Initiating Coverage Report

Nippon Life India Asset | Initiating Coverage Report

Nippon Life India Asset Management Ltd.

27th July 2022

BUY

CMP Rs. 285

TARGET Rs. 411 (+44.2%)

Too much pessimism priced-in

Nippon Life India AMC (NAM) is the 6th largest Asset Management Company

in India and the 2nd largest non-bank AMC with mutual fund Asset Under

Management (AUM) of Rs. 2.83 Trn (as of 31st Mar’22), commanding a

market share of 7.4%. It also manages PMS/AIF/offshore advisory mandates,

representing 20% of its total AUM but contributing ~11% to its topline. The

Company follows the ‘Investor First’ philosophy and launches schemes to

cater to investors’ varied and diverse needs. Currently, the Company is

focused on growing its retail franchise and remaining a relevant player in the

ETF space. We initiate coverage on Nippon Life India Asset Management with

a BUY rating and a target price of Rs. 411

Company Data

| MCAP (Rs. Mn) | 1,77,049 |

|---|---|

| O/S Shares (Mn) | 623 |

| 52w High/Low | 477 / 259 |

| Face Value (in Rs.) | 10 |

| Liquidity (3M) (Rs. Mn) |

173.6 |

Strong retail franchise in favourable in AUM mix

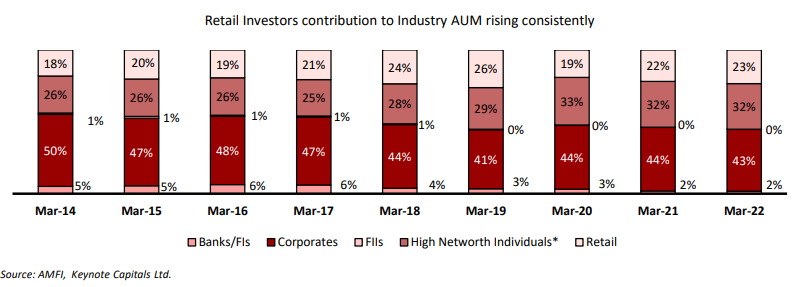

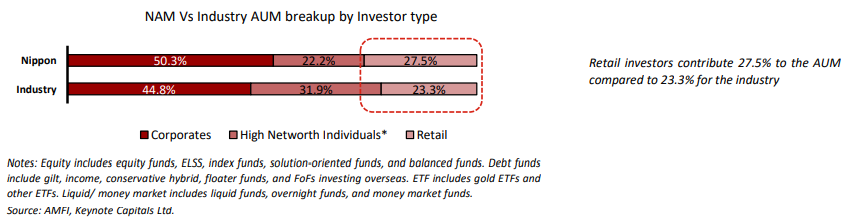

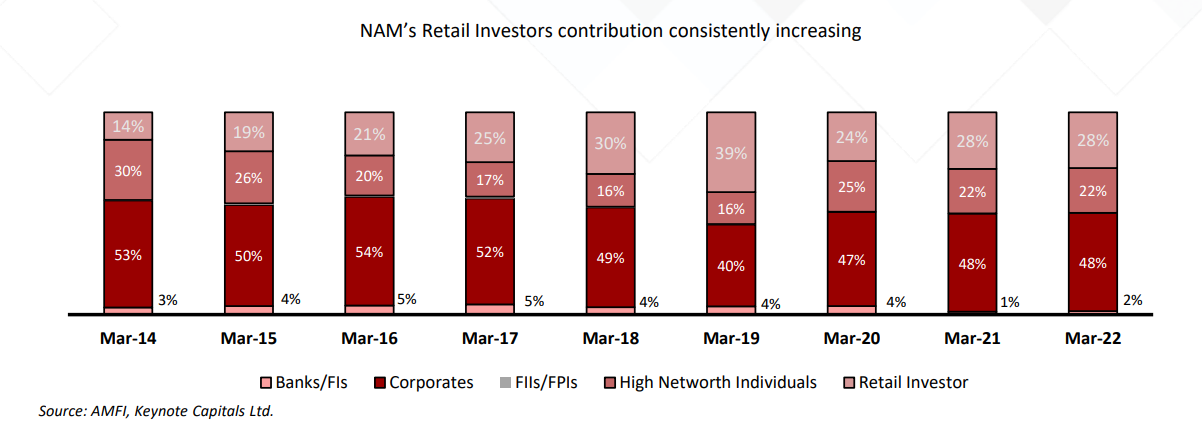

The share of retail investors in the AUM mix of NAM has increased from

13.6% in FY14 to 27.5% in FY22. A similar number for the industry is 23.3%.

Retail investors tend to be more inclined toward equity products and are

more sticky than other investor classes. A rising share of retail investors

bodes well for AMC’s AUM yield. NAM has a higher market share in the retail

segment at 8.7% vs. 7.4% overall market share.

Shareholding Pattern %

| Mar 22 | Dec 21 | Sep 21 | |

|---|---|---|---|

| Promoters | 73.8 | 73.8 | 74.0 |

| FIIs | 6.7 | 7.2 | 6.6 |

| DIIs | 8.8 | 8.4 | 8.8 |

| Non-Institutional< | 10.7 | 10.7 | 10.6 |

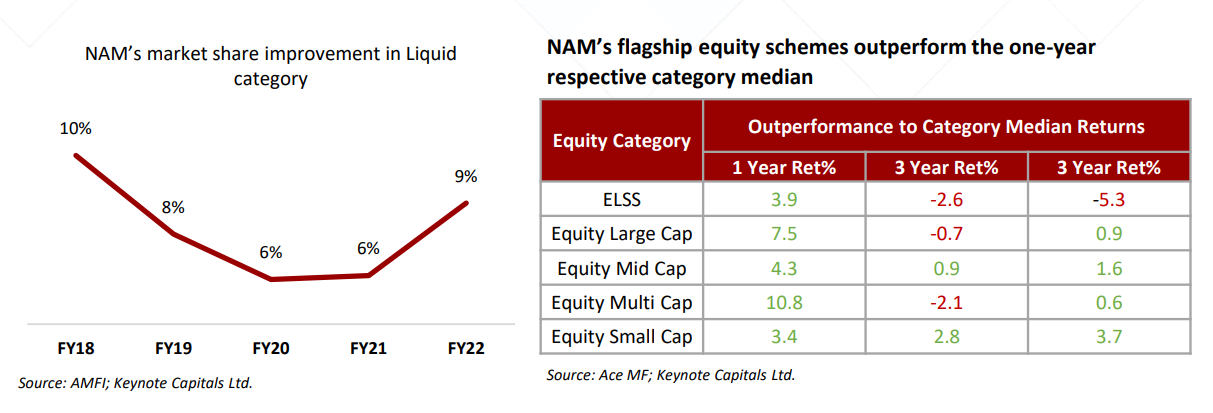

Recent equity fund performance showing encouraging sign

NAM has shown smart recovery in scheme performance. They have managed

to improve their ranking from 20/30+ rank in 3 & 5-year performance to

amongst the top performers in that category in last one year. Generally,

improvement in scheme performance is followed by market share gain.

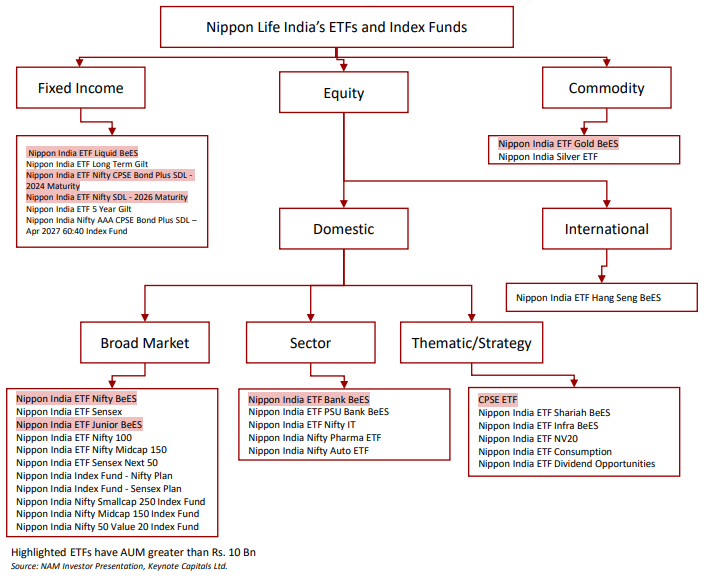

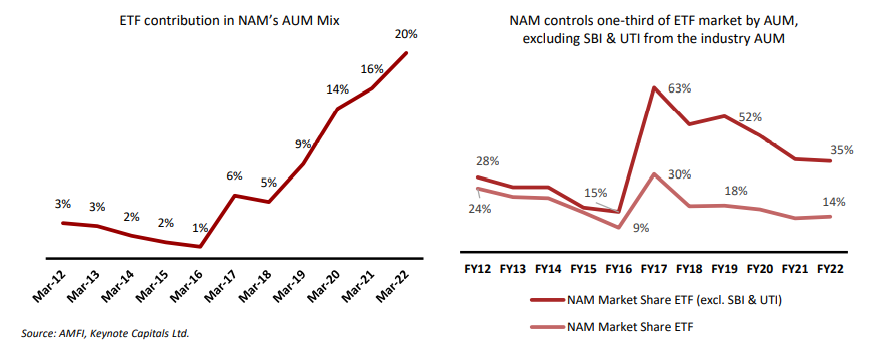

NAM continues to be a relevant player in ETF space

The company has one of the industry’s most extensive suites of passive

products, with 25-30 ETF schemes and 6 Index Funds. NAM has almost 58%

of the industry’s folio market share in the passive category. NAM’s ETF

schemes contribute ~68% of exchange ETF volumes. NAM has a 13.5%

market share of overall ETF AUM.

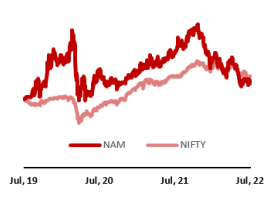

NAM vs Nifty

Source: Keynote Capitals Ltd.

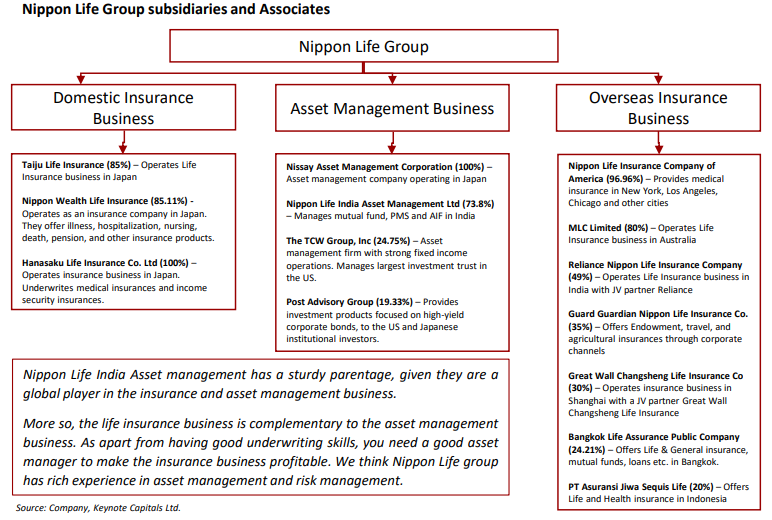

Strong parentage

Nippon Life India Asset management has a sturdy parentage, given they

have a global presence in the insurance and asset management business.

The life insurance business is complementary to the asset management

business as besides having underwriting skills, you need a good asset

manager to make the insurance business profitable. Nippon Life group has

rich experience in asset management and risk management.

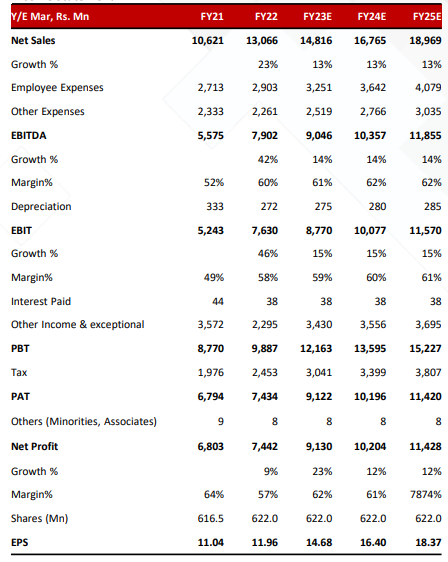

Key Financial Data

| (Rs mn) | FY22 | FY23E | FY24E |

|---|---|---|---|

| Revenue | 13,066 | 14,816 | 16,765 |

| EBITDA | 7,902 | 9,046 | 10,357 |

| Net Profit | 7,434 | 9,122 | 10,196 |

| Total Assets | 37,965 | 39,200 | 40,336 |

| ROCE (%) | 24% | 26% | 28% |

| ROE (%) | 23% | 26% | 28% |

Source: Company, Keynote Capitals Ltd.

View & Valuation

We initiate coverage on Nippon Life India Asset Management with a BUY

rating and a target of Rs. 411 (28x FY23 earnings). Since erstwhile promoter

Reliance Capital defaulted, the company’s growth has underperformed the

industry, but with the enhancement in market share in the last few quarters

and a massive improvement in scheme performance, we expect NAM to grow

at least in line with the industry going ahead. Given that NAM is trading at – 1

standard deviation of its trailing PE, chances of Re-rating are High, and the

downside from current levels seems limited.

Research Analyst

chirag@keynotecapitals.net

Nippon Life India Asset | Initiating Coverage Report

Industry Overview

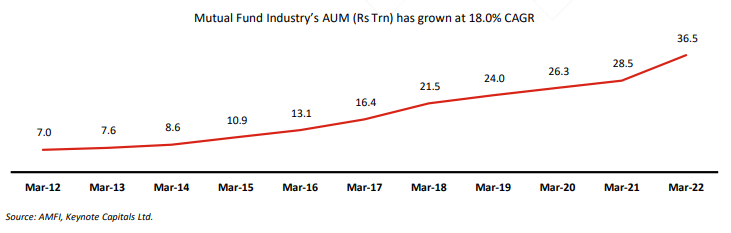

In 1963, the Indian mutual fund industry commenced operations with the

formation of the Unit trust of India (“UTI”) by an Act of Parliament. UTI

remained the only player in the mutual fund industry for over twenty-five

years, and its AUM increased from Rs. 250 million in 1965 to Rs. 67 Bn in

1988. In 1993, the mutual fund industry was opened for private players.

Many Banks and foreign mutual fund houses participated in the industry. By

the end of February 2003, there were 33 AMCs with total assets of Rs. 1.22

Trn. Since then, the industry has grown at a CAGR of 19.6% (Upto March

2022). Over the last decade, the mutual fund industry has maintained its

growth rate and has increased at an 18.0% CAGR from Rs. 7 Trn in FY12 to

Rs. 36.5 Trn in FY22.

Retail Investors are contributing to the growth…

The industry’s investor base can be broadly categorized as Retail, High Net

worth Individuals (HNI), and Institutional Investors. Participation from retail

investors increased from 18.1% in Mar 2014 to 23.3% in Mar 2022. Retail

and institutional investors tend to have a higher contribution towards

equity.

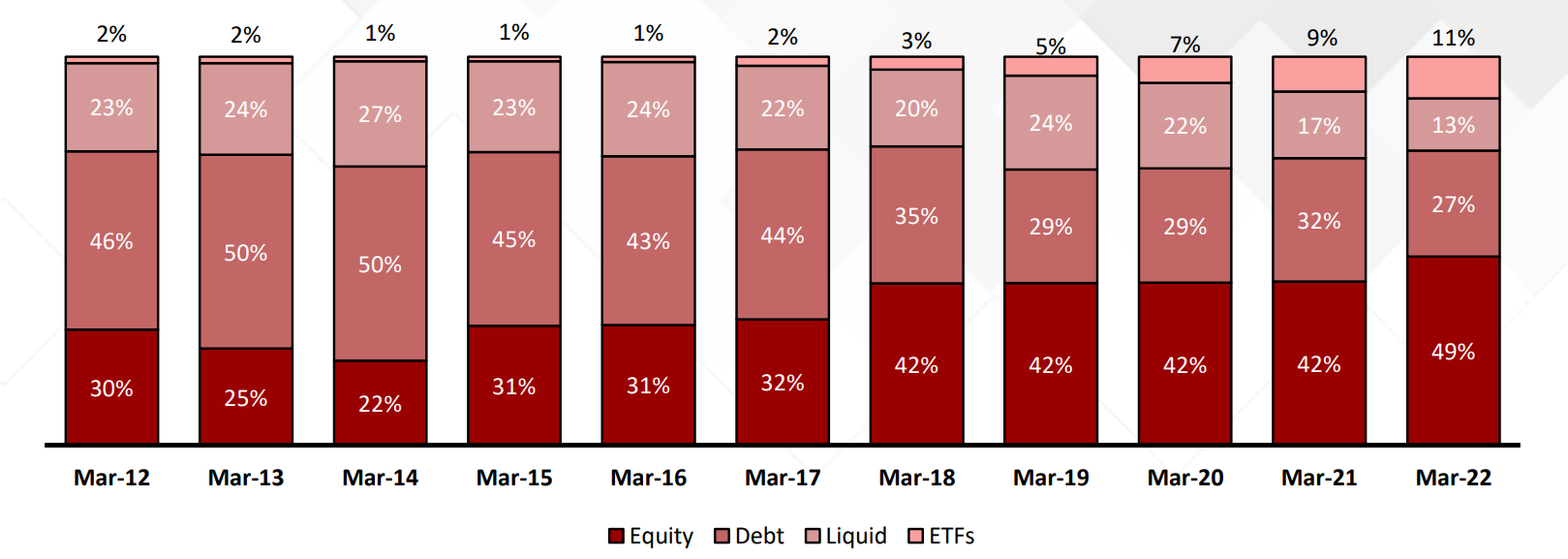

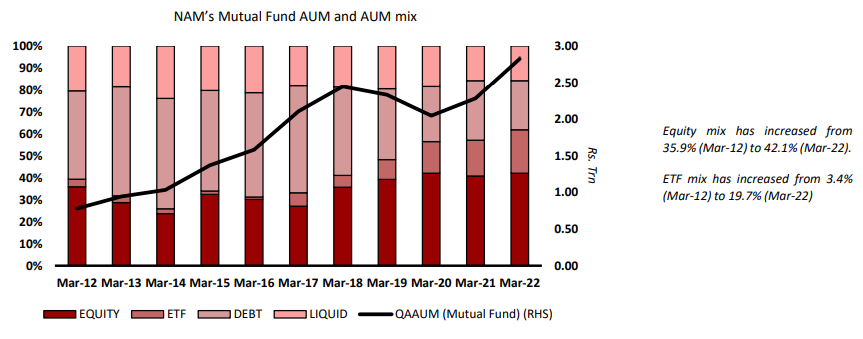

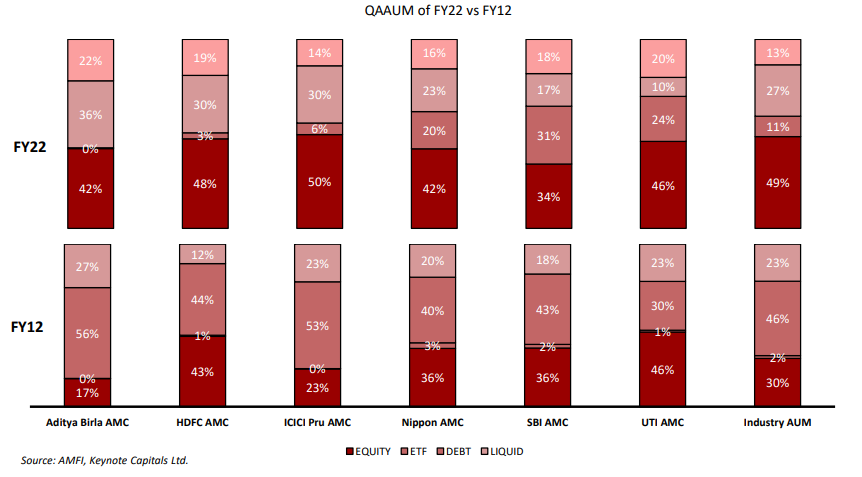

Increasing equity mix bodes well for AMCs…

Equity AUM as the proportion of total industry AUM rose from 29.8% in

March 2012 to 48.6% in Mar 2022, which can be attributed to increasing

awareness, financialization of savings, rise in SIPs, etc. Even increasing

contribution from retail investors (who have a high inclination towards

equities) has contributed to a surge in equity AUM in the overall mix.

Increasing equity mix bodes well for the AMCs since they get better yield

compared to debt/liquid/passive products.

Nippon Life India Asset | Initiating Coverage Report

Rising Mix of Equity and ETFs in Industry AUM

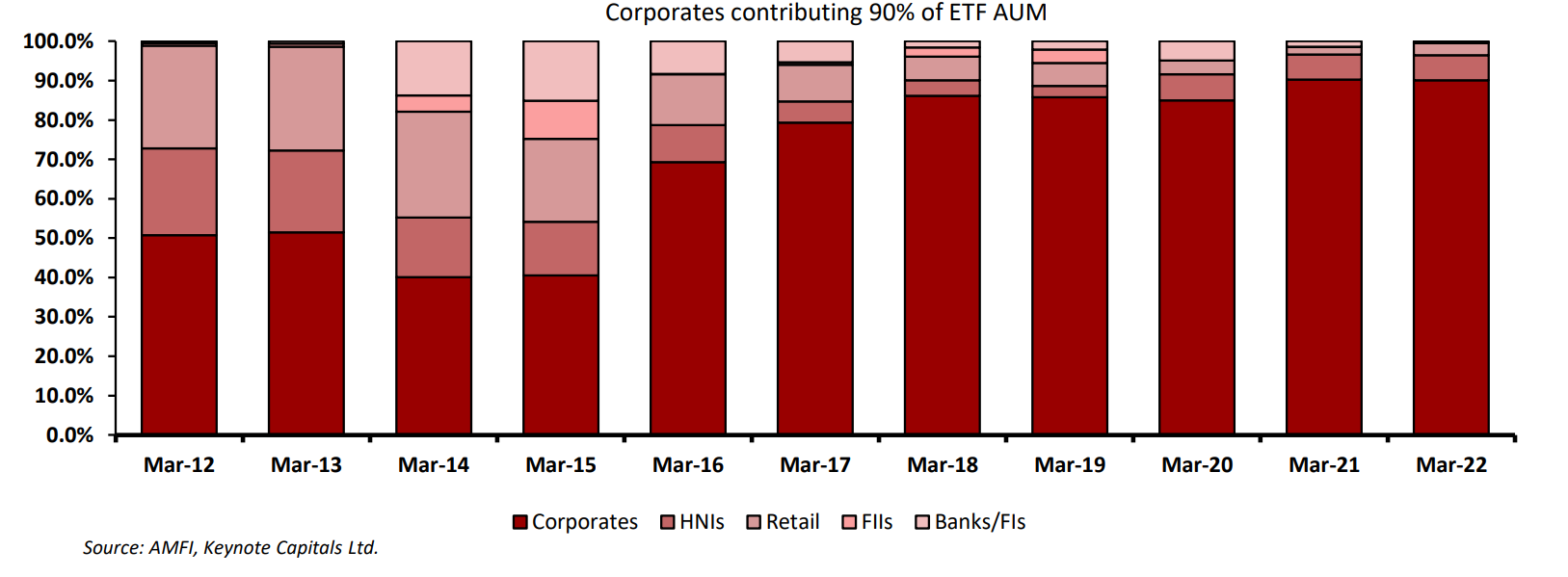

EPFO contributing to the growth of passive products…

With rising awareness and preference for passive funds, the contribution of

ETFs has also increased tremendously from 1.7% in March 2012 to 10.8% in

Mar 2022. Since Mar 2012, ETFs have posted the highest growth, with assets

swelling at 43.7% CAGR (on a low base). Institutional investors such as

Employee’s Provident Fund Organization (EPFO) began investing a portfolio

(currently 15%) of their fresh accretion/incremental deposits into equities via

passively managed funds. Of the ETF AUM, the majority is contributed by

corporates (~90% as of Mar 2022), whereas retail & HNI combined contribute

~10% of the AUM (Mar 2022).

SBI and UTI are the major AMCs in passive funds, driven by high ticket

mandates from public sector funds to manage investments in passive funds.

In the previous year, ETF AUM from retail has grown 2.4x owing to discounts

provided via government disinvestment schemes (CPSE ETF and Bharat 22),

aimed at increasing retail investor participation.

Nippon Life India Asset | Initiating Coverage Report

The expense ratio of passive ETFs and index funds is lower than actively

managed funds, and increasing the contribution of passive products in the

overall AUM mix can dent yields for AMCs. Though passive AUM may grow at

a faster pace compared to other categories, the revenue contribution of

passive products in AMC’s overall revenue mix will remain the same.

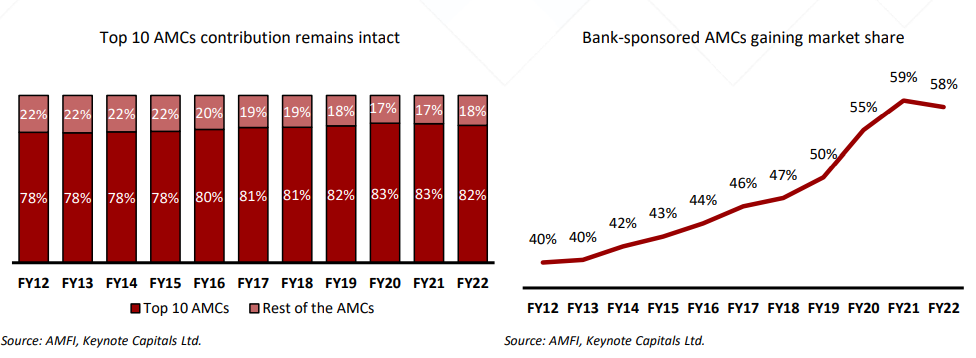

The Indian mutual fund industry has 45 AMCs comprising bank-sponsored

and private AMCs. Despite this, the industry continues to remain

consolidated, with the top 10 AMCs accounting for more than 80% of

industry AUM. Bank-sponsored AMCs continue to gain market share on the

back of the better distribution network of their parent.

Top 10 AMCs’ growth (18.6%) has been in line with the industry (18.0%) in the

last ten years.

Bank-sponsored AMCs have grown at a much faster pace of 22.4% since Mar-2012,

increasing their market share from 40% in FY12 to 58% in FY22

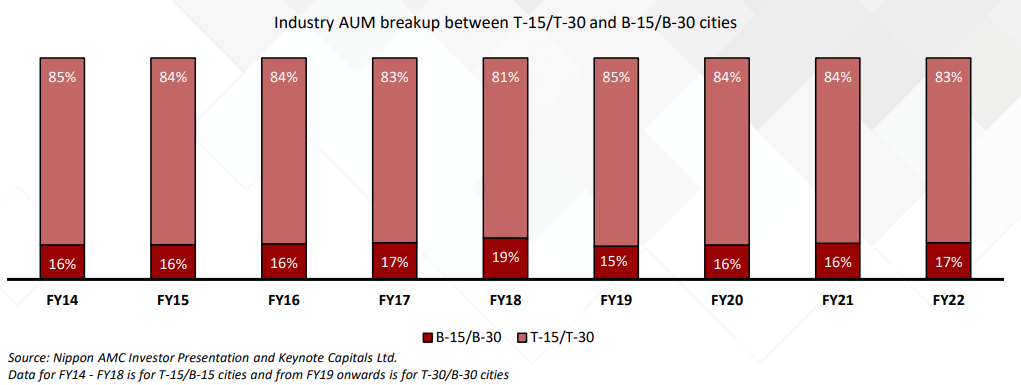

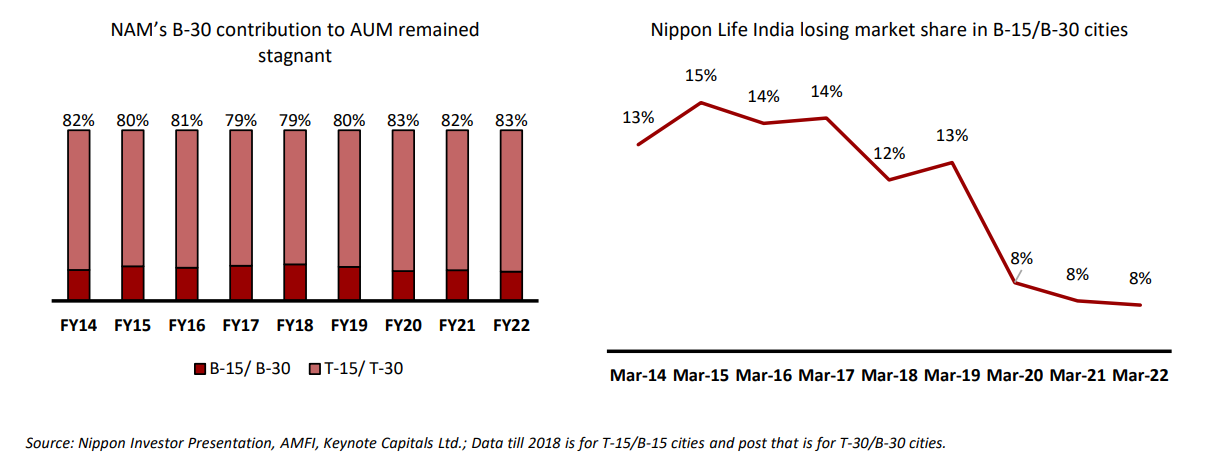

B-30 cities to be the next growth driver for AMCs, and bank-sponsored

AMCs have the upper hand…

Historically, AUM has been concentrated in the Top 30 (T-30) cities due to the

presence of institutional investors, and they have a high concentration of

assets in non-equity schemes. The T-30 cities hold the majority of mutual fund

assets with a share of 83.4%, whereas Beyond 30 (B-30), cities held 16.6% of

assets as of 31st March 2022. AUM from B-30 has a higher equity asset

composition than T-30 cities. Further, B-30 cities are gaining significance in the

industry AUM mix as the SEBI provides impetus to mutual fund penetration in

B-30 cities by allowing additional Total Expense Ratio (TER). Most investors

from B-30 tend to be individual investors with high exposure to equity via SIPs.

Given the higher concentration of retail investors in equity products, increased

B-30 market penetration should further increase the overall proportion of

equity AUM in the aggregate industry AUMs. AMCs with a higher share in B-30

cities are less susceptible to overall margin pressure than their T-30-focused

peers.

Gaining market share in B-30 cities is more manageable for those AMCs with

better brand recall among retail investors. Banks tend to have the upper hand

over non-bank-sponsored AMCs.

Nippon Life India Asset | Initiating Coverage Report

SIPs bringing sustainability to inflows

SIPs have helped further helped to increase retail investors participation in the

mutual fund space. A significant benefit of SIP is avoidance of behavioral

weakness during uncertain periods as it helps in Rupee Cost Averaging and

invest in a disciplined manner without worrying about market’s volatility and

timing the market. It is one of the strong pillars of the industry and provides

long-term sustainable inflows. It also inculcates a ‘savings habit’ among

investors and ensures a steady, disciplined approach to investing rather than

ad-hoc. SIPs have increased accessibility to lower-income households.

SIPs are far more profitable due to inflows’ stability and have a high inclination

towards equities.

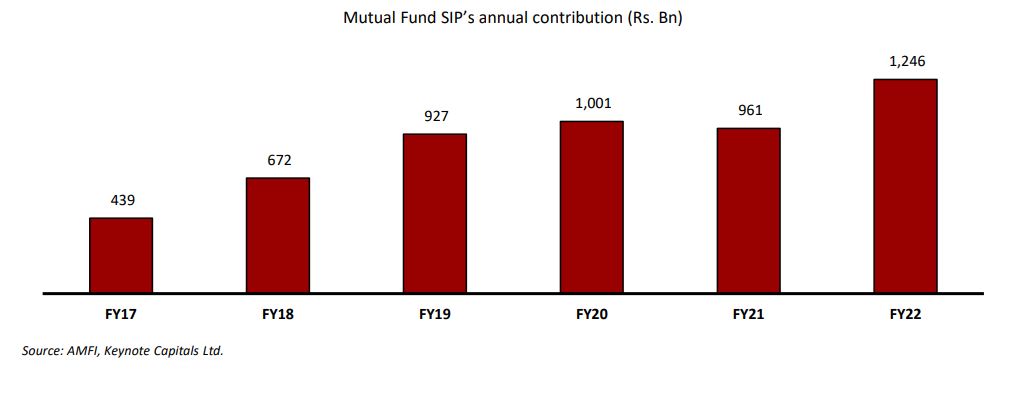

Mutual Fund SIP’s annual contribution has increased by 2.8x from Rs. 439 Bn

in FY17 to Rs. 1.25 Trn in FY22.

The popularity of equity funds, rising participation of investors, recent investor

education initiatives, and apparent benefits of SIPs to households that

traditionally did not invest in mutual funds indicate that growth in inflows

from SIPs will accelerate over the foreseeable future. This would make SIPs an

increasingly important component in overall AUM growth.

Nippon Life India Asset | Initiating Coverage Report

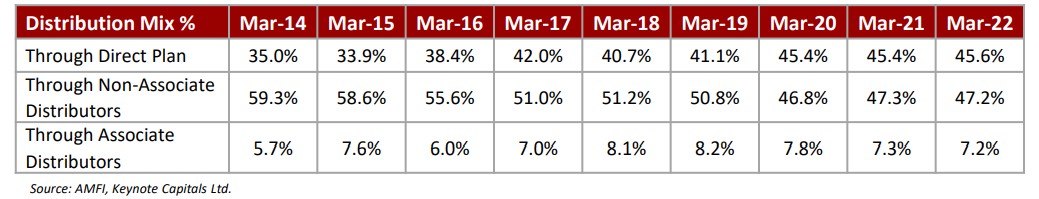

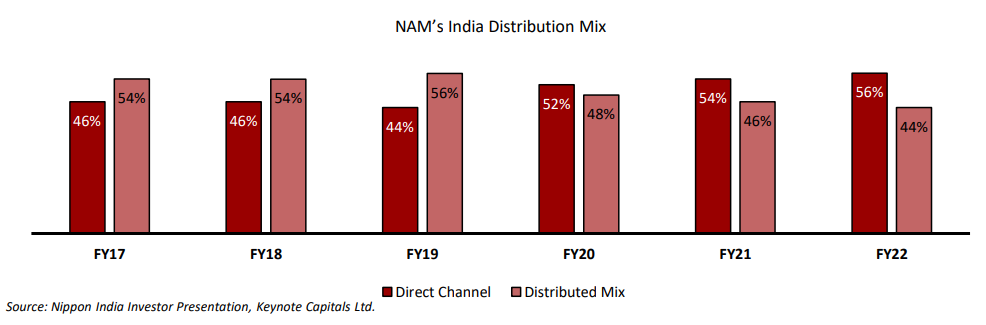

Direct channel sourcing is gaining prominence…

Direct channel’s contribution of MF assets stood at 45.6% as of March 2022.

Most of the debt AUM is invested via a direct channel as it is the preferred

route by institutional investors. Digitalization and increased adoption of

fintech apps like Zerodha coin, Paytm money, etc., which has made investing

in direct mutual funds an easy process, and increased awareness between

regular and direct plans led to the rise in direct mutual funds. As more and

more investors prefer to Do it Yourself (DIY) compared to advisory

professionals, we believe, this new set of DIY investors will unduly give more

weight to past returns, known brands, and the Total Expense Ratio (TER) of the

fund. The probability of them abandoning will be very high during a short

period of underperformance as no professional guides them through their

investment journey. Given the pickup in DIY trend, AMCs will have to educate

investors during extreme volatility. Hence, AMCs in the future, managing to do

that efficiently might lead in retail participation.

Over the last decade, there has been a gradual increase in net financial

savings, and its share in the overall household savings in India has stabilized

with an upward bias. Also, the share of mutual fund assets in gross financial

household assets in India rose in the last few years.

Although India’s mutual fund penetration (AUM to GDP) rose to 12.1%, it is

still much lower than the world average of 63%. It is also lower than many

developed economies such as the United States (120%), Canada (81%), France

(80%), and the UK (67%), and emerging economies such as Brazil (68%) and

South Africa (48%).

As India advances, favorable demographic, formalization of the economy,

growing financial inclusion, higher disposable income, and investable surplus,

increasing financial savings, higher investor awareness, investor-friendly

regulations, a wide range of transparent and investor-friendly products, ease

of investing, tax incentives, expanding distribution coverage, digitalization, and

perception of mutual funds as long-term wealth creators, are expected to be

key drivers for the growth of the Mutual Fund industry.

Nippon Life India Asset | Initiating Coverage Report

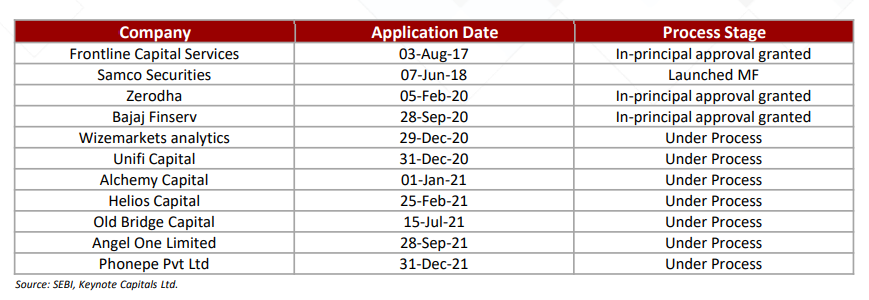

Competition Intensifying

SEBI’s recent relaxation of the AMC license issuance norm has paved the way

for many new AMCs applying for licenses. The new norms have eliminated

profitability as a criterion as long as companies obtain new licenses and

maintain Rs. 1 Bn in capital until they become profitable in five years.

Many new fintech companies like Zerodha, Phonepe, etc., have also applied

for the license. We expect their offering to be more focused towards passive

or rule-based offerings.

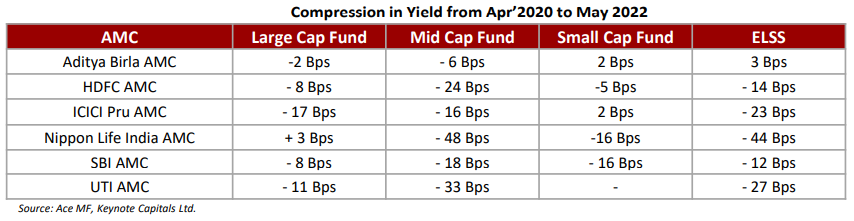

AMC’s revenue yield under pressure

Most of the listed AMCs have stated pressure on their revenue yields in the

last one year owing to multiple reasons:

• Due to the inverted pricing structure, a rise in AUM leads to lower TER

• Rising competition among AMCs getting into AUM gathering rather than

focusing on profitable growth has resulted in pricing indiscipline. Many

new NFOs are being priced at higher commissions, and AMCs are getting

lower yields. For example, in May 2021, Aditya Birla launched its Multi Cap

fund (Aditya Birla Multi Cap Fund) with a total expense ratio of 2.12% for

the regular scheme and 0.19% for the direct scheme. They are paying

1.93% commission to distributors against ~1% being the industry trend.

• Old assets with higher yields are getting replaced by newer assets with

lower yield.

• Passive funds are the fastest growing category that carries the lowest

yields for the AMCs.

Hence, yields for AMCs are likely to remain under pressure for the

foreseeable future.

Nippon Life India Asset | Initiating Coverage Report

Major regulatory changes in the industry

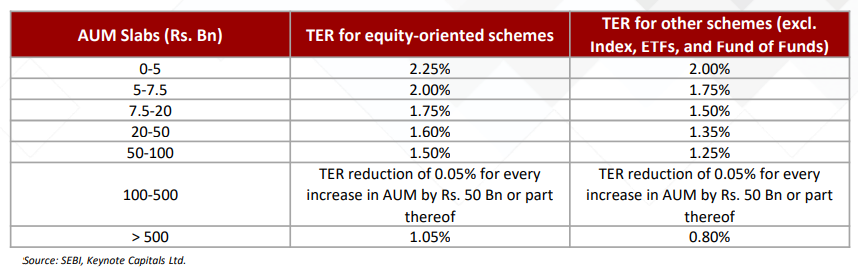

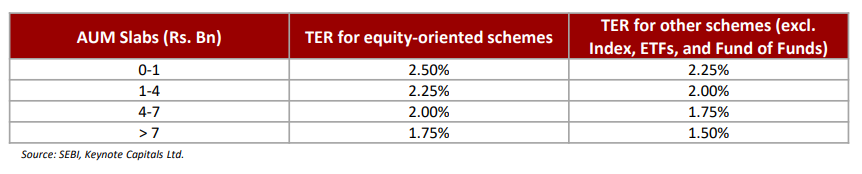

Capping on Total Expense Ratio (TER) from 1

st April 2019

From 1st Apr’19, TER has been capped based on fund size.

Revised Total Expense Ratio for open-ended schemes:

Prior Total Expense Ratio:

Reclassification of Mutual Fund Schemes

SEBI classified all open-ended schemes under five groups:

a. Equity

b. Debt

c. Hybrid

d. Solution Oriented; and

e. Others (Index, ETFs, FoFs)

For equity funds, ten categories are specified (based on market cap

orientation and investment style), 16 for debt funds (by portfolio duration,

type of securities, and credit risk), 6 for hybrid funds (by asset mix), and two

each for solution-oriented and other fund groups. Only one scheme per

category is permitted. However, Index funds, ETFs, FoFs, and sectoral or

thematic funds were exempted from the one product per category limit. So

each AMC can have a maximum of 34 schemes apart from passive, sectoral,

and thematic funds.

Discontinuation of upfront commission to distributors

SEBI banned upfront commission in mutual funds to stop the practice of

unnecessary churning in mutual fund portfolio, especially in B-30 cities. The

upfront commission is a one-time payment that an AMC pays a distributor on

selling a mutual fund scheme to an investor. Trail commission, on the other

hand, is a recurring fee paid to a distributor until the investment is

withdrawn. Trailing commission is calculated on a yearly basis and settled

every month.

Nippon Life India Asset | Initiating Coverage Report

Additional TER of upto 30 Bps for penetration in B-30 cities

SEBI permitted additional TER up to 30 bps on daily net assets of the scheme

based on inflows from B-30 cities subject to certain minimum inflows. Please

note that this additional TER can be charged based on inflows from retail

investors from B-30 cities. Thus, inflows from corporates and institutions

from B-30 cities would not attract the additional 30 bps TER.

Improving penetration beyond the top cities requires establishing more

branch networks and empanel distributors. Prior to this, AUM growth in B-30

cities does not compensate for additional operational costs. With additional

TER, the market regulator tried to incentive the same.

Scheme related expenses will not be charged on AMC books

All the scheme-related expenses which were borne by AMCs out of their

pocket earlier have to be shifted to the scheme now. Hence, the difference in

TER of the regular and direct plans will be the commission paid to

distributors.

Nippon Life India Asset | Initiating Coverage Report

Company Background

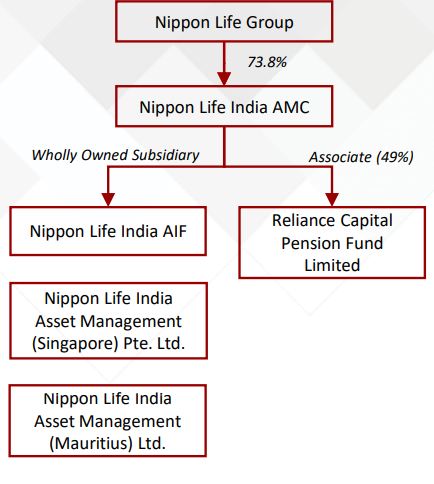

Nippon Life India Asset Management (NAM) is a subsidiary of Nippon Life

Insurance Company (NLI) which currently holds 73.8% of its outstanding

shares. NLI, a fortune 500 Company, is one of the largest life insurers in the

world, managing assets of over USD 700 Bn. NLI has an extensive global

network with a presence across the US, Europe, Asia, and Australia, a 130-year

track record in the Life Insurance business, and global investments across

Asset Management companies.

Nippon Life India AMC is the 6th largest AMC in India and the 2nd largest non-bank AMC with mutual fund Asset Under Management of Rs. 2.83 Trn (as of

31st Mar’22), commanding a market share of 7.4%.

The company is primarily involved in managing:

1. Mutual Fund, including exchange-traded funds (ETFs)

2. Managed accounts, which include Portfolio Management Services (PMS),

Alternate Investment Funds (AIFs), and Pension funds

3. Offshore funds and advisory mandates.

Mutual Fund business (80% of overall AUM)

Nippon Life India Mutual Fund manages 122 schemes and has a Quarterly

Average AUM of Rs. 2.83 Trn as on 31st March 2022. In the last decade, its

AUM has grown at a CAGR of 9.2%

AUM mix for the company is summarized below:

Nippon Life India Asset | Initiating Coverage Report

NAM remains among the leaders in the ‘Beyond Top 30 cities’ segment or B-30

locations. B-30 locations have a higher share of equity assets. This segment

contributed an AUM of Rs. 478 Bn, of which 76% were equity assets. 17% of its

total assets are sourced from B-30 cities, higher than the industry average.

NAM has a dominant market share (14%) of the ETF market with assets of Rs.

557 Bn as of 31st March 2022. The company has a product basket of 25-30 ETF

schemes and 6 Index Funds. NAM’s ETF schemes contribute ~68% of the ETF

exchange volumes. When choosing an ETF, the liquidity of an ETF plays a pivot

role in deciding the ETF since the impact cost of acquisition is reduced

substantially. NAM is comfortably placed in ETF space.

Nippon Life India Passive Product Basket

Nippon Life India Asset | Initiating Coverage Report

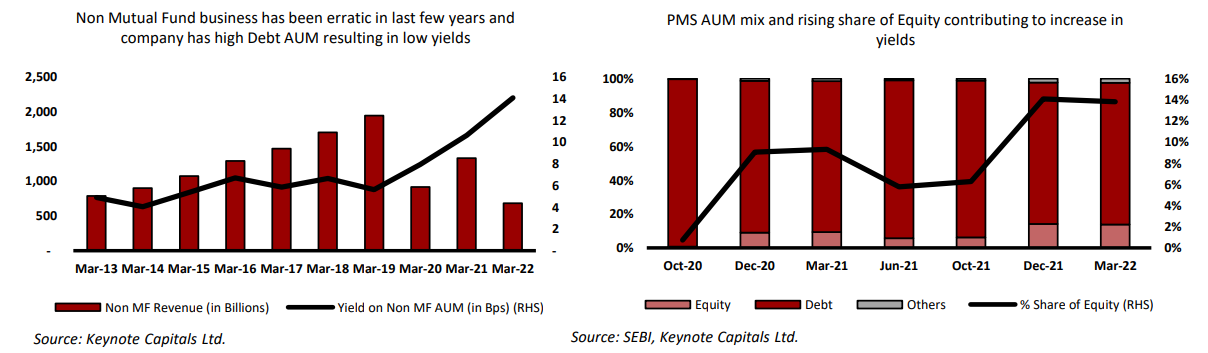

Managed Accounts (17% of overall AUM)

In addition to MFs, AMC also offers Portfolio Management Services (PMS),

Alternative Investment Funds (AIF), and offshore management/advisory

services to investors as alternate investments. These services usually generate

higher yields and create additional revenue opportunity for the company.

Alternate Investment Funds:

NAM manages 16 Alternative Investment Funds (AIFs) schemes across

Category II and Category III via its subsidiary, Nippon Life India AIF

Management Limited (NIAIF). NIAIF offers various strategies under Listed

Equity, High Yield Real Estate Debt, Credit, and Tech / VC FoF, which are

privately pooled investment vehicles registered with SEBI.

The total commitments raised across all schemes is Rs. 4.4 Bn as of March 31,

2022.

Portfolio Management Service (PMS):

NAM offers four equity strategies to its investors. As of March 31, 2022, the

Company’s total AUM is Rs. 550 Bn. The company also manages two

prestigious government mandates, i.e., Postal Life Insurance and Rural Postal

Life Insurance.

Generally, for AMCs, PMS and AIF products are yield accretive as they earn a

much higher yield than mutual funds. But as per SEBI monthly disclosure,

~85% of PMS AUM of Nippon Life India AMC is in the non-Discretionary debt

segment. Hence, AMC is not getting much benefit from a higher yield in PMS

products. They are currently earning a yield of ~10-15 bps from PMS products.

But the share of equity mix in PMS has been rising, which has increased from

0.7% in Oct 2020 to 13.8% in Mar-22, which has contributed to a steady

increase in yields from 8 bps in Mar-2020 to 14 bps in Mar 2022.

Offshore funds and advisory mandates (2.5% of overall AUM)

The Company manages offshore funds & distribution through its subsidiaries in

Singapore and Mauritius and has a representative office in Dubai. The overseas

subsidiaries help to cater to institutional and HNIs across Asia, Australia, the

Middle East, the UK, the US, and Europe.

As of March 31, 2022, the company had a total AUM of Rs. 87.6 Bn as part of

its international offshore managed portfolio. The Company also acts as an

Investment Advisor for India-focused equity and fixed income funds in Japan

and a Nifty 50 ETF in Australia.

Nippon Life India Asset | Initiating Coverage Report

Further, as of March 31, 2022, the Company had a total AUM of Rs. 26.8 Bn as

international advisory mandates. NAM India, in collaboration with BBL Asset

Management Company Ltd., an affiliated company of Bangkok Bank (BBL), the

largest Thai Commercial Bank, has launched Bualuang Bharata Fund in

Thailand for institutional investors and high net worth investors.

Peaking into the past

From 2012 to 2018, NAM was among the second or third largest AMC in India

after HDFC AMC and ICICI Pru AMC. Due to default by erstwhile promoter

Reliance Capital coupled with scheme underperformance hampered their

market share from 11.5% in Mar 2015 to 7.6% in Mar 2020.

Post default, in Sep 2019, NAM took over as the sole promoter with 73.8% of

the outstanding shares and rebranded the company as ‘Nippon Life Asset

Management’. Market share has stabilized since then and bottomed out in Mar

2021 at 7.1%; since then, they have managed to improve overall market share

to 7.4% in Mar 2022 owing to improved fund performance, better risk

management, and further investment into the distribution network.

The main focus area for the management has been increasing the contribution

of retail investors in their overall mix and penetrating further into B-30 cities,

which has largely remained untapped by the mutual fund industry. Along with

this, they continue to focus on passive offering to remain a relevant player in

the passive management space. Management follows the ‘Investor First’

philosophy and would launch schemes to cater to investors’ varied and diverse

needs.

Nippon Life India Asset | Initiating Coverage Report

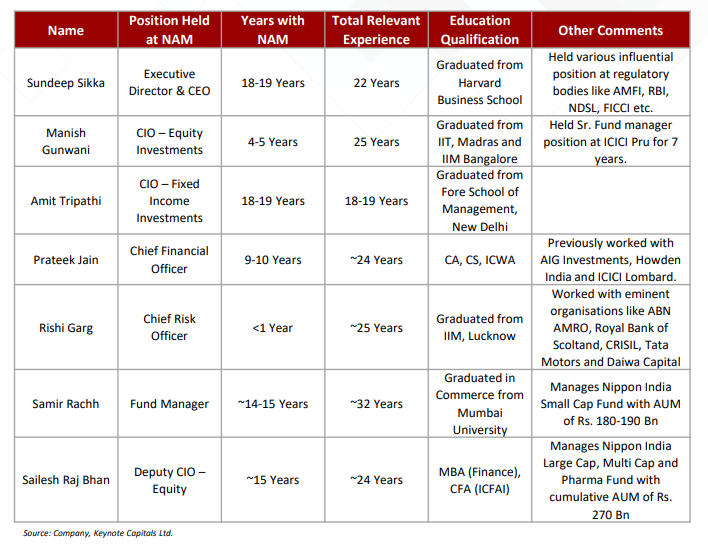

Board of Directors and Top Management

The company is currently headed by Mr. Sundeep Sikka, who has been with the

company since 2003 and CEO since 2009. Most of the company’s top

management has been with NAM for more than 10-15 years, and most have

more than 20 years of relevant industry experience.

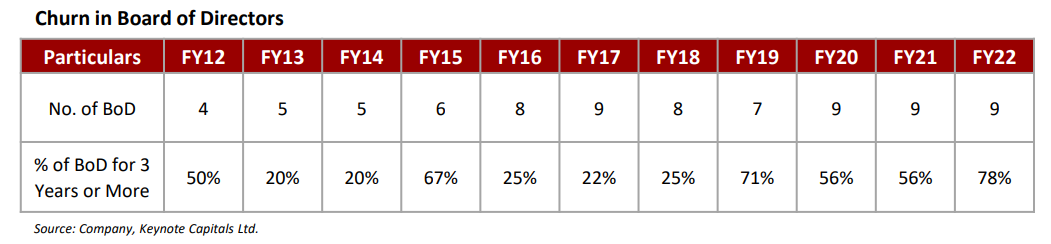

NAM has seen high churn in its Board of Directors in the initial years as less than

20-30% of the Board of Directors were with the company for three years or

more. But in the last few years, things have stabilized, and more than 50-70% of

the Board of Directors have been with the company for three years or more.

This is a very healthy sign.

Nippon Life India Asset | Initiating Coverage Report

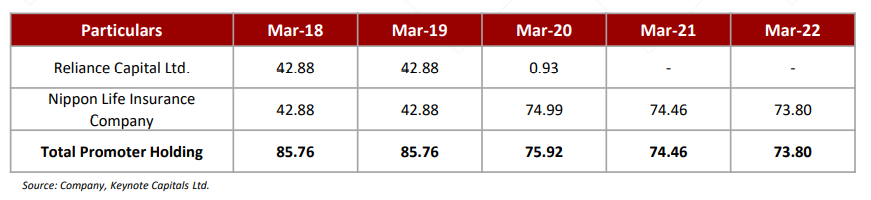

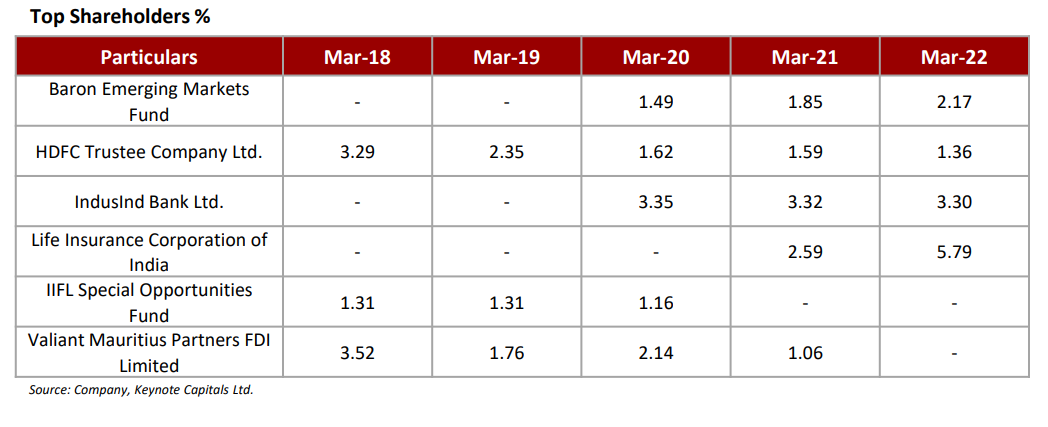

Skin in the game and Top Shareholders

The Company was incorporated as ‘Reliance Capital Asset Management’ in

Feb’1995. In 2012, Nippon Life made a strategic investment of 26% in Reliance

Capital Asset Management. Subsequently, Nippon Life holding was further

increased, and in 2015 company was renamed ‘Reliance Nippon Life Asset

Management Ltd.’ Eventually, the name was rechanged to ‘Reliance Nippon Life

Asset Management’ in May’2016. Post-IPO, both promoters held a 42.9% stake

in the Company. Later on, due to default by ADAG group, they sold their

holding to Nippon Life, making them the sole promoter of the Company.

Nippon Life rebranded the Company to ‘Nippon Life India Asset Management,’

and they own 73.8% of the Company.

Nippon Life India Asset | Initiating Coverage Report

Where does NAM stand against its peers?

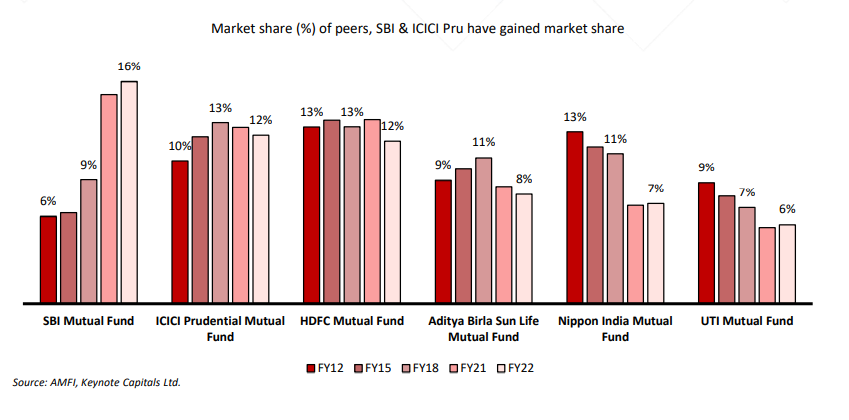

We have taken 6 AMCs (including NAM) for our analysis, representing 60-65%

of industry AUM.

SBI AMC has gained outstanding market share among our chosen peers in the

last decade across all asset classes (Equity/Debt/ETF and Liquid). All the other

AMCs have ceded market share in the last decade except SBI and ICICI Pru

AMC. HDFC AMC has lost significant market share in the equity segment due to

the poor performance of their schemes and the absence of few sector funds.

NAM has lost market share across all segments in the last decade.

Nippon Life India Asset | Initiating Coverage Report

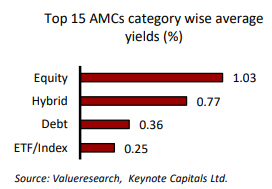

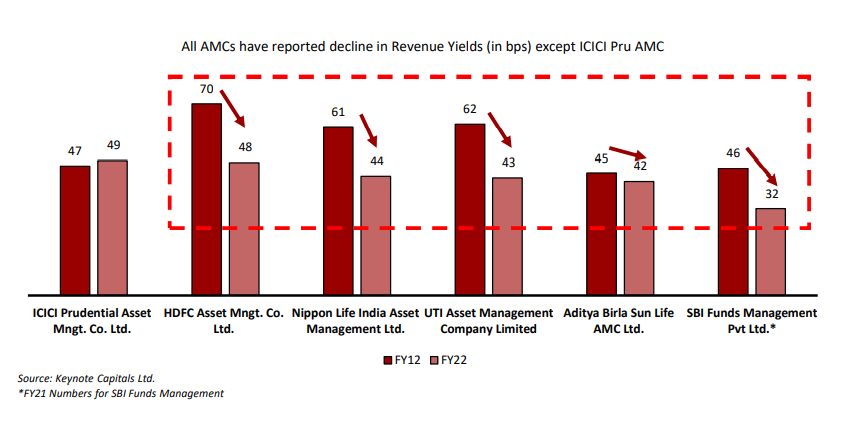

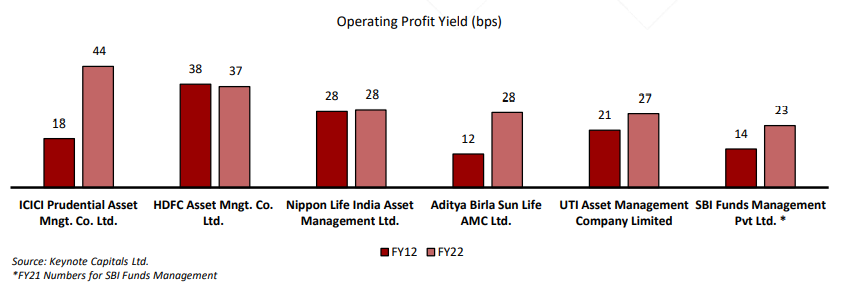

ICICI Pru AMC has the highest revenue yield among the chosen peers owning to

a high equity mix of ~50% (which are the highest yielding) and very minimal ETF

exposure at ~6% (which are the lowest yielding). ICICI Pru is the only AMC that

has managed to improve its yield in the last ten years. All other AMCs have seen

an erosion of yields. With a ban on upfront commission to distributors and the

adoption of trailing commission, revenue yields have declined for AMCs.

However, expenses related to the schemes are expensed from the mutual fund

schemes and hence had a limited impact on operating profit yields. All AMCs

have managed to maintain their operating profit in last decade. Revenue yield

will continue to remain under pressure for all AMCs as old AUM (at high yields)

gets replaced with new AUM at lower yields, but due to significant operating

leverage in AMC business, the impact on profitability will be limited.

ETF contribution for SBI and UTI has increased owing to EPFO contribution. All

of these AMCs have shown improvement in equity mix in the last decade

except SBI and UTI AMC. Aditya Birla AMC & ICIC Pru AMC has significantly

improved the equity mix from 17% and 23% in March 2012 to 42% and 50%,

respectively.

Nippon Life India Asset | Initiating Coverage Report

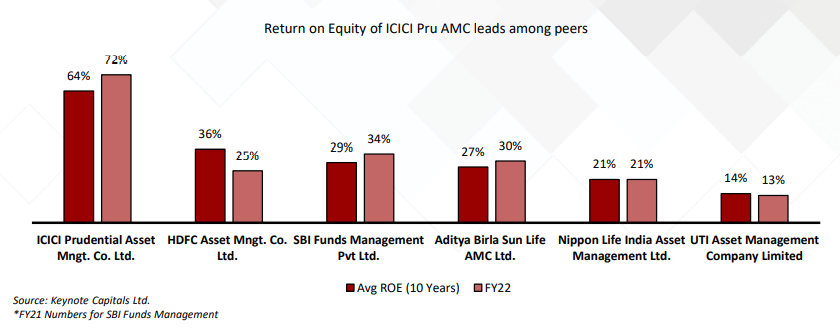

ICICI Pru has the highest ROE among its peers, owing to high operating profit

and revenue yield.

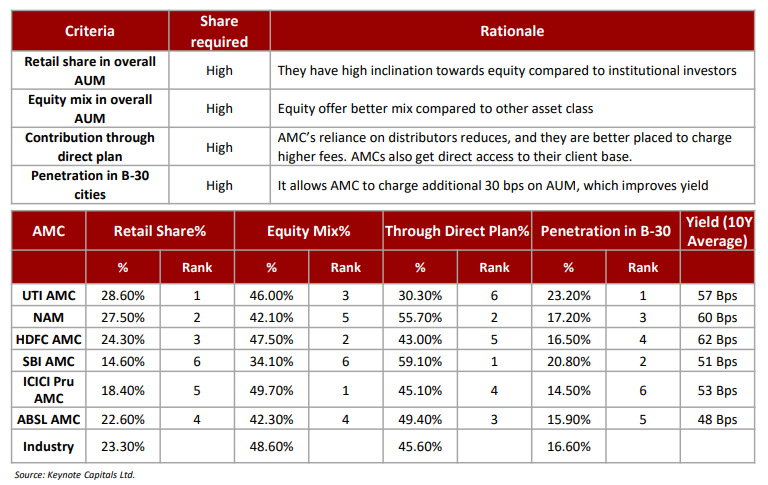

Ideal AUM mix for an AMC

According to our understanding, we believe for maximizing AUM yield for an

AMC; they need to meet all or most of the below criteria.

NAM has a higher share of retail investors (27.5%) compared to the industry

(23.3%), higher sourcing from direct channels (55.7%) vs. industry (45.6%), and

higher penetration in B-30 cities (17.2%) vs. industry (16.6%). All these are

yield-enhancing as it can be seen that NAM has the second highest ten-year

average yield after HDFCAMC.

Nippon Life India Asset | Initiating Coverage Report

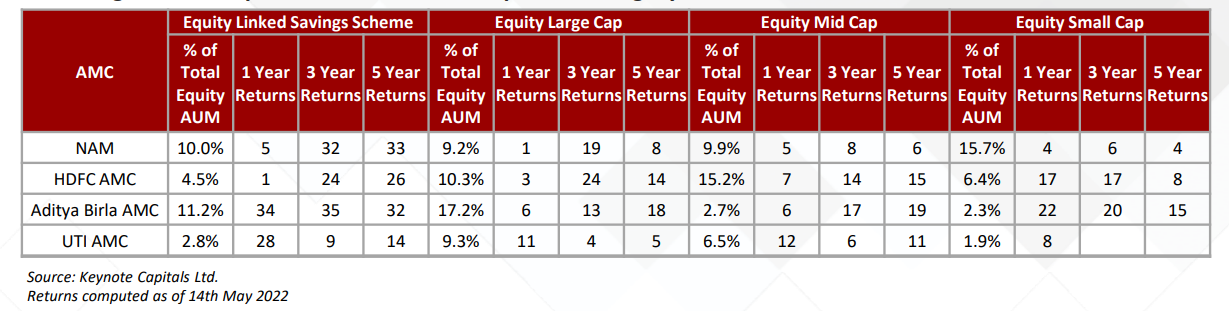

Ranking of scheme performance in their respective category for Listed AMCs

NAM and HDFC AMC have shown smart recovery in scheme performance. They

have managed to improve their ranking from 20/30+ rank in 3 & 5-year

performance to top performer in that category in last one year.

Generally, improvement in scheme performance is followed by market share

gain; hence, it bodes well for NAM and HDFC AMC, who have been losing

market share in the last few years due to scheme underperformance.

We believe scheme outperformance is essential to attract equity fund inflows,

especially from DIY retail investors who tend to give unequal weight to recent

scheme performance to zero down on a scheme.

An important thing to note is that NAM and HDFC AMC have outperformed

their peer group during a period when markets have been extremely volatile

and have not performed well.

Nippon Life India Asset | Initiating Coverage Report

Opportunities

Strong retail franchise

The share of retail investors in the AUM mix of NAM has increased from 13.6%

in FY14 to 27.5% in FY22. A similar number in the industry is 23.3%. Retail

investors tend to be more inclined towards equity products and are more sticky

than other investor classes. A rising share of retail investors bodes well for

AMC’s AUM yield. NAM has a higher market share in the retail segment at 8.7%

vs. 7.4% overall market share.

Leadership in passive products:

The company has one of the industry’s most extensive suites of passive

products with 25-30 ETF schemes and six index funds. NAM has almost 58% of

the industry’s folio market share in the passive category. Approx. NAM’s ETF

schemes contribute 68% of exchange ETF volumes. Among all the deciding

factors when choosing an ETF, having sufficient liquidity is of the essence;

otherwise, impact cost can be up to 2-3%. Hence, NAM is favorably placed in

the ETF market. NAM has a 13.5% market share of overall ETF AUM and one-third market share in the ETF space if we exclude SBI & UTI since their AUM is

skewed for EPFO contribution, access to which is not available to private players

like NAM. NAM’s ETF AUM has grown at a CAGR of 35.6% from Mar 2012 to

Mar 22.

Nippon Life India Asset | Initiating Coverage Report

The loss of market share is warranted since the company was among the few

AMCs to launch ETF products initially. Hence, they had a dominant market

share, but NAM’s market share eroded as other AMCs started expanding their

ETF offering. Market share also errored as major AUM is being contributed by

EPFO, which invests via SBI and UTI AMC’s ETF offering only. The magnitude of

the ETF offering by NAM is unmatched by its peers, placing them in a favorable

position.

A high share of the direct channel in the distribution mix:

NAM has a distribution network of around 160 banks, 95 national distributors,

and ~84,100 mutual fund distributors. Of the overall AUM, 56% is sourced via

direct channel as of Mar’ 2022. It is favorable for the AMC since their reliance

on distributors reduces, and they are better placed to charge higher fees. To

further strengthen its direct channel reach, they have partnered with 20 digital

platforms such as Paytmmoney, Groww, ETMoney, etc. This will give them

access to a direct customer base and enable them to cross-sell their offerings.

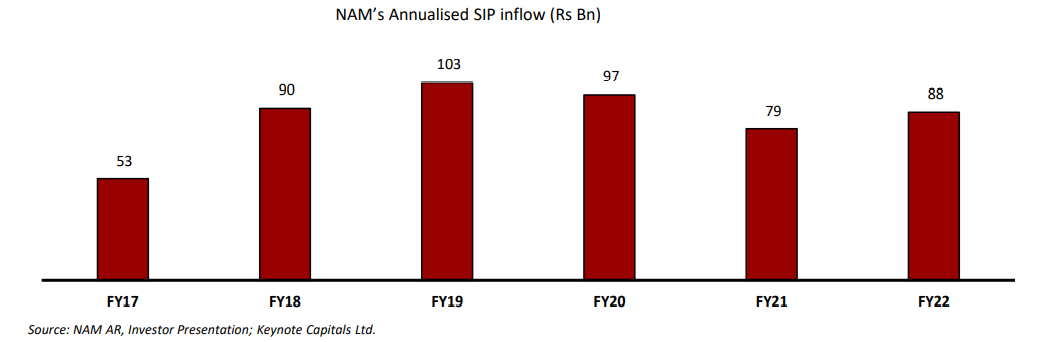

Strong SIP book with better stickiness than the industry

NAM has been focused on strengthening its penetration in B-30 cities via the

SIP route as it helps garner retail participation. SIP book of NAM has better

stickiness than the industry as SIP accounts continuing for more than five

years account for 48% of the AUM compared to 21% for the industry.

Since the default of the erstwhile promoter, SIP inflows have stabilized in

FY22. SIP inflow has increased from Rs. 53 Bn in FY17 to Rs. 88 Bn in FY22.

Given the improvement in scheme performance, we believe SIP flows will

improve strongly going forward.

Nippon Life India Asset | Initiating Coverage Report

Liquid category market share improved, equity category to follow

NAM has regained its lost market share in the liquid category in the Apr-Mar

22 period owing to better risk management practices followed by Nippon

Group, which has led to improved investor confidence. During FY22, liquid

AUM of NAM delivered a growth of 23.6% vs. negative -7.2% growth delivered

by industry.

Equity category market share has also stabilized in the last few quarters, and

recent improvement in scheme performance should be followed by market

share gain for them.

Nippon Life India Asset | Initiating Coverage Report

Challenges

Profitability vs market share, walking a tight rope

With increasing competitive intensity, AMCs face the dilemma of either

maintaining their market share or maintaining their profitability. With many

AMCs aggressively pricing their offerings, AMCs not matching up with the

industry pricing could lead to erosion of market share. NAM has been focused

on improving its profitability over market share. Hence, if pricing indiscipline

persists for a period greater than anticipated, the AUM growth of NAM could

be impacted.

Absence of strong captive banking channel and brand recall

Despite being a non-Bank AMC, Nippon has become the 6

th largest AMC inIndia. But NAM lacks captive banking channel access that all of the banking

AMC enjoy. Penetrating the untapped market of B-30 cities will need better

brand recall and an extensive distribution network, the benefit of which is

available to banking AMCs.

Losing market share in B-30 cities

AUM from B-30 cities provides the maximum yield to the AMCs as they tend to

have more inclination towards equities, and SEBI allows AMCs to charge a

further 30 bps. But in the last decade, the company’s AUM contribution from B-30 cities has remained stagnant and has been reducing since 2018 (around the

ADAG group default). They have been losing market share from B-30 cities,

which decreased to 7.7% in Mar 2022 compared to 12.1% in Mar 2018.

NAM’s AUM contribution (17.2%) from B-30 is higher than the industry’s

(16.6%). NAM’s market share from B-30 cities (7.7%) is better than T-30 cities

(7.3%) as of Mar-22.

Nippon Life India Asset | Initiating Coverage Report

Nippon Life India Asset | Initiating Coverage Report

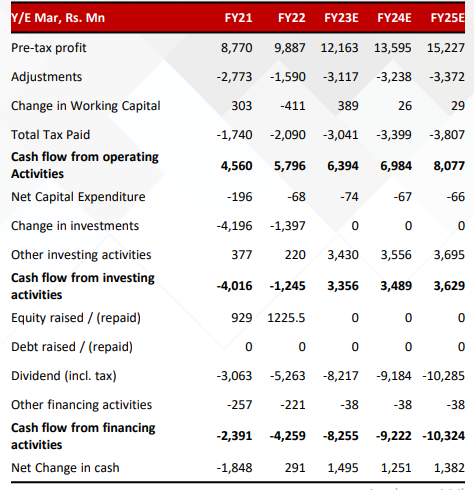

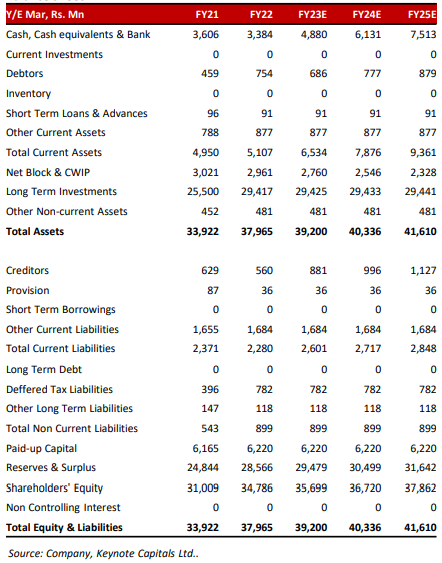

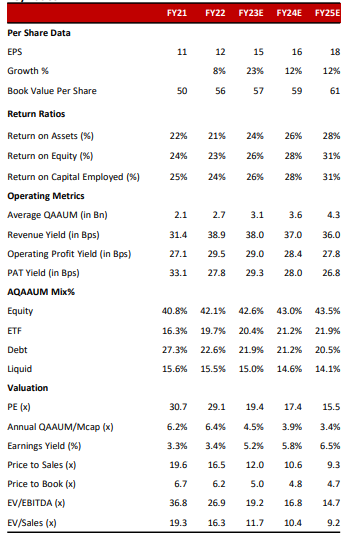

Valuation & Estimates

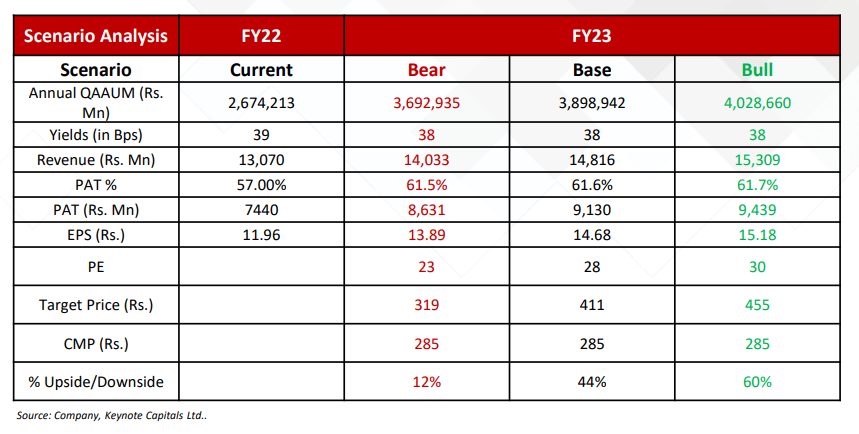

Base Case :

We have built an assumption of ~16.2% growth in AUM in FY23,

given that the company has managed to stabilize its market share and scheme

performance has improved in the last one year.

Given the ongoing yield pressure in the industry, we expect blended yields to

compress by ~1 bps in FY23. Most of this reduction is owing to increasing

competitive intensity in the industry, resulting in higher TER being passed on to

the distributors. In this case, trailing PE re-rates to ~28. Based on these

assumptions, we arrive at an upside of 44.2%.

Bear Case : We have built an assumption of 10% AUM growth in FY23, assuming

NAM continues to lose market share and grows at a pace lesser than the

industry. In which case PE of the company continues to trade at a -1 standard

deviation. We see an upside of 12% even in the Bear case scenario.

Bull Case : We have built an assumption of 20% AUM growth in FY23, assuming

NAM gains market share and grows at a pace higher than the industry. In that

case, we are assuming PE re-rates to around 30 (marginally below average

trailing PE of 33). Based on these assumptions, we arrive at an upside of 60%.

Nippon Life India Asset | Initiating Coverage Report

Valuations and Estimates

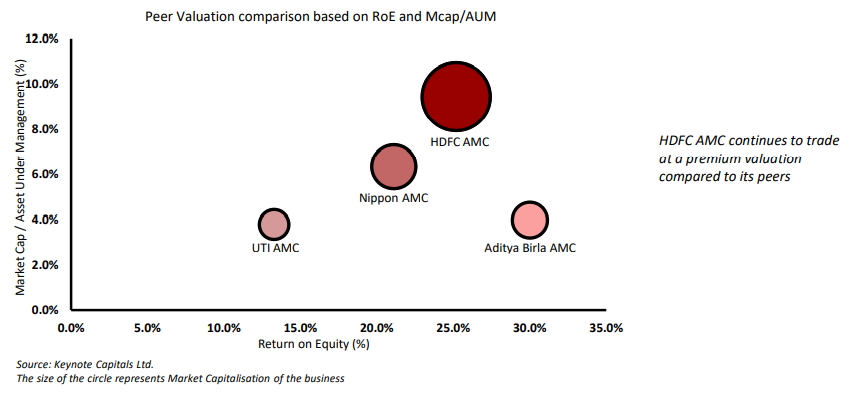

Peer Valuations

NAM trades at a premium valuation compared to Aditya Birla AMC owing to multiple

qualitative aspects like,

• NAM’s Leadership in the ETF category with almost one-third of market share by AUM

and 66% of traded volumes, whereas Aditya Birla has negligible presence in the ETF

space

• NAM’s management has guided more than 90-100% dividend payout in the future

compared to ~50% dividend payout guidance given by Aditya Birla AMC.

• NAM has strong parentage with a global presence in Insurance and Asset

Management. In contrast, Aditya Birla Group is a diversified conglomerate, with Asset

Management being a small part of the group’s business.

Nippon Life India Asset | Initiating Coverage Report

Rating Methodology

| Rating | Criteria |

|---|---|

| BUY | Expected positive return of > 10% over 1-year horizon |

| Neutral | Expected positive return of > 0% to < 10% over 1-year horizon |

| REDUCE | Expected return of < 0% to -10% over 1-year horizon |

| SELL | Expected to fall by >10% over 1-year horizon |

| NOT RATED (NR)/UNDER REVIEW (UR)/COVERAGE SUSPENDED (CS) | Not covered by Keynote Capitals Ltd/Rating & Fair value under Review/Keynote Capitals Ltd has suspended coverage |

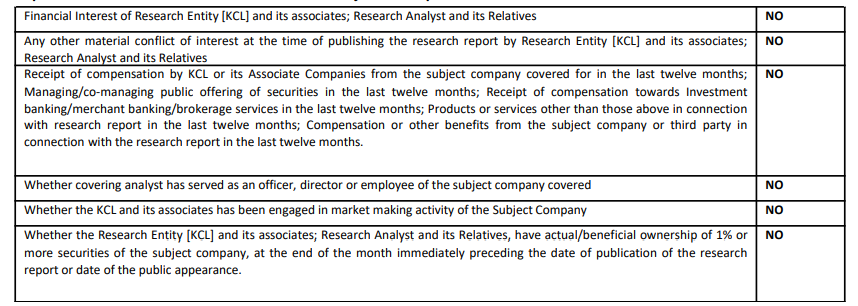

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst

Regulations 2014 (herein after

referred to as the

Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no.

INH000007997. KCL, the

Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant

services &

distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associate-entities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives

may; (a) from time to time,

have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned

herein. (b) be

engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial

instruments

of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other

potential conflict

of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing

whatsoever on the

specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely

independent of the

views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks

mentioned in the

research report.

KCL and / or its affiliates do and seek to do business including investment banking with

companies covered in its

research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect

the

objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service

transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com,

www.bseindia.com. Research Analyst views

on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates

maintains

arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an

independent

view with regards to Subject

Company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity

resident in a state, country

or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject

KCL & its

group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible

for sale in

all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves

of and to

observe such restriction.

Specific Disclosure of Interest statement for subjected Scrip in this document:

Nippon Life India Asset | Initiating Coverage Report

The associates of KCL may have:

-financial interest in the subject company

-actual/beneficial ownership of 1% or more

securities in the subject company

-received compensation/other benefits from the subject company in the

past 12 months

-other potential conflict of interests with respect to any recommendation and other

related information and opinions.;

however, the same shall

have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations

made by the

analyst(s) are

completely independent of the views of the associates of KCL even though there might exist an inherent

conflict of

interest in some of the stocks

mentioned in the research report.

-acted as a manager or co-manager of public offering of securities of

the subject company in past 12 months

-be engaged in any other transaction involving such securities and

earn brokerage or other compensation or act as a

market maker in the financial

instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies)

-received compensation from the subject company in the past 12 months for investment

banking / merchant banking /

brokerage services or from

other than said services

The associates of KCL has not received any compensation or other benefits from third party in

connection with the

research report.

Above disclosures includes beneficial holdings lying in demat account of KCL which are opened

for proprietary

investments only. While calculating

beneficial holdings, it does not consider demat accounts which are opened in name of KCL for other purposes

(i.e.

holding client securities,

collaterals, error trades etc.). KCL also earns DP income from clients which are not considered in above

disclosures.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the

analyst(s) about the subject

securities or issues, and no part

of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the

specific

recommendations and views expressed

by research analyst(s) in this report.

Terms & Conditions:

This report has been prepared by KCL and is meant for sole use by the recipient and not for

circulation. The report and

information contained herein

is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part

or in whole,

to any other person or to the

media or reproduced in any form, without prior written consent of KCL. The report is based on the facts,

figures and

information that are believed to

be true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The

information is

obtained from publicly

available media or other sources believed to be reliable. Such information has not been independently

verified and no

guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information

and opinions

are subject to change

without notice. The report is prepared solely for informational purpose and does not constitute an offer

document or

solicitation of offer to buy or

sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all

the

customers simultaneously, not all

customers may receive this report at the same time. KCL will not treat recipients as customers by virtue of

their

receiving this report

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the

selected recipient and may

not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any

form, without prior written

consent. This report and information herein is solely for informational purpose and may not be used or

considered as an

offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in

this report

constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to

your

specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all investors, who must

make their

own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not

be taken in

substitution for the exercise

of independent judgment by any recipient. Each recipient of this document should make such investigations as

it deems

necessary to arrive at an

independent evaluation of an investment in the securities of companies referred to in this document

(including the

merits and risks involved), and

should consult its own advisors to determine the merits and risks of such an investment. The investment

discussed or

views expressed may not be

suitable for all investors. Certain transactions -including those involving futures, options, another

derivative product

as well as non-investment

grade securities – involve substantial risk and are not suitable for all investors. No representation or

warranty,

express or implied, is made as to the

accuracy, completeness or fairness of the information and opinions contained in this document. The

Disclosures of

Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as

endorsement of

the views expressed

in the report. This information is subject to change without any prior notice. The Company reserves the

right to make

modifications and

alternations to this statement as may be required from time to time without any prior approval. KCL, its

associates,

their directors and the

employees may from time to time, effect or have affected an own account transaction in, or deal as principal

or agent in

or for the securities

mentioned in this document. KCL, its associates, their directors and the employees may from time to time

invest in any

discretionary PMS/AIF

Fund and those respective PMS/AIF Funds may affect or have effected any transaction in for the securities

mentioned in

this document. They may

perform or seek to perform investment banking or other services for, or solicit investment banking or other

business

from, any company referred

to in this report. Each of these entities functions as a separate, distinct and independent of each other.

The recipient

should take this into account

before interpreting the document. This report has been prepared on the basis of information that is already

available in

publicly accessible media

or developed through analysis of KCL. The views expressed are those of the analyst, and the Company may or

may not

subscribe to all the views

expressed therein. This document is being supplied to you solely for your information and may not be

reproduced,

redistributed or passed on,

directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This

report is

not directed or intended for

distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality,

state,

country or other jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would

subject KCL to

any registration or licensing

requirement within such jurisdiction.

Nippon Life India Asset | Initiating Coverage Report

The securities described herein may or may not be eligible for sale in all jurisdictions or to

certain category of

investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction. Neither the

Firm, not its

directors, employees, agents

or representatives shall be liable for any damages whether direct or indirect, incidental, special or

consequential

including lost revenue or lost

profits that may arise from or in connection with the use of the information. The person accessing this

information

specifically agrees to exempt KCL

or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse

and agrees not

to hold KCL or any of its affiliates

or employees responsible for any such misuse and further agrees to hold KCL or any of its affiliates or

employees free

and harmless from all losses,

costs, damages, expenses that may be suffered by the person accessing this information due to any errors and

delays.

Keynote Capitals Limited (CIN: U67120MH1995PLC088172)

Compliance Officer: Mr. Jairaj Nair; Tel: 022-68266000; email id: jairaj@keynoteindia.net

Registered Office: 9th Floor, The Ruby, Senapati Bapat Marg, Dadar West, Mumbai – 400028,

Maharashtra. Tel: 022 –

68266000.

SEBI Regn. Nos.: BSE / NSE (CASH / F&O / CD): INZ000241530; DP: CDSL- IN-DP-238-2016; Research

Analyst: INH000007997

For any complaints email at kcl@keynoteindia.net

General Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant

exchanges and the T&C on www.keynotecapitals.com; Investment in

securities market are subject to market risks, read all the related documents

carefully before investing.