Quarterly Update Q1FY23

Nippon Life India Asset | Quarterly Update

Nippon Life India Asset Management Ltd.

1st Aug 2022

BUY

CMP Rs. 282

TARGET Rs. 411 (+45.7%)

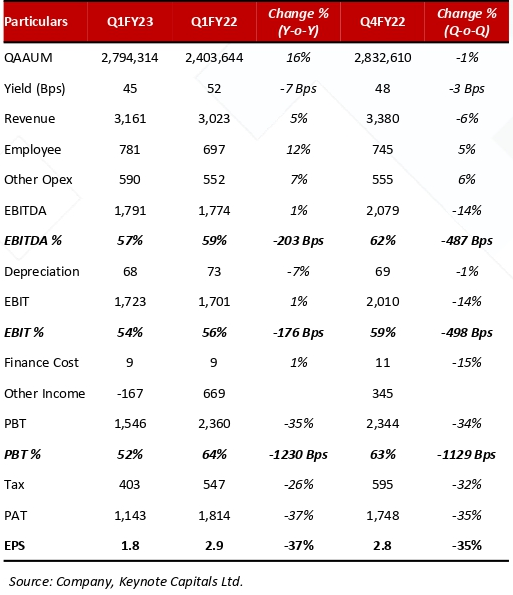

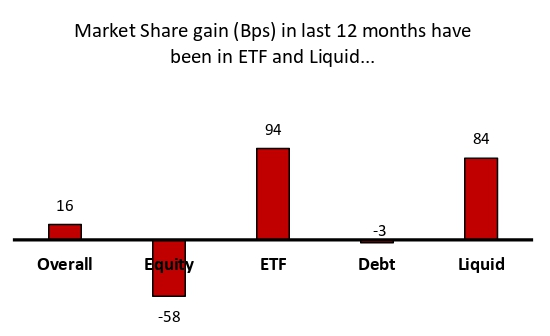

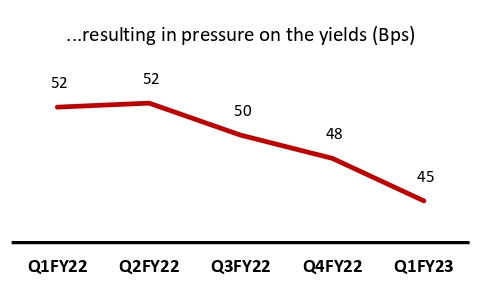

Company gains market share but at a cost of lower yield

Nippon Life India AMC (NAM) has outperformed the industry growth during

Q1FY23. NAM QAAUM grew by 16.3% YoY (-1.4% QoQ) vs. 13.8% YoY (-1.6%

QoQ) growth delivered by the industry, resulting in a market share gain of 16

Bps YoY, but AUM growth has come on the back of ETF and liquid AUM

growth, which are low yielding in nature, thus impacting NAM’s yield, which

has fallen by 7 Bps YoY (3 Bps QoQ).

Company Data

| MCAP (Rs. Mn) | 1,77,049 |

|---|---|

| O/S Shares (Mn) | 623 |

| 52w High/Low | 477 / 259 |

| Face Value (in Rs.) | 10 |

| Liquidity (3M) (Rs. Mn) |

173.6 |

Opex/QAAUM continues to remain under check

Opex/QAAUM increased by 1 bps to 19.5 Bps on a QoQ basis but still is below

FY22 levels (19.9 bps). Spike in operating cost is due to a hike given to

employees and normalization of business expenses which were suppressed

owing to covid led restrictions. Even management has increased spending on

marketing, and they plan to continue to spend on marketing as they are

getting better traction due to improvement in scheme performance.

Shareholding Pattern %

| Jun 22 | Mar 22 | Dec 21 | |

|---|---|---|---|

| Promoters | 73.7 | 73.8 | 73.8 |

| FIIs | 6.5 | 6.7 | 7.2 |

| DIIs | 9.2 | 8.8 | 8.4 |

| Non-Institutional | 10.5 | 10.7 | 10.7 |

Blended yield under pressure

NAM has witnessed higher flows towards ETF and liquid AUM during the

quarter, which are low-yielding categories, which has resulted in yields

dropping by 3 bps QoQ. Management expects pressure on yields to continue

for more time as its peers are focused on AUM gathering rather than

profitability.

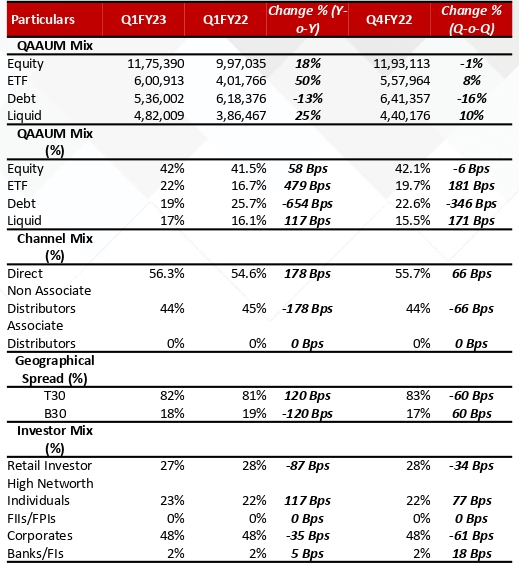

NAM fortifying its presence in ETF

NAM has gained significant market share in the ETF segment, with market

share increasing from 13.2% in Q1FY22 to 14.1% in Q1FY23. ETF AUM is

among the fastest growing category for NAM, growing by 49.6% YoY

compared to overall AUM growth of 16.3%. NAM’s ETF remains the

category leader with the highest liquidity in the industry.

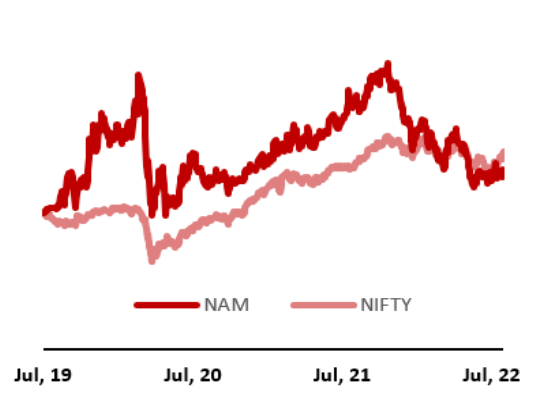

NAM vs Nifty

Source: Keynote Capitals Ltd.

Strong equity scheme performance, market share gain to follow with a lag

In the last one year, NAM’s equity scheme performance has improved

massively compared to its 3 and 5-year performance. An improvement in

scheme performance is normally followed by market share gain, but with a

lag. NAM has improved its market share in the ETF and liquid category, and

we expect that they will gain market share in equity category also.

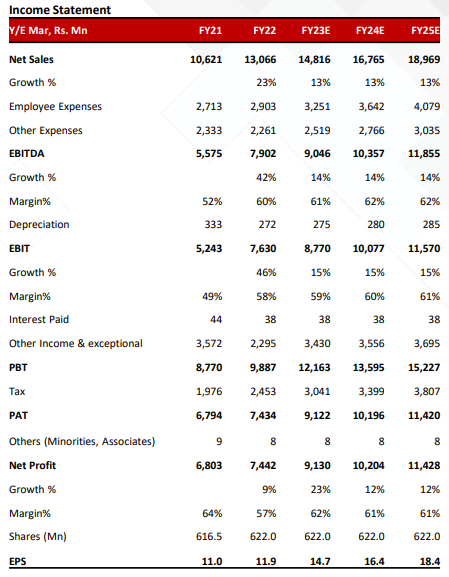

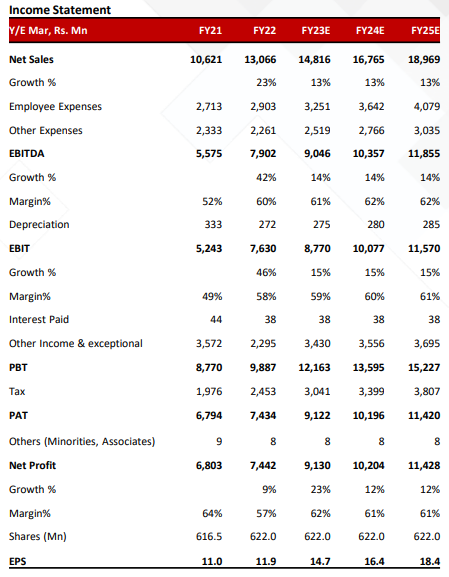

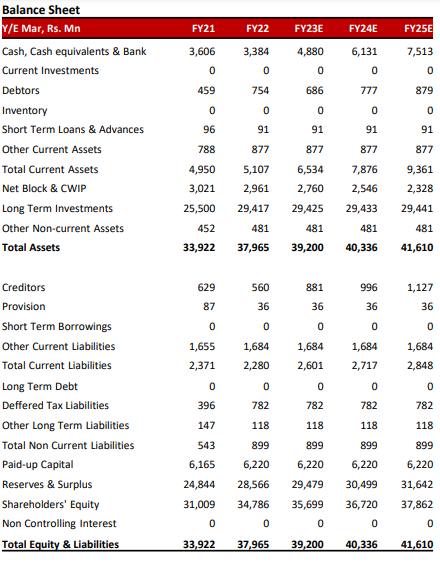

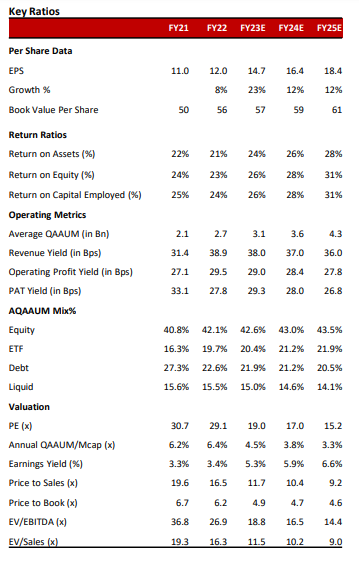

Key Financial Data

| (Rs mn) | FY22 | FY23E | FY24E |

|---|---|---|---|

| Revenue | 13,066 | 14,816 | 16,765 |

| EBITDA | 7,902 | 9,046 | 10,357 |

| Net Profit | 7,434 | 9,122 | 10,196 |

| Total Assets | 37,965 | 39,200 | 40,336 |

| ROCE (%) | 24% | 26% | 28% |

| ROE (%) | 23% | 26% | 28% |

Source: Company, Keynote Capitals Ltd.

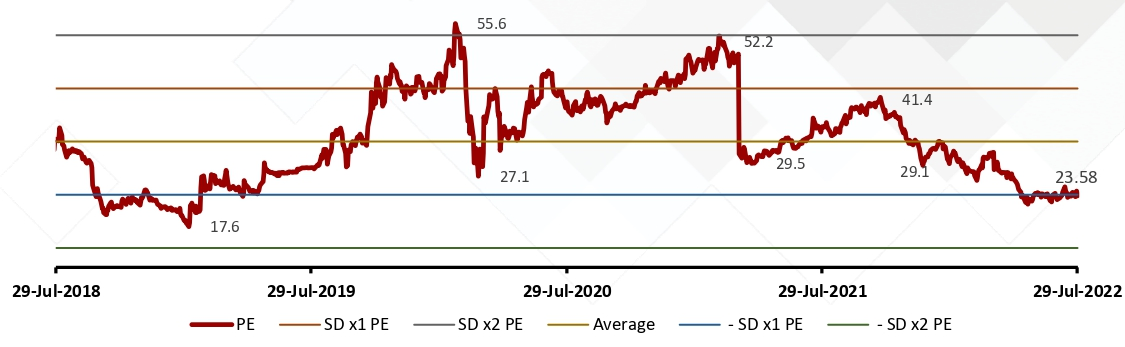

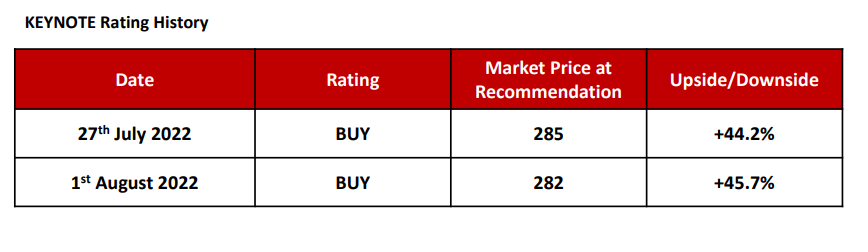

View & Valuation

We maintain our view on Nippon Life India Asset Management with a BUY

rating and a target of Rs. 411 (~28x FY23 earnings). At the current valuations

market is expecting NAM to lose market share or grow at slower pace than the

industry. Based on the enhancement in market share in the last few quarters

and a massive improvement in scheme performance we think NAM is at a

pivot point. Going ahead, we expect NAM to grow at least in line with the

industry. Given that NAM is trading at – 1 standard deviation of its trailing PE,

chances of re-rating are High, and the downside from current levels seems

limited.

Research Analyst

chirag@keynotecapitals.net

Supreme Industries Ltd. | Initiating Coverage Report

Q1FY23 Conference Call Takeaways

Yields

– Yields have declined on YoY and QoQ basis owing to growth in low-yielding

assets like Liquid and ETF.

– Redemptions of old high-yielding assets have gone down. Going forward,

impact on the yields will not be significant.

Other Income

– During the quarter, Other Income has turned negative due to mark-tomarket (M2M) losses. The Company has almost Rs. 2.5 Bn exposure to

equity and market has fallen by 12-15% in last 3 months (Apr-Jun’22). Also,

10-Yr G-sec increased by 50 bps in Q1, leading to M2M losses in the Debt

portfolio.

– NAM has 70% of its debt portfolio at the shorter end of the duration curve.

Mutual Fund AUM

– MF QAAUM increased by 16.3% YoY (-1.4 QoQ), driven by growth in

Equity/ETF/Liquid AUM by 17.9% YoY (-1.5% QoQ), 49.6% YoY (7.7% QoQ)

and 24.7% YoY (9.5% QoQ) respectively.

– Debt AUM has de-grown by -13.3% YoY (-16.4% QoQ).

– As of June 2022, no category of fund manager has more than 16% of total

assets. The majority of the funds are jointly managed, and no individual

fund manager manages more than 23% of equity AUM, and that too is

spread across funds which have other co-fund managers.

– Q1 MF QAAUM market share is at 7.4%, up 16 bps YoY. NAM has 13 million

unique investors, up 76% YoY. NAM’s share of the industry’s investors is at

37% (vs. 31% as of June 2021).

– NAM’s Q1 systematic flows at Rs. 22.8 Bn, up 30% YoY. SIP accounts

continuing for more than 5 years is at 13% vs. 9% for the industry.

– Share of ETF volumes on NSE & BSE is at ~74%.

Employee and Operating Expenses

– Employee cost increased by 12.1% YoY. It has increased primarily by hike

given to employees which were not given in last 2 years.

– As the economy opens up, certain expenses have normalized, and certain

marketing activities were carried out. Management will continue with

marketing activities as they are seeing good traction due to improvement

in scheme performance.

Distribution

– During the quarter, NAM added 1200 mutual fund distributors, totaling to

~85,300. NAM has a presence across 275 locations pan India which is

among the highest in the industry

– Digital channel contributed 55% of total new purchase transactions

Nippon Life India Asset | Quarterly Update

Q1FY23 Result Update

Nippon Life India Asset | Quarterly Update

Supreme Industries Ltd. | Quarterly Update Report

Valuation

4-Year Trailing PE – NAM is trading at – Standard Deviation of its historical range

Nippon Life India Asset | Quarterly Update

Rating Methodology

| Rating | Criteria |

|---|---|

| BUY | Expected positive return of > 10% over 1-year horizon |

| Neutral | Expected positive return of > 0% to < 10% over 1-year horizon |

| REDUCE | Expected return of < 0% to -10% over 1-year horizon |

| SELL | Expected to fall by >10% over 1-year horizon |

| NOT RATED (NR)/UNDER REVIEW (UR)/COVERAGE SUSPENDED (CS) | Not covered by Keynote Capitals Ltd/Rating & Fair value under Review/Keynote Capitals Ltd has suspended coverage |

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst

Regulations 2014 (herein after

referred to as the

Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no.

INH000007997. KCL, the

Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant

services &

distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associate-entities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives

may; (a) from time to time,

have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned

herein. (b) be

engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial

instruments

of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other

potential conflict

of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing

whatsoever on the

specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely

independent of the

views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks

mentioned in the

research report.

KCL and / or its affiliates do and seek to do business including investment banking with

companies covered in its

research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect

the

objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service

transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com,

www.bseindia.com. Research Analyst views

on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates

maintains

arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an

independent

view with regards to Subject

Company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity

resident in a state, country

or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject

KCL & its

group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible

for sale in

all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves

of and to

observe such restriction.

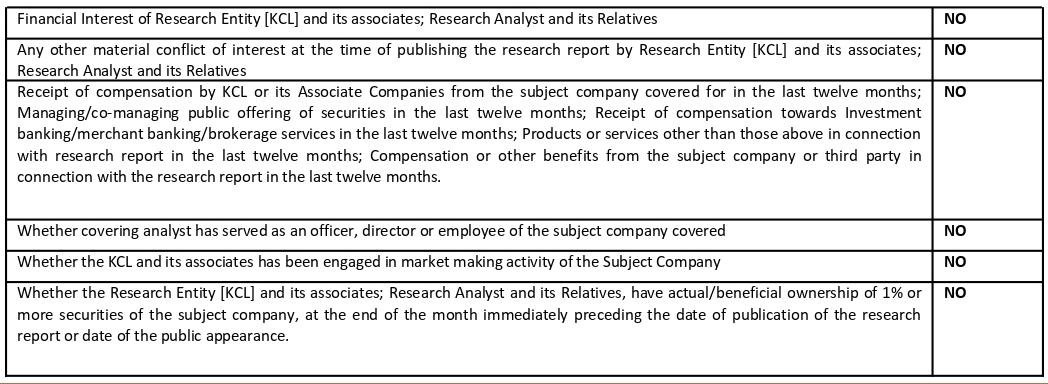

Specific Disclosure of Interest statement for subjected Scrip in this document:

Nippon Life India Asset | Quarterly Update

The associates of KCL may have:

-financial interest in the subject company

-actual/beneficial ownership of 1% or more

securities in the subject company

-received compensation/other benefits from the subject company in the

past 12 months

-other potential conflict of interests with respect to any recommendation and other

related information and opinions.;

however, the same shall

have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations

made by the

analyst(s) are

completely independent of the views of the associates of KCL even though there might exist an inherent

conflict of

interest in some of the stocks

mentioned in the research report.

-acted as a manager or co-manager of public offering of securities of

the subject company in past 12 months

-be engaged in any other transaction involving such securities and

earn brokerage or other compensation or act as a

market maker in the financial

instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies)

-received compensation from the subject company in the past 12 months for investment

banking / merchant banking /

brokerage services or from

other than said services

The associates of KCL has not received any compensation or other benefits from third party in

connection with the

research report.

Above disclosures includes beneficial holdings lying in demat account of KCL which are opened

for proprietary

investments only. While calculating

beneficial holdings, it does not consider demat accounts which are opened in name of KCL for other purposes

(i.e.

holding client securities,

collaterals, error trades etc.). KCL also earns DP income from clients which are not considered in above

disclosures.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the

analyst(s) about the subject

securities or issues, and no part

of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the

specific

recommendations and views expressed

by research analyst(s) in this report.

Terms & Conditions:

This report has been prepared by KCL and is meant for sole use by the recipient and not for

circulation. The report and

information contained herein

is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part

or in whole,

to any other person or to the

media or reproduced in any form, without prior written consent of KCL. The report is based on the facts,

figures and

information that are believed to

be true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The

information is

obtained from publicly

available media or other sources believed to be reliable. Such information has not been independently

verified and no

guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information

and opinions

are subject to change

without notice. The report is prepared solely for informational purpose and does not constitute an offer

document or

solicitation of offer to buy or

sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all

the

customers simultaneously, not all

customers may receive this report at the same time. KCL will not treat recipients as customers by virtue of

their

receiving this report

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the

selected recipient and may

not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any

form, without prior written

consent. This report and information herein is solely for informational purpose and may not be used or

considered as an

offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in

this report

constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to

your

specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all investors, who must

make their

own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not

be taken in

substitution for the exercise

of independent judgment by any recipient. Each recipient of this document should make such investigations as

it deems

necessary to arrive at an

independent evaluation of an investment in the securities of companies referred to in this document

(including the

merits and risks involved), and

should consult its own advisors to determine the merits and risks of such an investment. The investment

discussed or

views expressed may not be

suitable for all investors. Certain transactions -including those involving futures, options, another

derivative product

as well as non-investment

grade securities – involve substantial risk and are not suitable for all investors. No representation or

warranty,

express or implied, is made as to the

accuracy, completeness or fairness of the information and opinions contained in this document. The

Disclosures of

Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as

endorsement of

the views expressed

in the report. This information is subject to change without any prior notice. The Company reserves the

right to make

modifications and

alternations to this statement as may be required from time to time without any prior approval. KCL, its

associates,

their directors and the

employees may from time to time, effect or have affected an own account transaction in, or deal as principal

or agent in

or for the securities

mentioned in this document. KCL, its associates, their directors and the employees may from time to time

invest in any

discretionary PMS/AIF

Fund and those respective PMS/AIF Funds may affect or have effected any transaction in for the securities

mentioned in

this document. They may

perform or seek to perform investment banking or other services for, or solicit investment banking or other

business

from, any company referred

to in this report. Each of these entities functions as a separate, distinct and independent of each other.

The recipient

should take this into account

before interpreting the document. This report has been prepared on the basis of information that is already

available in

publicly accessible media

or developed through analysis of KCL. The views expressed are those of the analyst, and the Company may or

may not

subscribe to all the views

expressed therein. This document is being supplied to you solely for your information and may not be

reproduced,

redistributed or passed on,

directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This

report is

not directed or intended for

distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality,

state,

country or other jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would

subject KCL to

any registration or licensing

requirement within such jurisdiction.

Nippon Life India Asset | Quarterly Update

The securities described herein may or may not be eligible for sale in all jurisdictions or to

certain category of

investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction. Neither the

Firm, not its

directors, employees, agents

or representatives shall be liable for any damages whether direct or indirect, incidental, special or

consequential

including lost revenue or lost

profits that may arise from or in connection with the use of the information. The person accessing this

information

specifically agrees to exempt KCL

or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse

and agrees not

to hold KCL or any of its affiliates

or employees responsible for any such misuse and further agrees to hold KCL or any of its affiliates or

employees free

and harmless from all losses,

costs, damages, expenses that may be suffered by the person accessing this information due to any errors and

delays.

Keynote Capitals Limited (CIN: U67120MH1995PLC088172)

Compliance Officer: Mr. Jairaj Nair; Tel: 022-68266000; email id: jairaj@keynoteindia.net

Registered Office: 9th Floor, The Ruby, Senapati Bapat Marg, Dadar West, Mumbai – 400028,

Maharashtra. Tel: 022 –

68266000.

SEBI Regn. Nos.: BSE / NSE (CASH / F&O / CD): INZ000241530; DP: CDSL- IN-DP-238-2016; Research

Analyst: INH000007997

For any complaints email at kcl@keynoteindia.net

General Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant

exchanges and the T&C on www.keynotecapitals.com; Investment in

securities market are subject to market risks, read all the related documents

carefully before investing.