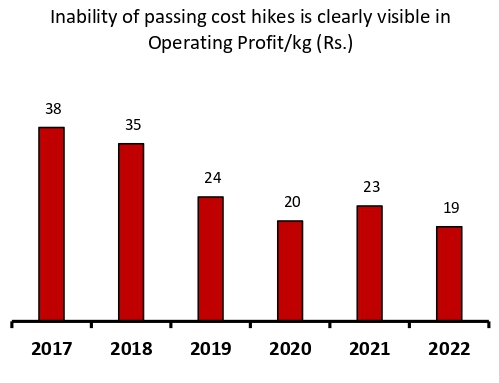

Looking at the operating profitability timeline for the packaging business of

SIL, one thing is very evident they are unable to exercise pricing power on

customers despite having the best-in-class customers and making the best

quality product.

Profitability has seen steep degrowth since 2016. Hopefully, some part of it

will come back with Tarpaulin business normalizing on account of normal

business this year. For the last two years, the Tarpaulin business was getting

impacted due to COVID as India was in a country-wide lockdown during the

peak season of Tarpaulin sales which is Q1 & Q2. Things can change if this

business starts contributing closer to 40%.

Bottom line is, competition is impacting SIL in the packaging business and

that is visible in numbers. The company has mentioned the impact on the

business from competition on various occasions in various communications

in the past. Given the current product portfolio and competitive scenario in

this business, it might not be possible for the company to reclaim the

historical 17% kind margins.

Packaging Business Progression

Supreme Industries Ltd. | Initiating Coverage Report

Commentary and actions such as producing economical products from reprocessed granules and

scrap indicate that there is intense competition.

Supreme Industries Ltd. | Initiating Coverage Report

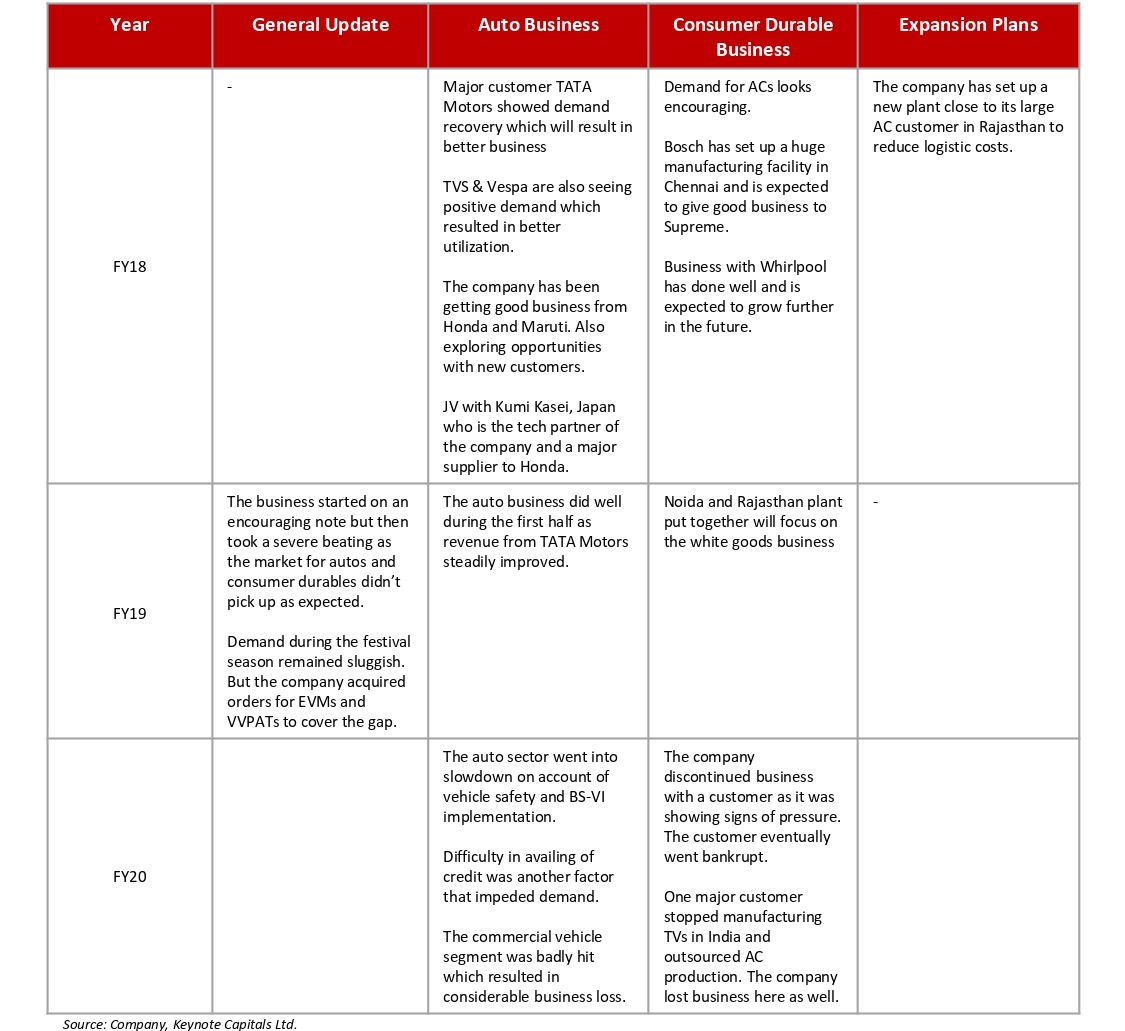

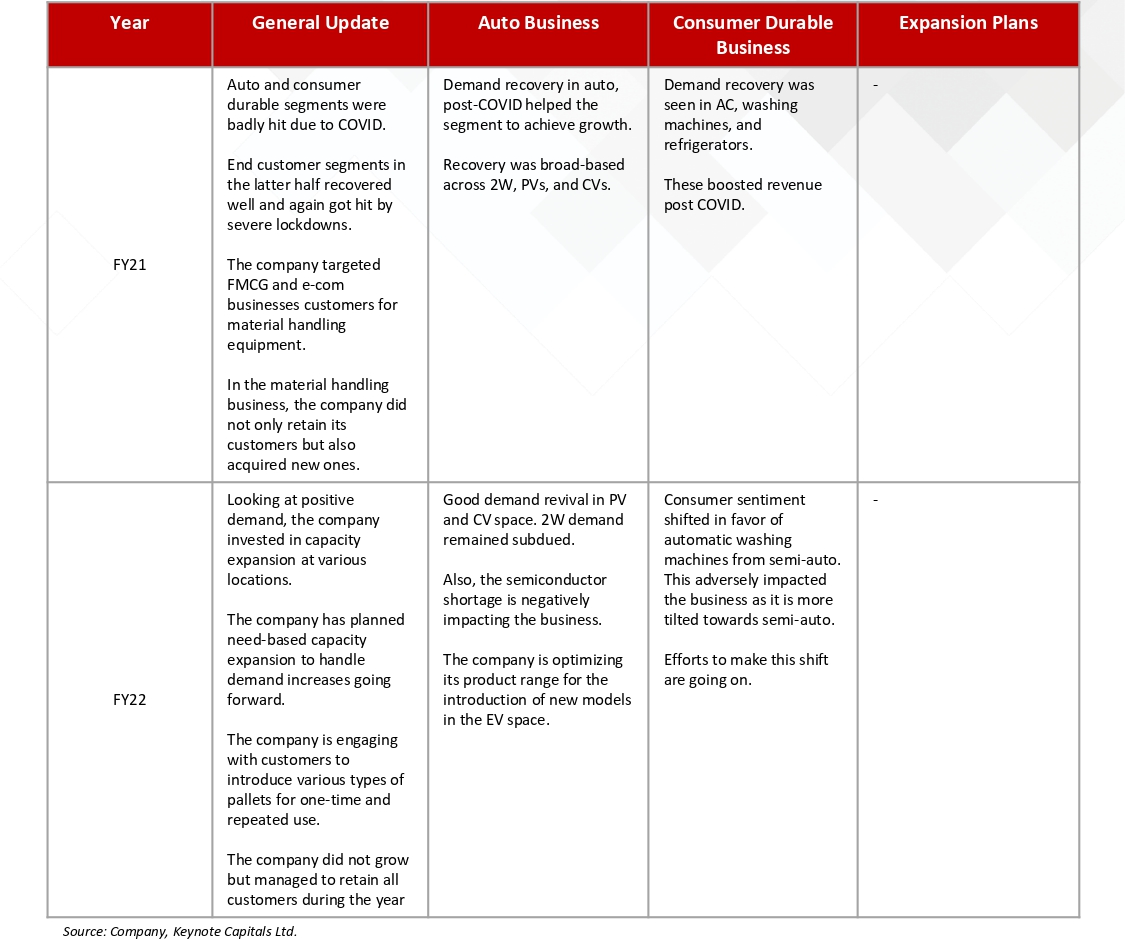

3. Supreme’s Industrial Products Business – Coming back on track

The industrial components business of Supreme Industries Ltd. can be

subdivided into three categories based on the customer base and the type

of product of the company.

Automotive

In the automotive business, SIL supplies various exterior and interior plastic

body parts to auto OEMs. SIL generates maximum revenue from auto.

Consumer Durables

SIL in its consumer durable business manufactures exterior boxes for

washing machines, ACs, Coolers, and Refrigerators

Material Handling

The Material Handling business of Supreme manufactures various products

like crates, pallets, bins, etc. which find application under various industrial

setups

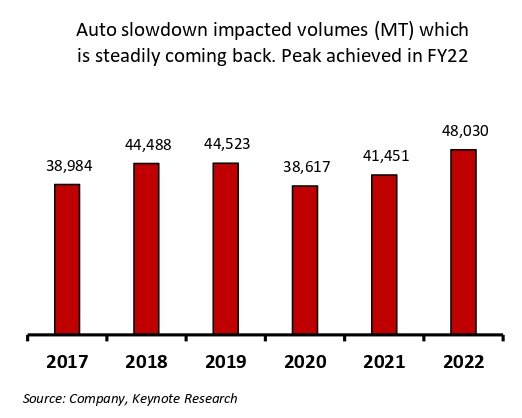

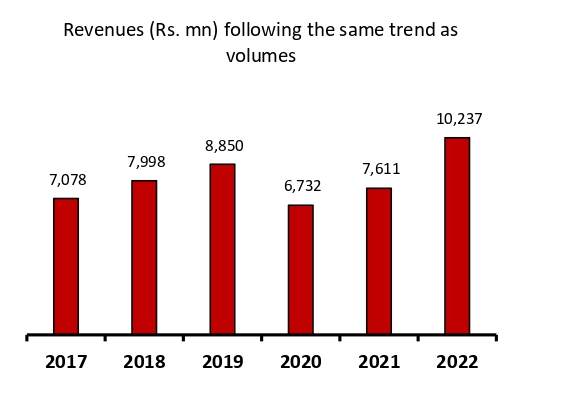

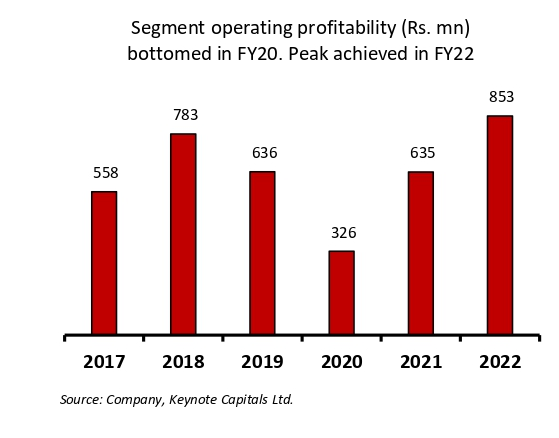

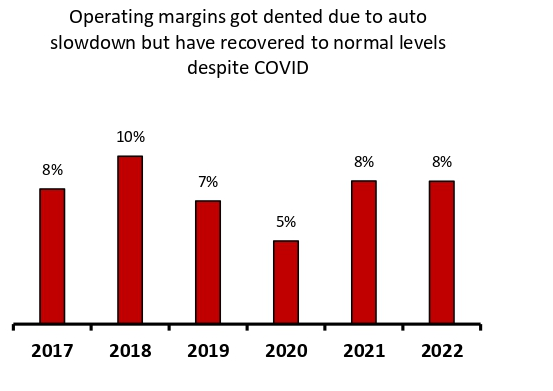

Industrial Products Business Progression in Numbers

Supreme Industries Ltd. | Initiating Coverage Report

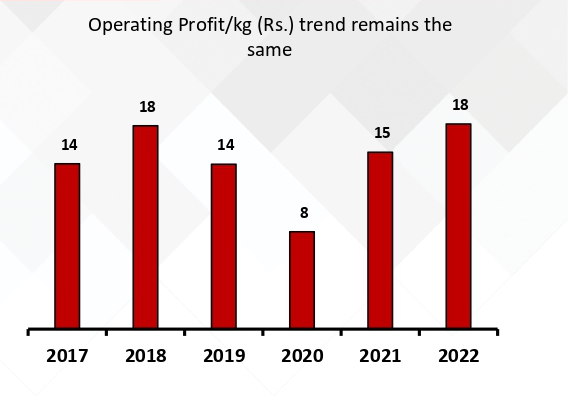

Industrial Products Business Progression

Supreme Industries Ltd. | Initiating Coverage Report

SIL in the industrial business is serving top-notch customers in the

automobile and consumer durables segment. Apart from this, the company

is also catering to varied industries with its material handling products.

This business segment, unlike other segments, has shown record volumes

since 2017. Also, the margins have come back to the normal range of 8%.

These margins cannot be expected to go to a 15%+ range because this is a

B2B business where the SIL is dependent on customers who will always have

bargaining power over SIL.

This bargaining power of customers over SIL can be seen in the company’s

action to set up a plant near its large AC customer in Ghiloth, Rajasthan.

The business provides good growth prospects as end-user industries like

consumer durables and auto are expected to grow. Also, entry barriers of

strong relationships and large-scale capacity will keep competition at bay

because it enjoys strong relationships with customers and is also capable of

delivering large quantities required by large customers.

Supreme Industries Ltd. | Initiating Coverage Report

4. SIL’s Consumer Products Business – Can it Breakout?

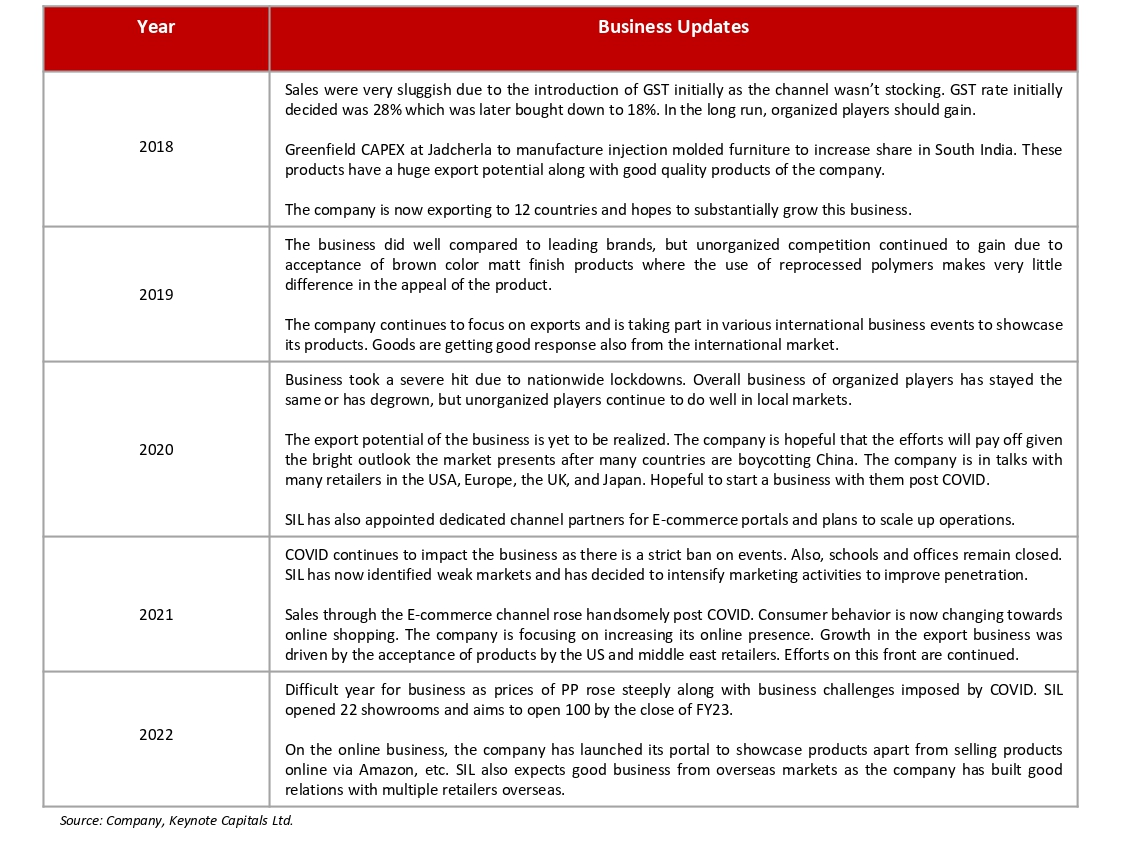

The Consumer Products segment of Supreme Industries Ltd. houses the

furniture manufacturing business of the company. SIL manufacturers various

type of plastic furniture which is used in various indoor and outdoor setups.

The company holds a leadership position in “Premium Range” plastic

furniture and manufactures furniture using Injection moulding, Blow

moulding, and Roto moulding technologies.

SIL in its furniture business enjoys excellent pan-India reach because the

company manufacturers plastic furniture at 7 locations across the country.

The company’s focus now is to create large retail showrooms across India

and strengthen this business. Supreme plans to have 100 showrooms across

India by the end of FY23.

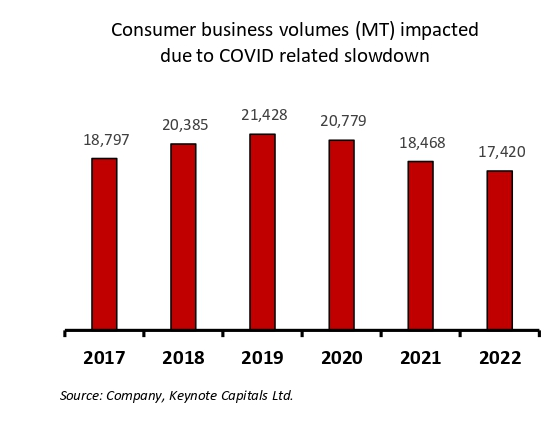

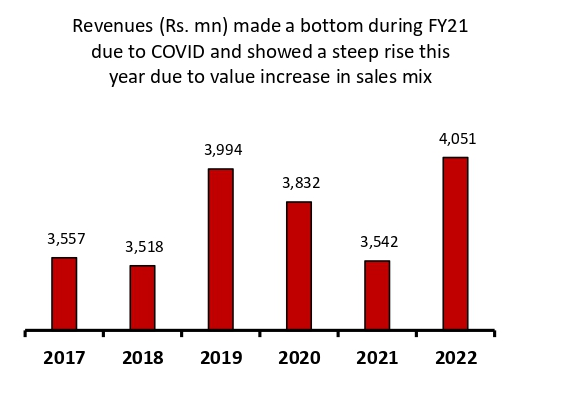

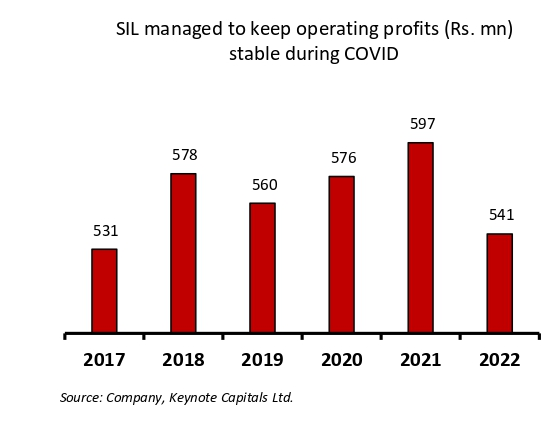

Consumer Business Progression in Numbers

Supreme Industries Ltd. | Initiating Coverage Report

The story in the furniture business remains like that of packaging when we

look at aspects like unorganized competition. Unorganized players are giving

tough competition to SIL here as well. Apart from this, the company has

been talking about the export potential and its efforts.

Supreme Industries Ltd. | Initiating Coverage Report

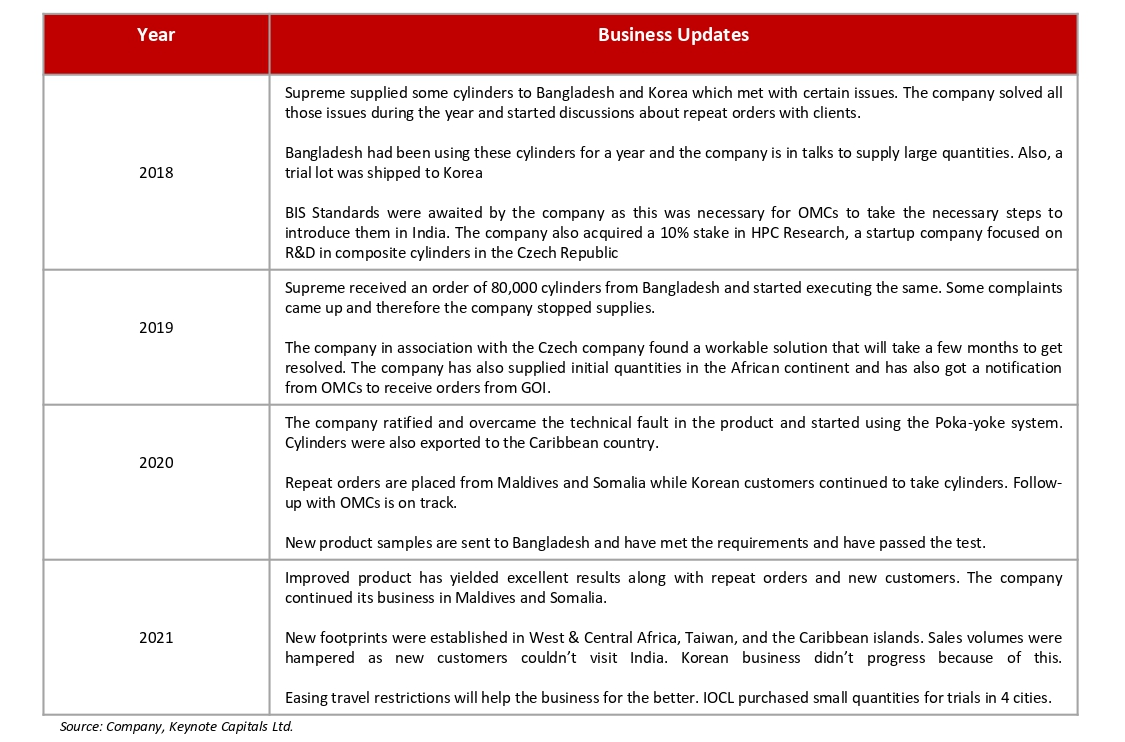

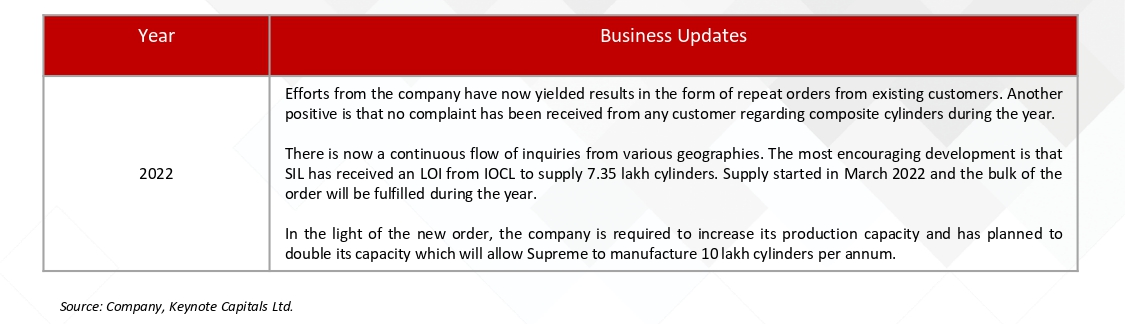

Composite Cylinder Business – Some green shoots are

now visible. Sustainability & Scalability will be key things

to watch out for.

SIL manufactures composite LPG cylinders which can replace traditional

metal cylinders. There are good reasons for this switch to happen but

somehow it hasn’t happened yet. There are multiple advantages that

composite cylinders provide over traditional cylinders which are as follows.

- They are less than half the weight of conventional steel cylinders

- Wall transparency provides gas level visibility

- Explosion-proof

- Rust and moist proof

Despite the good quality and many advantages which the product provides,

SIL was unable to develop a business for composite cylinders as it is a B2B

product and switching decision lies in the hands of oil marketing companies.

Therefore, SIL had to wait for such a long time before it got an order to

supply 7,35,186 cylinders to Indian Oil Corporation Ltd.

Composite LPG Cylinder Business Progression

Supreme Industries Ltd. | Initiating Coverage Report

Supreme Pertochem Ltd.

Supreme Petrochem Ltd (SPL) was formed as a JV between Supreme

Industries Ltd and Rajan Raheja Group; the company started commercial

production in 1995 with the business of manufacturing Polystyrene (PS),

which is used in plastic industries like refrigerators, air conditioning bodies,

television, etc. SPL holds a 50% market share of the Polystyrene market in

India.

To widen the spectrum, the company is now making more value-added

products from PS, i.e., Expanded polystyrene (EPS) and Extruded Polystyrene

(XPS). SPL is now increasing its operations toward value-added products.

The company has two manufacturing plants. One is in Raigad, Maharashtra,

and another in Chennai, Tamil Nadu. The key raw material for

manufacturing PS and EPS is a Styrene monomer. International pricing and

demand/ supply risks are inherent in importing this raw material; therefore,

the company has entered annual contracts for procuring its raw materials

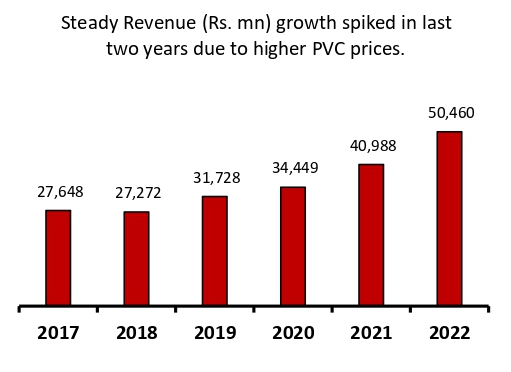

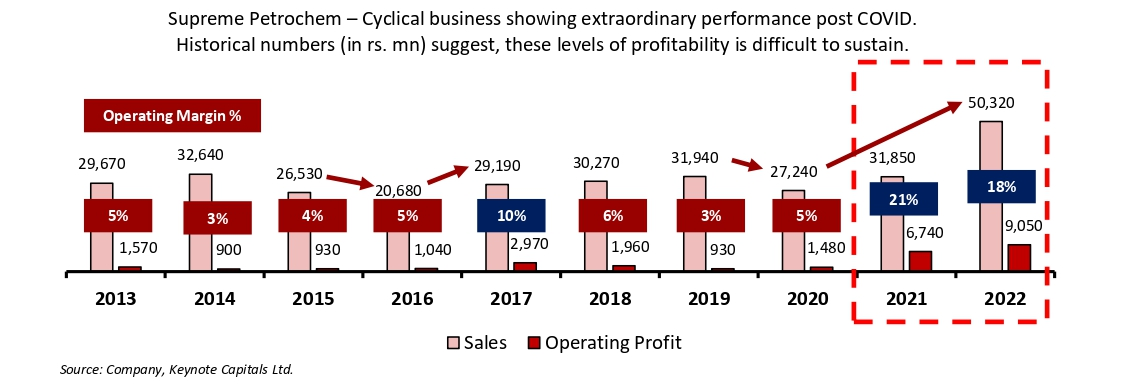

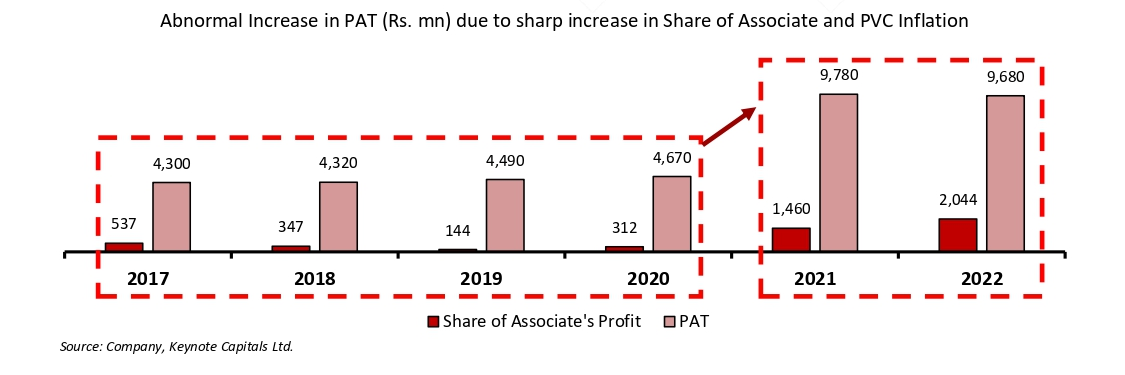

SPL showed abnormal performance post-COVID. Revenues of the company

rallied from ~27,000 mn. To ~50,000 mn. In a matter of 2 years. Not only

growth but also the margins are now on a trajectory that looks

unsustainable. The above chart shows historical data which says that

standard margins stay in the 3%-6% range. Even a 10% number in 2017 was

unsustainable. Currently, margins have doubled from 2017 levels as well.

Normalization of profitability of Supreme Petrochem will weigh on SIL’s

profitability just like it aided the profitability of SIL in a big way in the last

two years.

Supreme Industries Ltd. | Initiating Coverage Report

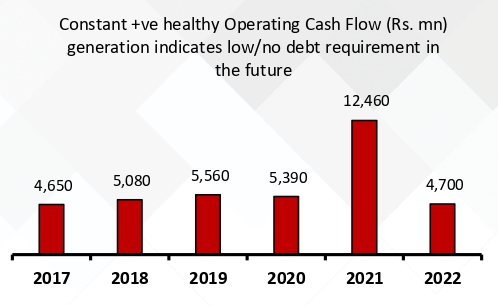

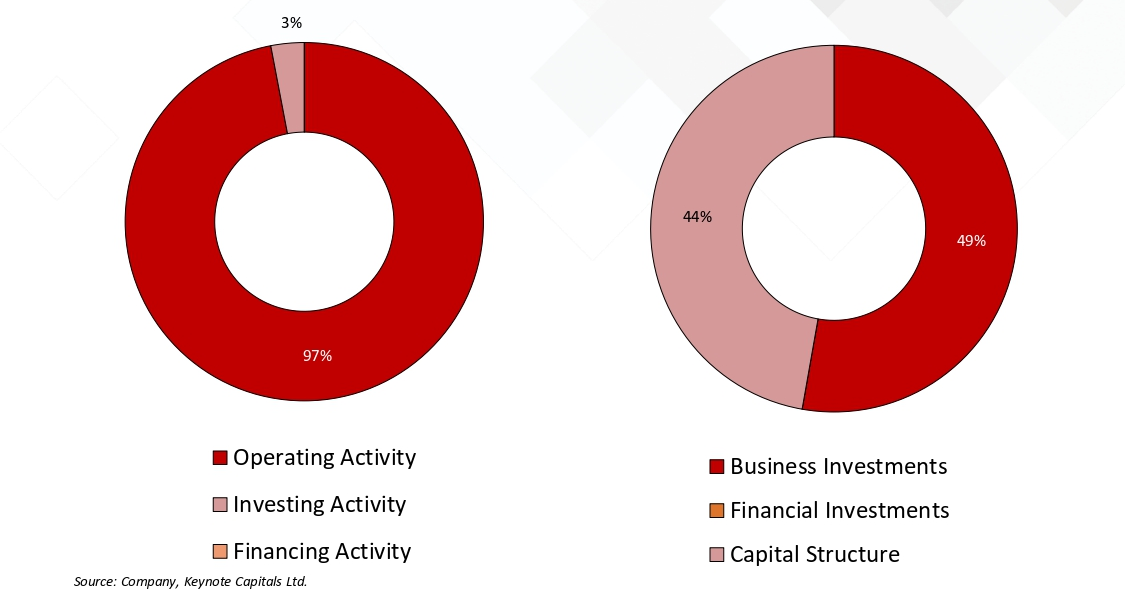

Historical Capital Allocation – Complete Reliance on Operations/Accruals

A decade of cash flow history of Supreme Industries Ltd. depicts that almost

all the cash generated by SIL came from operating activities. On the

deployment front, almost 50% is deployed behind increasing production

capabilities.

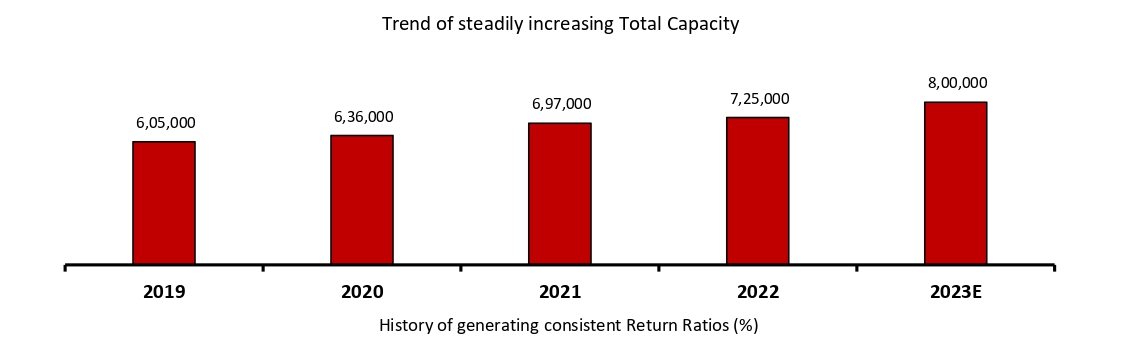

SIL has constantly invested in plants and machinery over the years and has

increased its plastic processing capacity at a CAGR of 6% in the last 3 years

despite COVID disruption. The company has also planned further expansion

of its capacity which is expected to increase by 10% this year as well.

Almost 30% of this is paid back to shareholders in the form of dividends,

and the rest is used for repayment of borrowing, interest costs, and other

activities.

Based on the above breakup of cash inflow and outflow we think that the

capital generation and allocation activities of SIL look healthy and have no

red flags. SIL has relied on its internal accruals to expand its capacity and

has attained debt-free status. Apart from this, surplus generated funds are

given back to the owners of the company.

Supreme Industries Ltd. | Initiating Coverage Report

Management Analysis – Layer 1 indicates rearrangement requirements, and Layer two

indicates a pipeline of sufficient professionals who can step up.

| Name | Designation | With SIL Since? | Age | Qualification |

|---|---|---|---|---|

| BL Taparia | Chairman | 45+ | 87 | B.A, B. Com |

| MP Taparia | MD | 45+ | 84 | B.A |

| SJ Taparia | Ex. Director | 45+ | 74 | BE. Mech |

| VK Taparia | Ex. Director | 35+ | 66 | B. Com |

| R. Kannan | Ind. Director | 8 | 74 | M. Tech |

| RM Pandia | Ind. Director | 8 | 72 | ME. Chem, BE |

| Ms. Ameeta Parpia | Ind. Director | 3 | 57 | BA, LLB |

| S Behuria | Ind. Director | 3 | 70 | B.A |

Source: Company, Keynote Capitals Ltd.

Looking at the first layer of leaders, we can say that there are enough family

people with significant experience at the helm of Supreme Industries Ltd. One

concern is that 85%+ members are above the age of 65. This indicates a clear

need to rejig the top brass.

Second Level Management – Well-experienced & loyal professionals waiting in the wings

| Name | Designation | With SIL Since? | Qualification |

|---|---|---|---|

| AK Tripathi | Ex. VP Plastic Piping | 36 | Exe. MBA, ISB |

| Vasudeo Malu | Ex. VP Industrial Components | 16 | BE Mech |

| Susanta Patniak | COO Protective Packaging | 2 | MBA, IIM C |

| Siddharth Roongta | VP Cross Laminated Films | 30 | CA |

| Pradeep Kamat | VP Composite Cylinders | 7 | Engineering Plastic |

| Sanjeev Jain | VP Furniture | 32 | BE Mech |

| Manish Poddar | VP Commercial | 31 | Cost Accountant |

| Sanjay Mishra | AVP Business Head | 6 | B. Sc |

Source: Company, Keynote Capitals Ltd.

A deep dive into the second-tier management team tells us that all the

segments are led by credible and capable leaders most of whom are with the

company for decades.

Supreme Industries Ltd. | Initiating Coverage Report

Compensation & Skin in the game

| Particulars | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 |

|---|---|---|---|---|---|

| % Promoter Holding | 49.7% | 49.7% | 49.9% | 48.9% | 48.9% |

| Promoter Salary (Rs. Mn) | 282 | 292 | 330 | 439 | 464 |

| % of PAT | 6% | 6% | 7% | 4% | 5% |

Source: Company, Keynote Capitals Ltd.

Promoter shareholding in the company has stayed close to 50% for the past

five years which signifies good skin in the game of the promoter. Also, their

salary has been in the range of 4%-6% of PAT, which is a comfortable

compensation range.

Top Shareholders %

| Particulars | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 |

|---|---|---|---|---|---|

| Nalanda India | 5.94% | 4.81% | 4.81% | 4.81% | 4.81% |

| Kotak MF | – | – | 2.15% | 2.45% | 3.14% |

| DSP MF | 1.17% | 1.33% | 1.43% | 1.72% | 2.37% |

| HDFC MF | 1.69% | 2.07% | 2.30% | 2.15% | 1.93% |

| Gov. Pension Fund Global | – | 1.35 | 1.47% | 1.64% | 1.66% |

| Axis MF | 1.24% | 2.36% | 2.78% | 4.16% | 1.50% |

Source: Company, Keynote Capitals Ltd.

Supreme Industries Ltd. | Initiating Coverage Report

OPPORTUNITIES

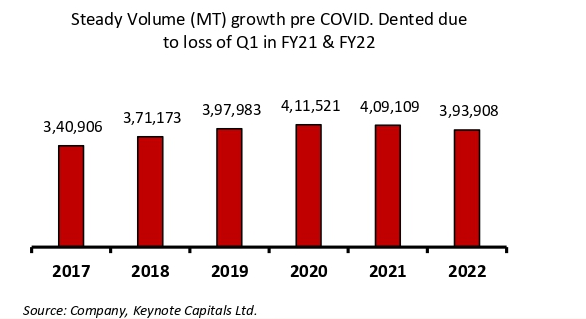

Strong volume rebound is expected from PVC pipes

Nearly 30% of SIL’s piping business comes from the agriculture sector. Most

of this demand is generated around Q1, just before monsoon. Demand was

impacted in Q1 of FY21 & FY22 due to COVID restrictions post which prices

of PVC skyrocketed, which affected demand.

Now that COVID has receded, the prices of PVC have softened along with

expectations of a normal monsoon. These factors indicate that demand for

plastic pipes (mainly PVC) will sharply rebound.

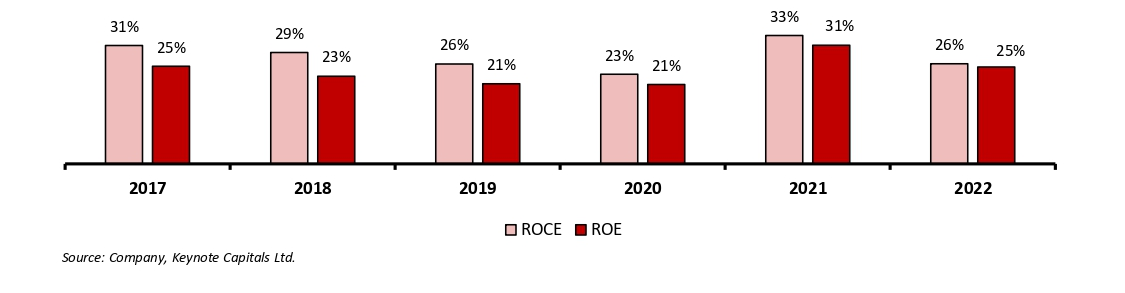

Prudent capital allocation along with maintaining return ratios

SIL has constantly invested in expanding its capacity and has sourced most

of its capital from the business, thereby relying less on external funds. Along

with augmenting capacity across segments, the company has done well to

maintain its return ratios. In the future, SIL is expected to meet their

capacity expansion requirements through internal accruals. They are going

to invest at least 3-4bn p.a

Optionality Bearing Fruits

For many years, SIL struggled to get a breakthrough in its composite

cylinder business as there was no customer acceptance. Recently, SIL

received an order from IOCL to supply 7,35,186 cylinders, pushing them to

double their cylinder capacity. This augmented capacity at 100% utilization

can generate 1.8-2.0 bn revenue.

This is a very positive development that was long pending for SIL and its

investors.

Supreme Industries Ltd. | Initiating Coverage Report

CHALLANGES

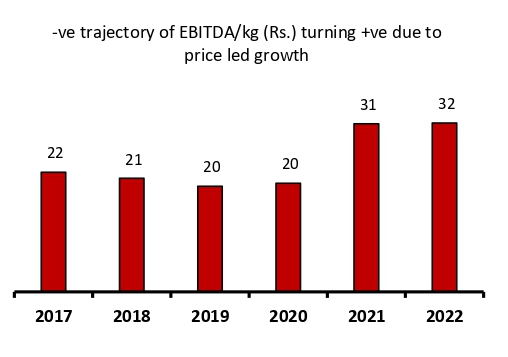

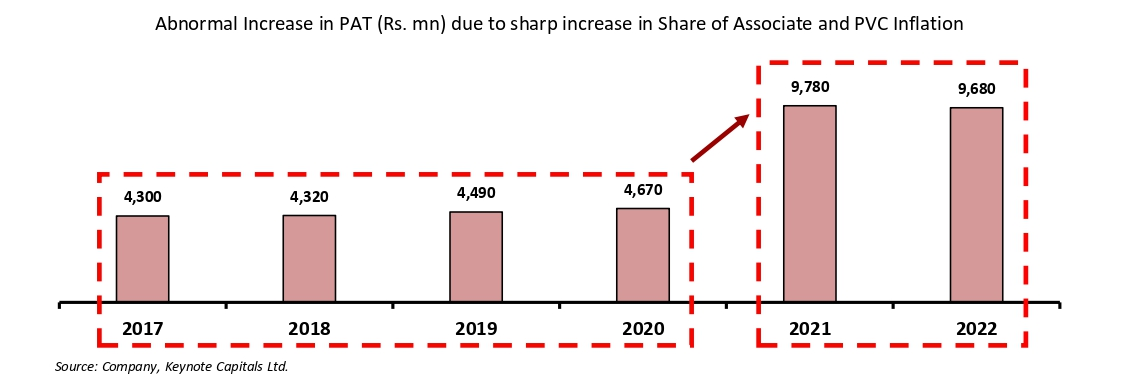

Profit Normalcy on the cards – Difficult to sustain and grow profits

from this level as the rise is commodity-led.

Supreme Petrochem Ltd, the associate company of SIL has shown a staller

performance due to business tailwinds. As a result of this, the “Share of

Associate” on the PNL for Supreme has elevated from an Rs. 300 mn run

rate to upwards of Rs. 1400 mn in the last two years. This plus PVC inflation

has led to a sharp jump in profitability for SIL.

This jump in the performance of SPL can be primarily attributed to the

inflationary commodity environment for SPL’s products. It is difficult to say

that this kind of performance will sustain for long.

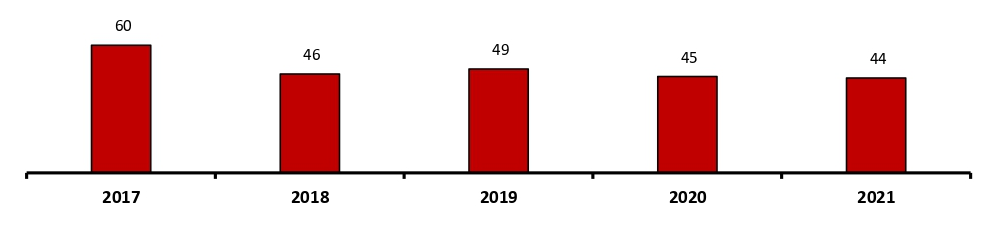

Lack of Marketing Spends vs Peers

Plastic product segments in which SIL operates (except furniture) were not

branding-oriented product segments. But the game is not the same

anymore. Players like Astral Ltd and Prince Pipes and Fittings Ltd. have

changed the game by creating brands in a commoditized sector like piping.

This strategy has given them great success and therefore they continue to

put thrust on branding and marketing.

Astral ltd and Prince Pipes and Fittings Ltd. have signed up high-profile

Bollywood actors like Salman Khan, Akshay Kumar, and Ranveer Singh. SIL

has lagged in this area and is also not looking committed to increasing

marketing spending in the future. This can be detrimental to the company’s

growth, especially in the VAP segment.

Supreme Industries Ltd. | Initiating Coverage Report

There is a stark difference in the ad-spend trend between SIL and other

piping majors. Astral ltd has taken its spending from 2.9% in 2017 to 3.3% in

2021. Prince Pipes and Fittings Ltd. has increased spending from 1.2% in

2017 to 3.2% in 2021, close to Astral ltd. SIL has not only not spent behind

marketing but has shown a declining trajectory which is not very

encouraging. Also, it doesn’t look like the situation will change in the future

Struggle vs Competition in the Packaging Segment

Supreme Industries Ltd, despite having excellent quality packaging

products, is unable to grow its business and sustain its profitability along the

way. This is because the company faces fierce competition from low-cost,

low-quality unorganized players.

Products in which SIL can generate 17%+ EBITDA are considered VAP by

the company. In FY17-18, the entire packaging segment was operating at

VAP margin levels. These margins started coming down from FY19 and

have not been able to recover ever since.

On multiple occasions in the annual reports, the company has also

mentioned competitive pressure weighing on the packaging business. The

company has also made sincere efforts to produce cost-effective products.

However, it is still unable to fight low-quality competition and hence, ends

up sacrificing the business as the company doesn’t want to operate below a

certain margin.

Sacrificing such a business is a reasonable step by SIL, but it eventually

dents the overall business and profitability as this was a healthy profitmaking business.

Supreme Industries Ltd. | Initiating Coverage Report

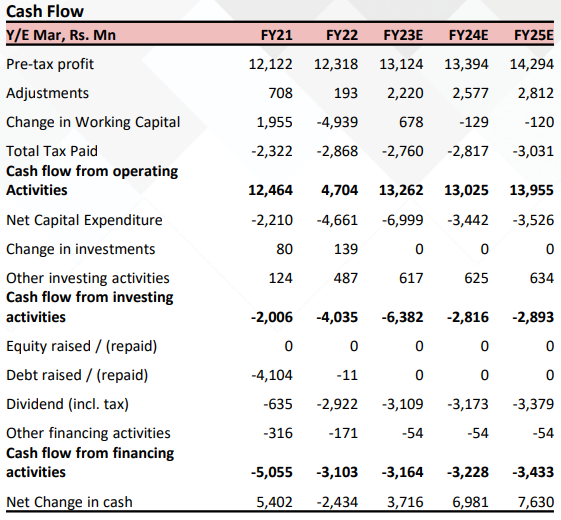

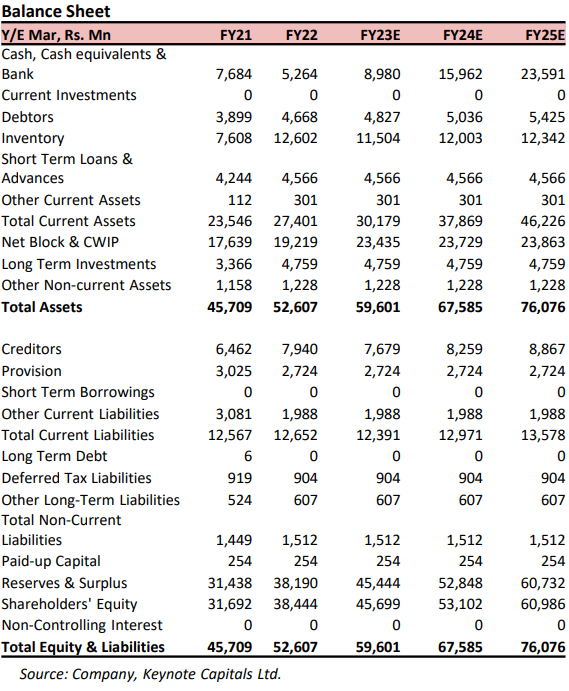

Financial Statement Analysis

Supreme Industries Ltd. | Initiating Coverage Report

Valuation

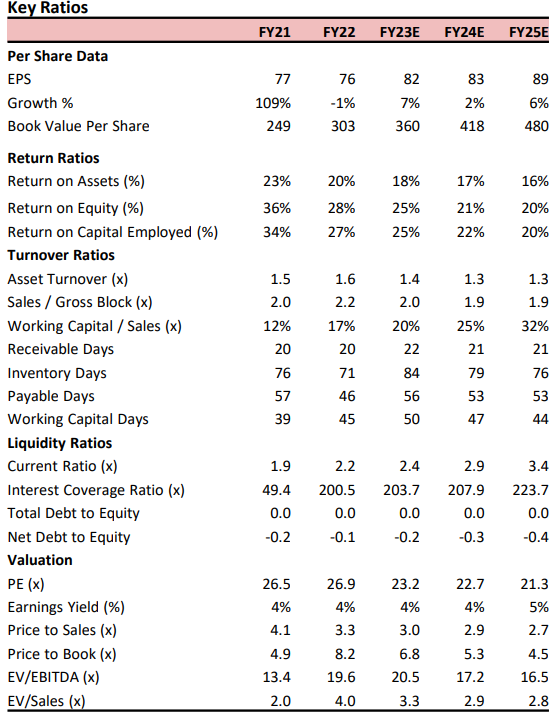

5 Year Trailing PE – Supreme looking optically cheap due to abnormal earnings since last 2 years

A look at the PE band says that Supreme Industries Ltd. is trading a little

lower than –ve one standard deviation from the mean. A closer look at

earnings acts as an eye-opener and gives a reality check. Earnings for SIL

over the last 2 years have been abnormally high because of PVC inflation

and supernormal performance from the associate Supreme Petrochem Ltd.

This performance doesn’t look sustainable in the long run.

PVC prices and the supernormal performance of Supreme Petro might not

normalize immediately. It is impossible to predict price movements, but it

looks tough for these numbers to move up from here or sustain at these

levels for long.

It is prudent to not fall for this optically low PE and take a harder look at

earnings sustainability and growth, raising a question on sustainability.

2-3 piping companies in the past calls have gone on to highlight the same

point and have said that volatility in PVC prices now is very high and price

prediction is impossible. Volatility might stay as it is for some time but the

peak level which the PVC prices saw, doesn’t look sustainable and must

normalize. This will lead to inventory losses and hence, profit

normalization

Supreme Industries Ltd. | Initiating Coverage Report

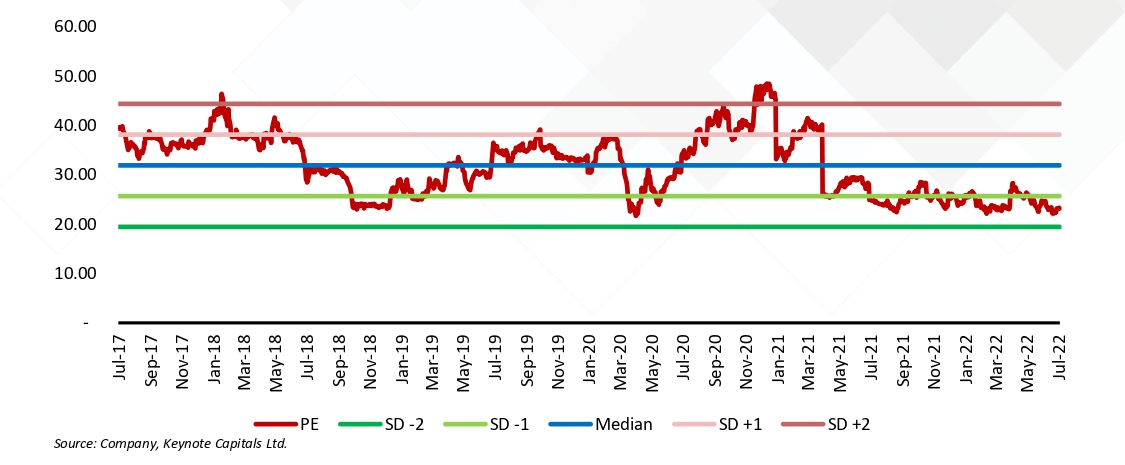

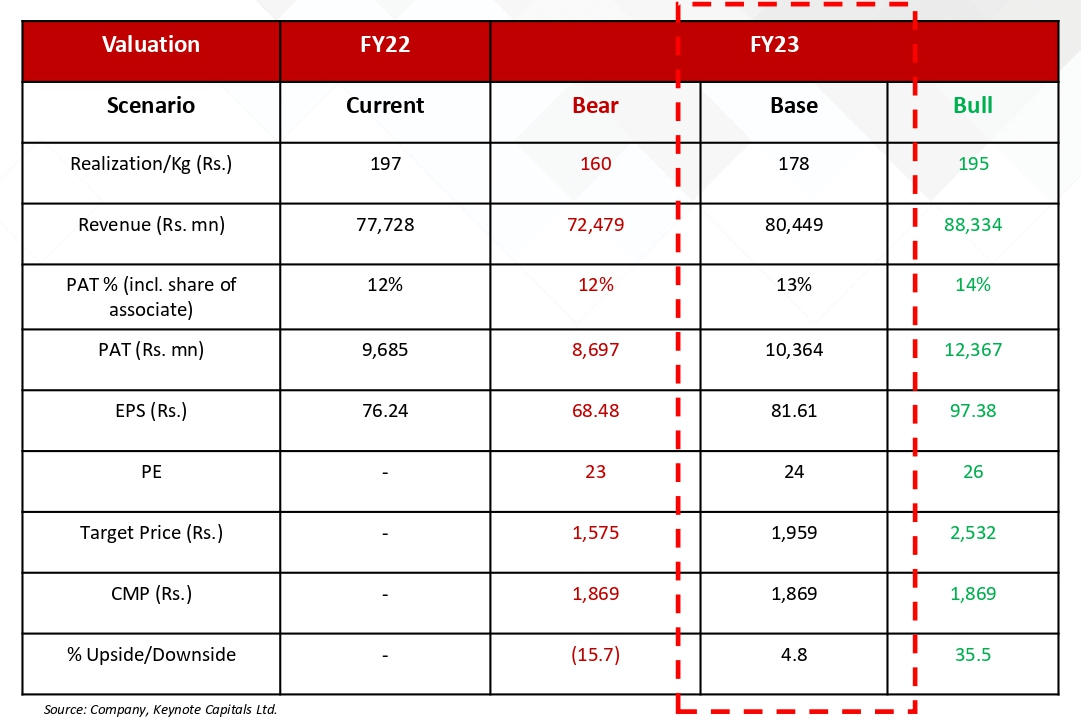

Valuation based on Sensitivity of Realizations

It is impossible to predict the price trend of PVC in the future. Still, if we go

by the past data and words of the management of a few companies, we

can safely say that price volatility can remain for some time. Still, PVC

prices going beyond FY22 levels now look difficult given the normalization

of global supply chain disruptions.

Base Case – We have built a 10% lower realization for FY23 because the

realizations of FY22 capture the rampant PVC upcycle post COVID. These

levels of realization don’t look sustainable. At the same time, the recent

drop in PVC prices points towards a strong volume recovery which we have

built in our assumptions as well. Normalization of realizations with

improved volumes makes us arrive at a target price of Rs. 1,869, which is

~5% higher than CMP.

Bull Case – We have assumed peak realizations to continue along with

higher volumes. SIL can generate a substantial 35% upside, given things

remain as it is. This coupled with multiple re-rating, can result in a price of

Rs. 2,532 a share

Bear Case – We have assumed an ~18% drop in realizations given the sharp

correction from the peak visible in the PVC prices. This scenario will result

in a ~16% downside from current levels bringing the price down to Rs.

1,575 at a PE of 23x

Supreme Industries Ltd. | Initiating Coverage Report

Rating Methodology

| Rating | Criteria |

|---|---|

| BUY | Expected positive return of > 10% over 1-year horizon |

| Neutral | Expected positive return of > 0% to < 10% over 1-year horizon |

| REDUCE | Expected return of < 0% to -10% over 1-year horizon |

| SELL | Expected to fall by >10% over 1-year horizon |

| NOT RATED (NR)/UNDER REVIEW (UR)/COVERAGE SUSPENDED (CS) | Not covered by Keynote Capitals Ltd/Rating & Fair value under Review/Keynote Capitals Ltd has suspended coverage |

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst

Regulations 2014 (herein after

referred to as the

Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no.

INH000007997. KCL, the

Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant

services &

distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associateentities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives

may; (a) from time to time,

have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned

herein. (b) be

engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial

instruments

of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other

potential conflict

of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing

whatsoever on the

specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely

independent of the

views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks

mentioned in the

research report.

KCL and / or its affiliates do and seek to do business including investment banking with

companies covered in its

research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect

the

objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service

transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com,

www.bseindia.com. Research Analyst views

on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates

maintains

arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an

independent

view with regards to Subject

Company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity

resident in a state, country

or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject

KCL & its

group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible

for sale in

all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves

of and to

observe such restriction.

Specific Disclosure of Interest statement for subjected Scrip in this document:

Supreme Industries Ltd. | Initiating Coverage Report

The associates of KCL may have:

-financial interest in the subject company

-actual/beneficial ownership of 1% or more

securities in the subject company

-received compensation/other benefits from the subject company in the

past 12 months

-other potential conflict of interests with respect to any recommendation and other

related information and opinions.;

however, the same shall

have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations

made by the

analyst(s) are

completely independent of the views of the associates of KCL even though there might exist an inherent

conflict of

interest in some of the stocks

mentioned in the research report.

-acted as a manager or co-manager of public offering of securities of

the subject company in past 12 months

-be engaged in any other transaction involving such securities and

earn brokerage or other compensation or act as a

market maker in the financial

instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies)

-received compensation from the subject company in the past 12 months for investment

banking / merchant banking /

brokerage services or from

other than said services

The associates of KCL has not received any compensation or other benefits from third party in

connection with the

research report.

Above disclosures includes beneficial holdings lying in demat account of KCL which are opened

for proprietary

investments only. While calculating

beneficial holdings, it does not consider demat accounts which are opened in name of KCL for other purposes

(i.e.

holding client securities,

collaterals, error trades etc.). KCL also earns DP income from clients which are not considered in above

disclosures.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the

analyst(s) about the subject

securities or issues, and no part

of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the

specific

recommendations and views expressed

by research analyst(s) in this report.

Terms & Conditions:

This report has been prepared by KCL and is meant for sole use by the recipient and not for

circulation. The report and

information contained herein

is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part

or in whole,

to any other person or to the

media or reproduced in any form, without prior written consent of KCL. The report is based on the facts,

figures and

information that are believed to

be true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The

information is

obtained from publicly

available media or other sources believed to be reliable. Such information has not been independently

verified and no

guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information

and opinions

are subject to change

without notice. The report is prepared solely for informational purpose and does not constitute an offer

document or

solicitation of offer to buy or

sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all

the

customers simultaneously, not all

customers may receive this report at the same time. KCL will not treat recipients as customers by virtue of

their

receiving this report

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the

selected recipient and may

not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any

form, without prior written

consent. This report and information herein is solely for informational purpose and may not be used or

considered as an

offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in

this report

constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to

your

specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all investors, who must

make their

own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not

be taken in

substitution for the exercise

of independent judgment by any recipient. Each recipient of this document should make such investigations as

it deems

necessary to arrive at an

independent evaluation of an investment in the securities of companies referred to in this document

(including the

merits and risks involved), and

should consult its own advisors to determine the merits and risks of such an investment. The investment

discussed or

views expressed may not be

suitable for all investors. Certain transactions -including those involving futures, options, another

derivative product

as well as non-investment

grade securities – involve substantial risk and are not suitable for all investors. No representation or

warranty,

express or implied, is made as to the

accuracy, completeness or fairness of the information and opinions contained in this document. The

Disclosures of

Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as

endorsement of

the views expressed

in the report. This information is subject to change without any prior notice. The Company reserves the

right to make

modifications and

alternations to this statement as may be required from time to time without any prior approval. KCL, its

associates,

their directors and the

employees may from time to time, effect or have affected an own account transaction in, or deal as principal

or agent in

or for the securities

mentioned in this document. KCL, its associates, their directors and the employees may from time to time

invest in any

discretionary PMS/AIF

Fund and those respective PMS/AIF Funds may affect or have effected any transaction in for the securities

mentioned in

this document. They may

perform or seek to perform investment banking or other services for, or solicit investment banking or other

business

from, any company referred

to in this report. Each of these entities functions as a separate, distinct and independent of each other.

The recipient

should take this into account

before interpreting the document. This report has been prepared on the basis of information that is already

available in

publicly accessible media

or developed through analysis of KCL. The views expressed are those of the analyst, and the Company may or

may not

subscribe to all the views

expressed therein. This document is being supplied to you solely for your information and may not be

reproduced,

redistributed or passed on,

directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This

report is

not directed or intended for

distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality,

state,

country or other jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would

subject KCL to

any registration or licensing

requirement within such jurisdiction.

Supreme Industries Ltd. | Initiating Coverage Report

The securities described herein may or may not be eligible for sale in all jurisdictions or to

certain category of

investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction. Neither the

Firm, not its

directors, employees, agents

or representatives shall be liable for any damages whether direct or indirect, incidental, special or

consequential

including lost revenue or lost

profits that may arise from or in connection with the use of the information. The person accessing this

information

specifically agrees to exempt KCL

or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse

and agrees not

to hold KCL or any of its affiliates

or employees responsible for any such misuse and further agrees to hold KCL or any of its affiliates or

employees free

and harmless from all losses,

costs, damages, expenses that may be suffered by the person accessing this information due to any errors and

delays.

Keynote Capitals Limited (CIN: U67120MH1995PLC088172)

Compliance Officer: Mr. Jairaj Nair; Tel: 022-68266000; email id: [email protected]

Registered Office: 9th Floor, The Ruby, Senapati Bapat Marg, Dadar West, Mumbai – 400028,

Maharashtra. Tel: 022 –

68266000.

SEBI Regn. Nos.: BSE / NSE (CASH / F&O / CD): INZ000241530; DP: CDSL- IN-DP-238-2016; Research

Analyst: INH000007997

For any complaints email at [email protected]

General Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant

exchanges and the T&C on www.keynotecapitals.com; Investment in

securities market are subject to market risks, read all the related documents

carefully before investing.