Quarterly Update Report

Ratnamani Metals & Tubes Ltd. | Quarterly Update

Ratnamani Metals & Tubes Ltd.

15th August 2022

NEUTRAL

CMP Rs. 1,730

TARGET Rs. 1,824(+5.4%)

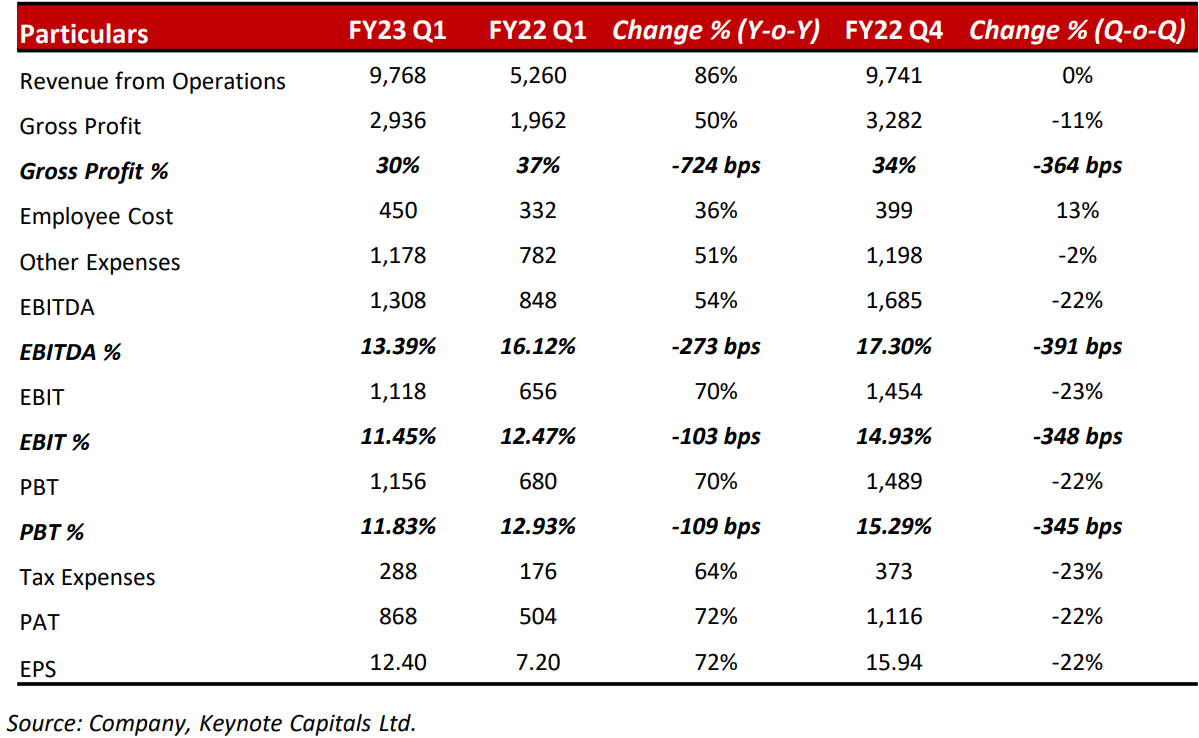

Strong growth in turnover, but product mix dented margins

On a lower base, Ratnamani Metals & Tubes Limited (RMTL) posted a strong

YoY growth of 86% and a flat growth on a QoQ basis. Due to changes in

product mix and higher raw material costs, operating margins were down by

3% & 4% on YoY & QoQ basis, respectively. RMTL would deliver a top-line

growth of 15-20% in FY23 based on a strong order book of Rs. 23,450 Mn as

on Q1FY23, which is expected to be executed by the end of FY23.

Company Data

| MCAP (Rs. Mn) | 121,610 |

|---|---|

| O/S Shares (Mn) | 70 |

| 52w High/Low | 1,920 / 1,237 |

| Face Value (in Rs.) | 2 |

| Liquidity (3M) (Rs. Mn) |

48.2 |

Changes in product mix dented operating margins

Carbon Steel (CS) pipes are lower-margin products than stainless steel (SS)

pipes. An increase in revenue proportion of CS pipes & lower value-added

SS pipes lead to a decrease in operating margins.

Shareholding Pattern %

| Jul 22 | Mar 22 | Dec 21 | |

|---|---|---|---|

| Promoters | 60.16 | 60.16 | 60.16 |

| FIIs | 12.28 | 12.13 | 12.01 |

| DIIs | 16.36 | 16.26 | 16.02 |

| Non-Institutional | 11.2 | 11.45 | 11.81 |

Active bidding to fuel order book growth

In water infrastructure projects, RMTL is bidding in areas that are in closer

proximity to its operating plants. In volume terms, cumulative prospectus

order book for Gujarat (250,000 MT), Rajasthan (110,000 MT) & Madhya

Pradesh (200,000-300,000 MT) is 560,000-660,000 MT. Apart from this, RMTL

has already tendered for 100,000 MT in the oil & gas industry.

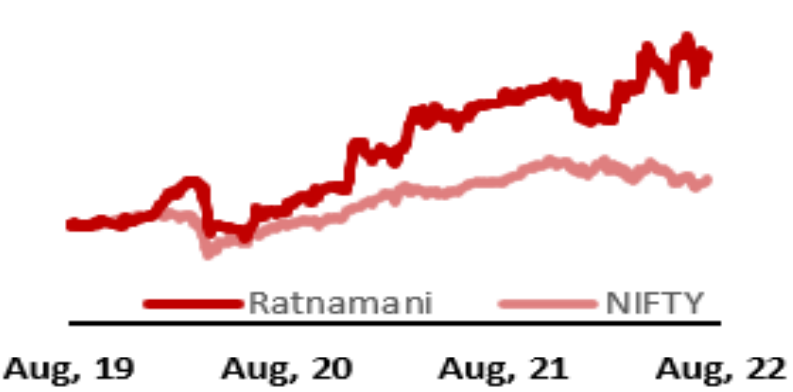

Ratnamani vs Nifty

Source: Keynote Capitals Ltd.

Capacity expansion (Capex)

In earlier quarters, management indicated that they will be spending Rs. 3.5 Bn

for capacity expansion in SS pipes (brownfield) & Helical Submerged Arc

Welding (HSAW) pipes (greenfield). SS pipes expansion is progressing as per

expectations. As HSAW pipes expansion is a greenfield project, management

requires another six months to give a clarity on development progress.

Key Financial Data

| (Rs mn) | FY22 | FY23E | FY24E |

|---|---|---|---|

| Revenue | 31,388 | 37,665 | 42,413 |

| EBITDA | 4,947 | 6,026 | 6,998 |

| Net Profit | 3,226 | 3,812 | 4,503 |

| Total Assets | 29,625 | 33,061 | 37,308 |

| ROCE (%) | 14% | 16% | 17% |

| ROE (%) | 15% | 16% | 16% |

Source: Company, Keynote Capitals Ltd.

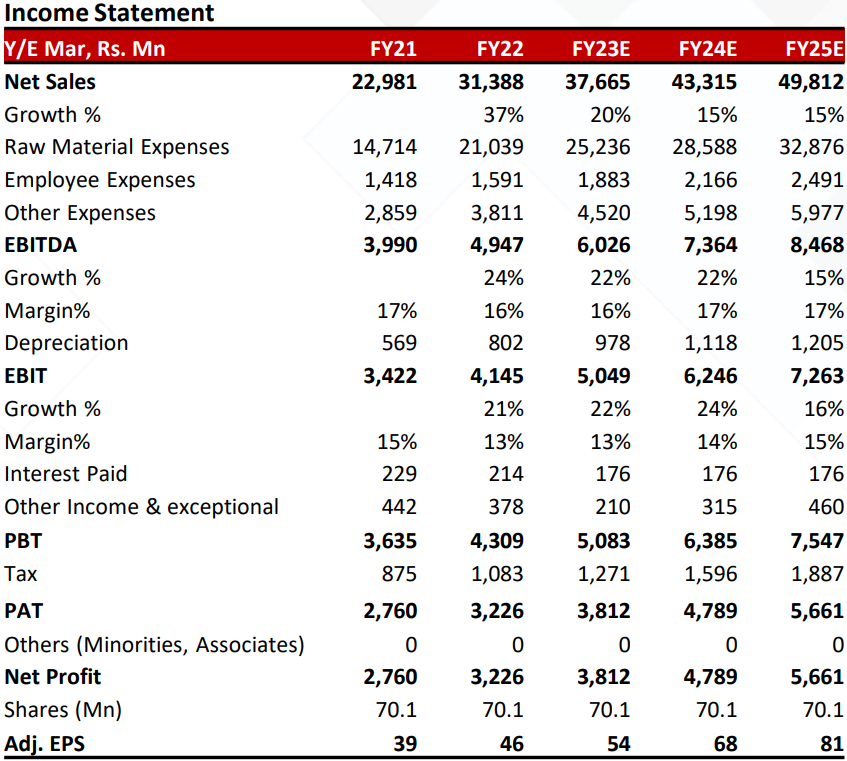

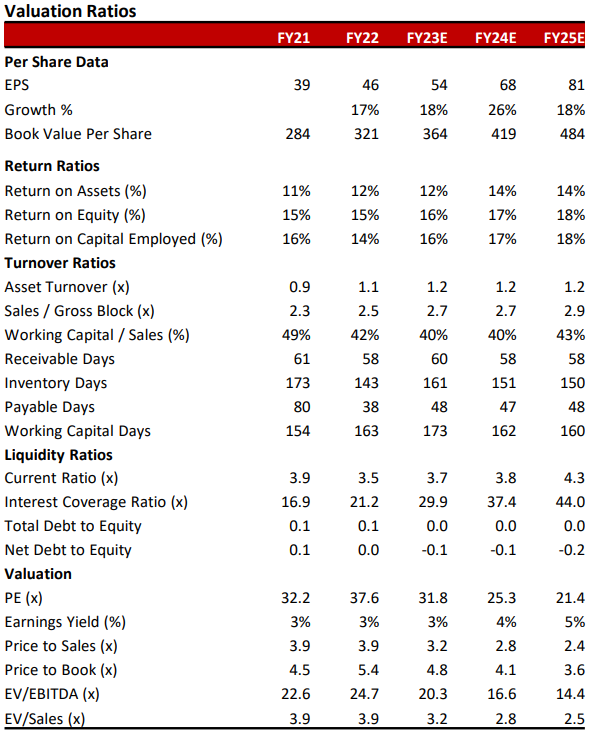

View & Valuation

We maintain our views on Ratnamani Metals & Tubes Ltd with a NEUTRAL

rating and a target price of Rs. 1,824 (32x FY23e earnings), giving it a 15%

premium to median multiples based on a strong order book and execution

track record of the management.

Result Highlights (Rs. Mn)

Research Analyst

Ratnamani Metals & Tubes Ltd. | Quarterly Update

Q1FY23 Conference Call Takeaways

General Highlights

– Change in product mix and higher inventory cost had put some pressure on

operating margins.

– As of June’2022, liquid cash on books & fixed investments are worth Rs.

2,200 Mn+ & debt is worth Rs. 1,500-1,600 Mn.

CS pipes

– Electrical Resistance Welding (ERW) pipes capacity is fully booked till

November’2022. For future projects, RMTL has already bid for a few tenders.

– Management expects a strong pipeline in CS pipes: Longitudinal

Submerged Arc Welding (LSAW) pipes for the oil & gas industry & HSAW pipes for water infrastructure projects.

SS pipes

– In the last few quarters, RMTL has not delivered a growth in SS pipes (volume terms).

– Management indicated that their focus is to increase the value-added proportion in SS pipes. This will help them to differentiate themselves from

the competition.

Management Guidance

– In the short term, RMTL can see blips in operating margins, but in the long

term, they will have stable operating margins in the range of 16-18%.

– In FY23, RMTL will see top-line growth of 15-20%.

CAPEX

– Annual maintenance expense is Rs. 400 Mn.

– SS pipes (brownfield) expansion is progressing as per expectation.

– For any development in HSAW pipes (greenfield) expansion, management

requires six months for a clear guidance.

Order Book

– Currently, RMTL has an order book worth Rs. 23,450 Mn, which includes Rs.

4,550 Mn export orders & 18,900 Mn domestic orders.

– In Water infrastructure projects, RMTL has a prospectus order book of

560,000-660,000 MT, which are close to its manufacturing plants.

– RMTL has already made a bid for 100,000 MT in the oil & gas industry.

Ratnamani Metals & Tubes Ltd. | Quarterly Update

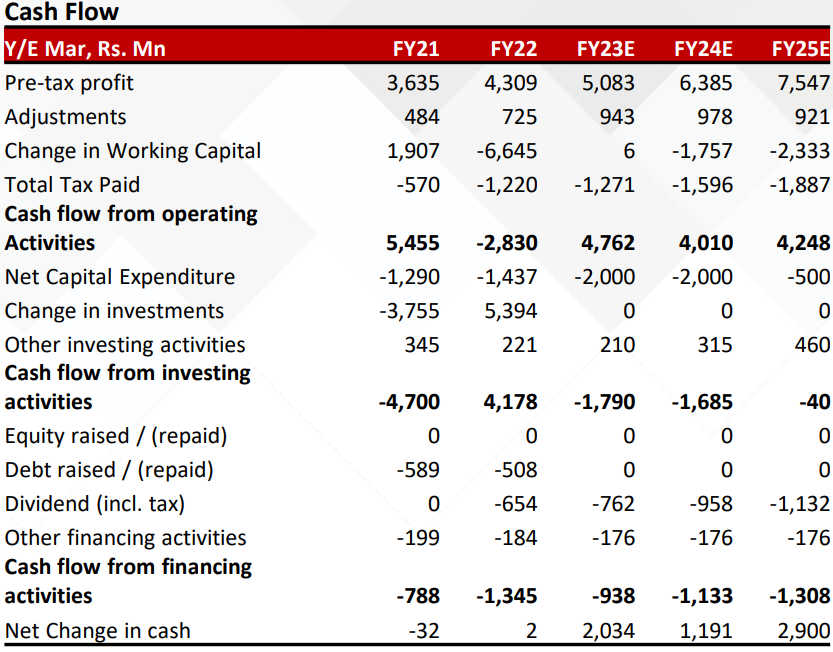

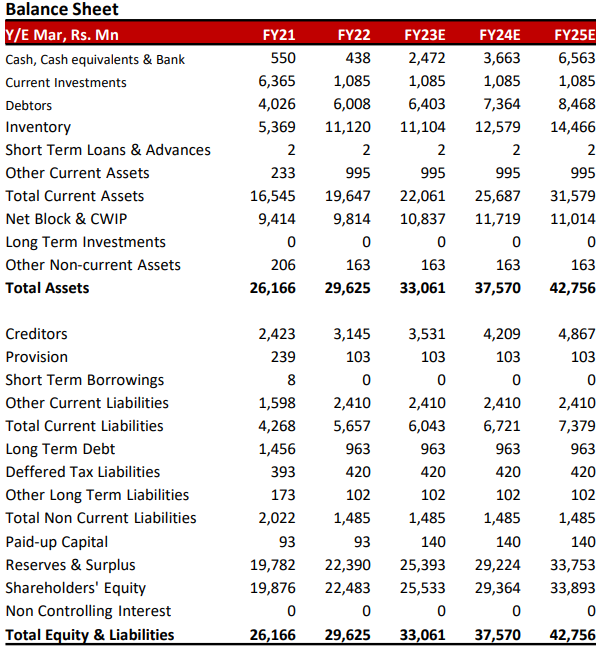

Financial Statement Analysis

Ratnamani Metals & Tubes Ltd. | Quarterly Update

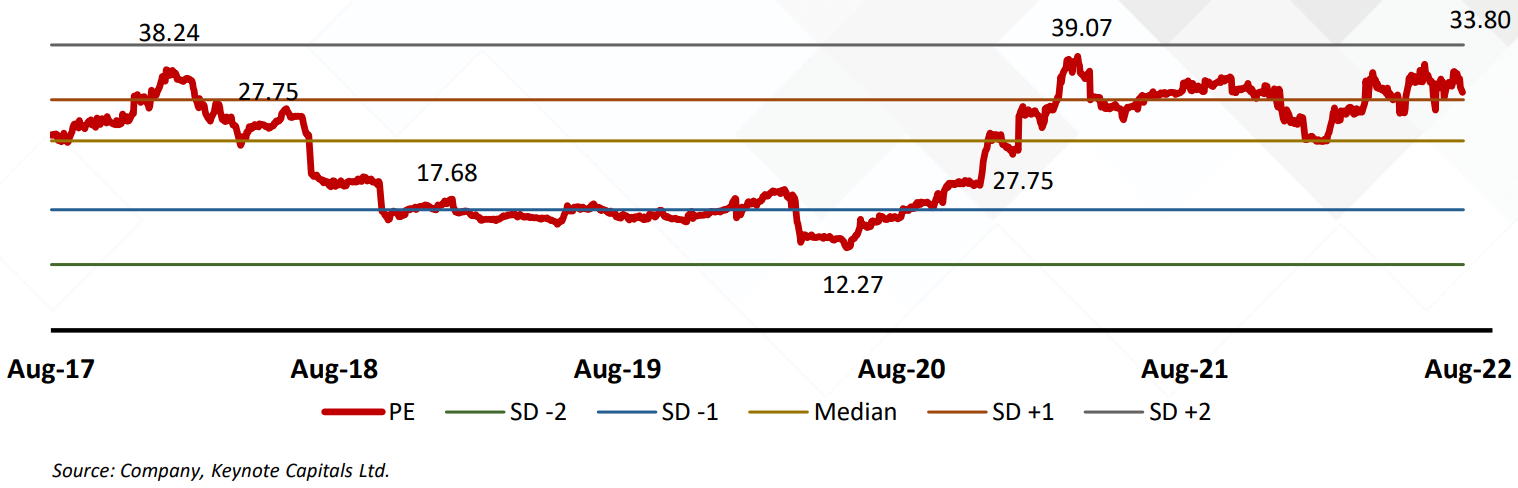

Valuation

KEYNOTE Rating History

| Date | Rating | Market Price at Recommendation | Upside/Downside |

|---|---|---|---|

| 4th August 2022 | NEUTRAL | 1,779 | +2.5% |

| 12th August 2022 | NEUTRAL | 1,730 | +5.4% |

Ratnamani Metals & Tubes Ltd. | Quarterly Update

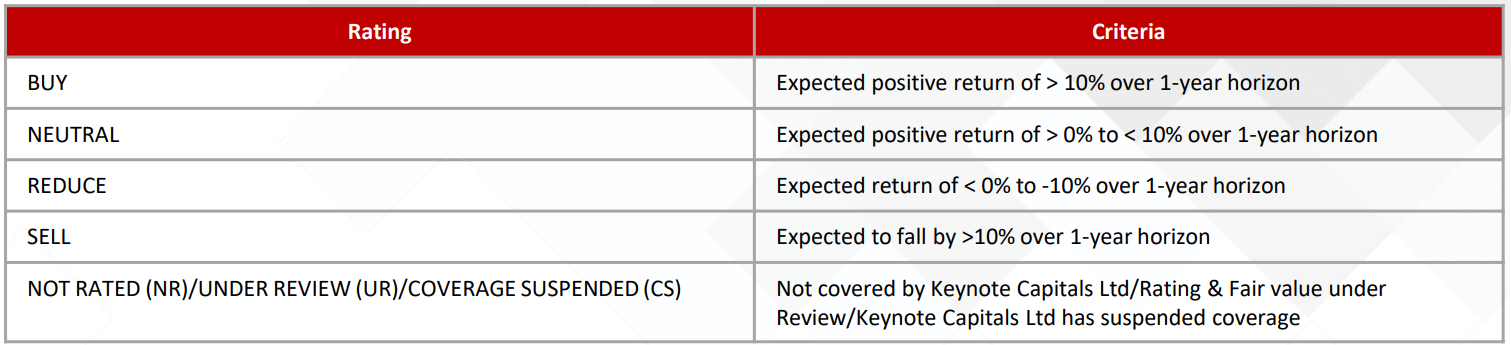

Rating Methodology

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no. INH000007997. KCL, the Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant services & distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associate-entities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives may; (a) from time to time, have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report.

KCL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect the objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com, www.bseindia.com. Research Analyst views on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates maintains arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an independent view with regards to Subject

Company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject KCL & its group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

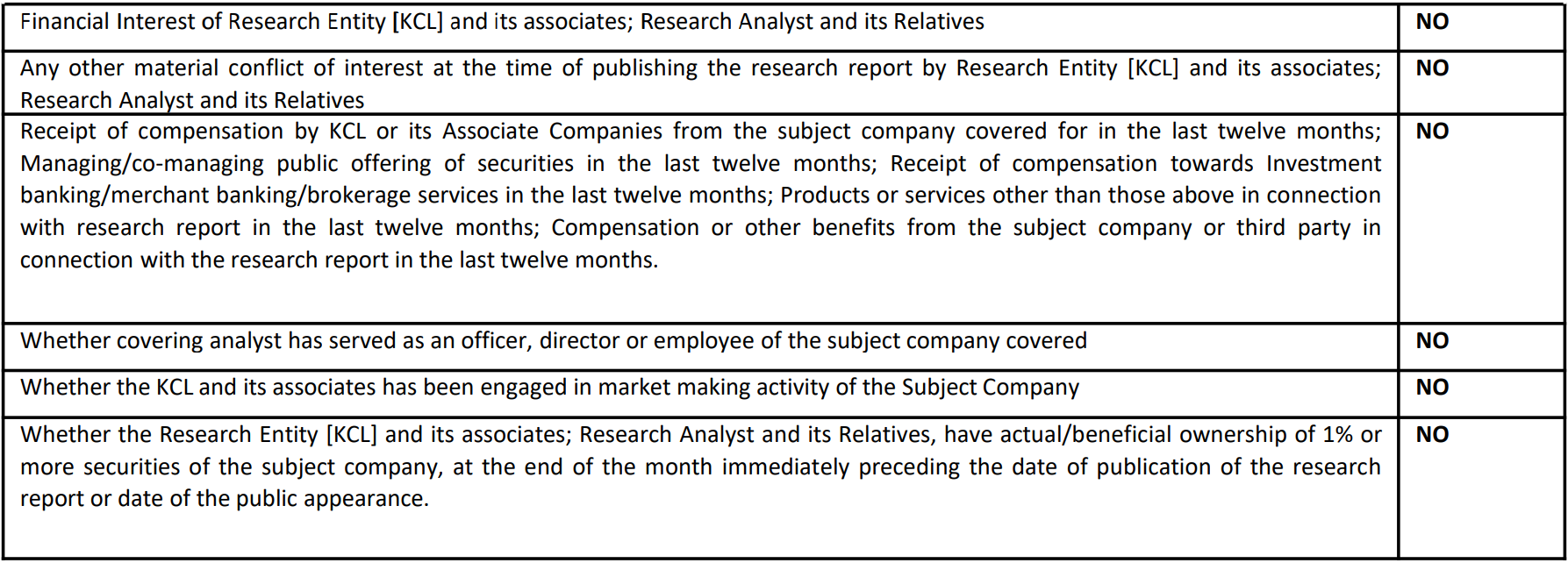

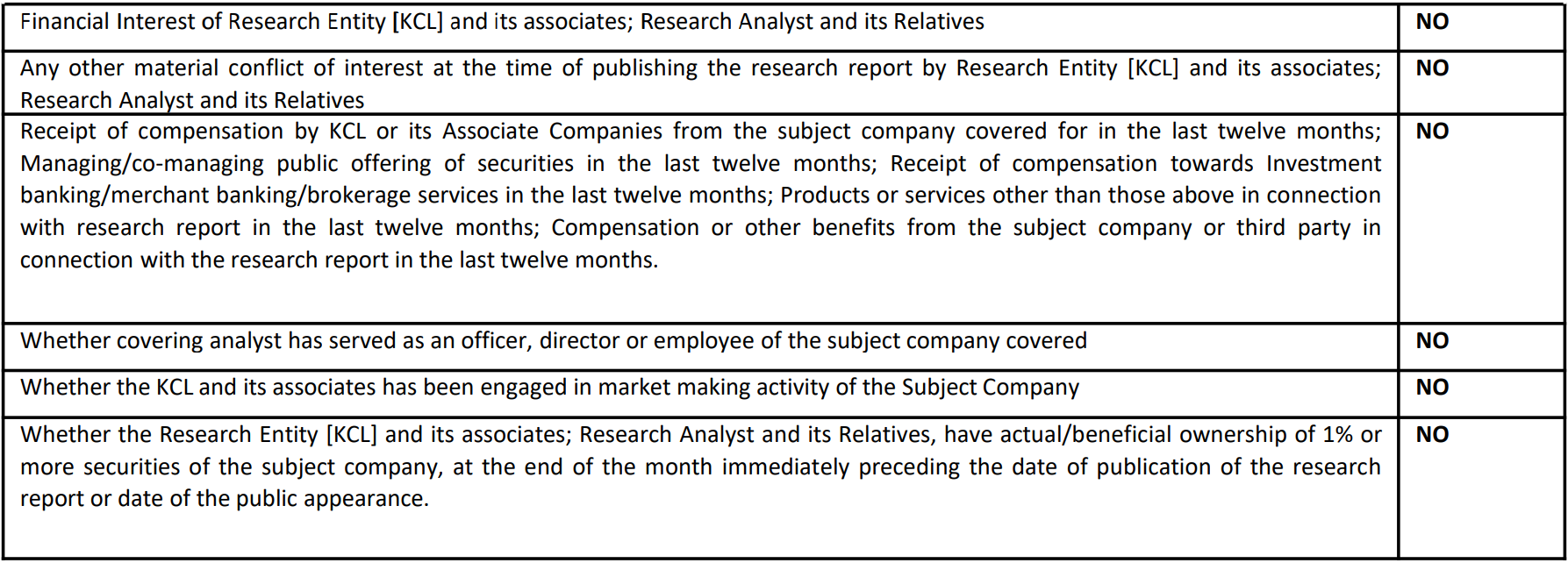

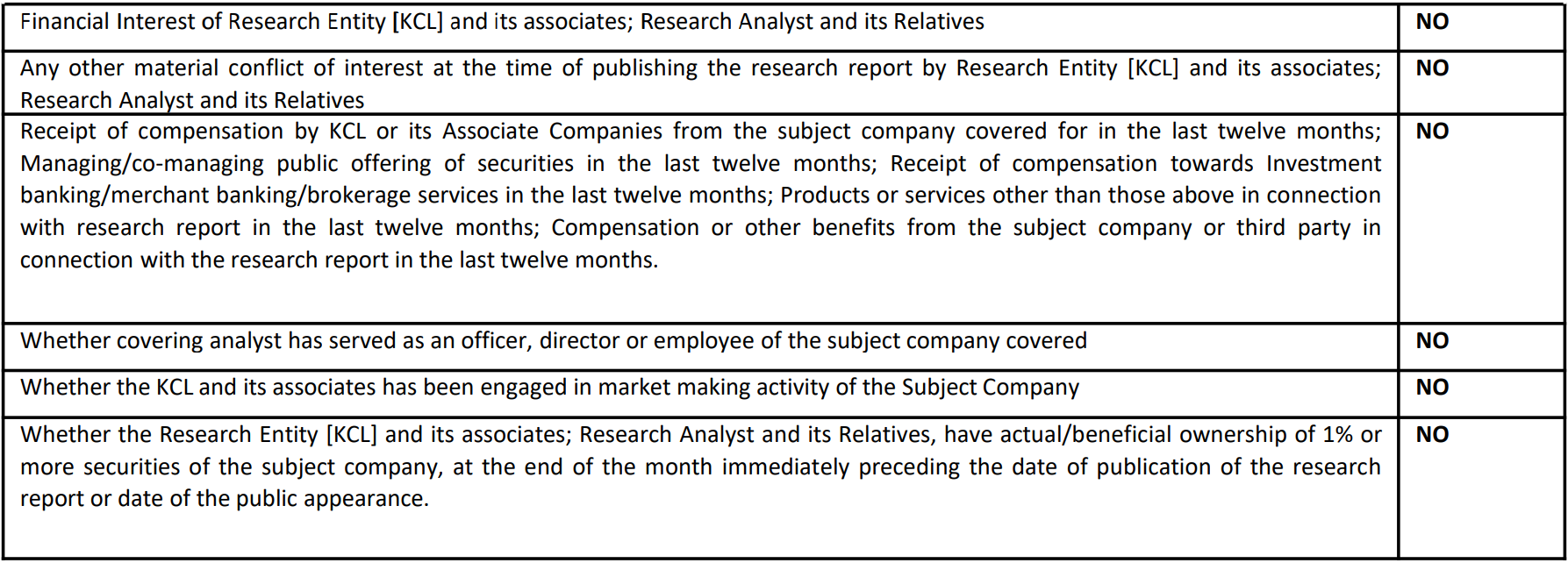

Specific Disclosure of Interest statement for subjected Scrip in this document:

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no. INH000007997. KCL, the Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant services & distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associate-entities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives may; (a) from time to time, have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report.

KCL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect the objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com, www.bseindia.com. Research Analyst views on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates maintains arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an independent view with regards to Subject

Company for which Research Team have expressed their views.

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject KCL & its group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

Specific Disclosure of Interest statement for subjected Scrip in this document:

Ratnamani Metals & Tubes Ltd. | Quarterly Update

The associates of KCL may have:

– financial interest in the subject company

-actual/beneficial ownership of 1% or more securities in the subject company

-received compensation/other benefits from the subject company in the past 12 months

-other potential conflict of interests with respect to any recommendation and other related information and opinions.; however, the same shall

have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are

completely independent of the views of the associates of KCL even though there might exist an inherent conflict of interest in some of the stocks

mentioned in the research report.

-acted as a manager or co-manager of public offering of securities of the subject company in past 12 months

-be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial

instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies)

-received compensation from the subject company in the past 12 months for investment banking / merchant banking / brokerage services or from

other than said services.

The associates of KCL has not received any compensation or other benefits from third party in connection with the research report.

Above disclosures includes beneficial holdings lying in demat account of KCL which are opened for proprietary investments only. While calculating

beneficial holdings, it does not consider demat accounts which are opened in name of KCL for other purposes (i.e. holding client securities,

collaterals, error trades etc.). KCL also earns DP income from clients which are not considered in above disclosures.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part

of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed

by research analyst(s) in this report

Terms & Conditions:

This report has been prepared by KCL and is meant for sole use by the recipient and not for circulation. The report and information contained herein

is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the

media or reproduced in any form, without prior written consent of KCL. The report is based on the facts, figures and information that are believed to

be true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly

available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or

sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all

customers may receive this report at the same time. KCL will not treat recipients as customers by virtue of their receiving this report

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise

of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an

independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and

should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be

suitable for all investors. Certain transactions -including those involving futures, options, another derivative product as well as non-investment

grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the

accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed

in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and

alternations to this statement as may be required from time to time without any prior approval. KCL, its associates, their directors and the

employees may from time to time, effect or have affected an own account transaction in, or deal as principal or agent in or for the securities

mentioned in this document. KCL, its associates, their directors and the employees may from time to time invest in any discretionary PMS/AIF

Fund and those respective PMS/AIF Funds may affect or have effected any transaction in for the securities mentioned in this document. They may

perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred

to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account

before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media

or developed through analysis of KCL. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views

expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on,

directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for

distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would subject KCL to any registration or licensing

requirement within such jurisdiction.

Ratnamani Metals & Tubes Ltd. | Quarterly Update

The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents

or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost

profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt KCL

or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold KCL or any of its affiliates

or employees responsible for any such misuse and further agrees to hold KCL or any of its affiliates or employees free and harmless from all losses,

costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Keynote Capitals Limited (CIN: U67120MH1995PLC088172)

Compliance Officer: Mr. Jairaj Nair; Tel: 022-68266000; email id: [email protected]

Registered Office: 9th Floor, The Ruby, Senapati Bapat Marg, Dadar West, Mumbai – 400028, Maharashtra. Tel: 022 – 68266000.

SEBI Regn. Nos.: BSE / NSE (CASH / F&O / CD): INZ000241530; DP: CDSL- IN-DP-238-2016; Research Analyst: INH000007997

For any complaints email at [email protected]

General Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on

www.keynotecapitals.com; Investment in securities market are subject to market risks, read all the related documents carefully before investing.