Quarterly Update Report

Supreme Industries Ltd. | Quarterly Update

Supreme Industries Ltd.

28th July 2022

NEUTRAL

CMP Rs. 1,876

TARGET Rs. 1,941 (+3.5%)

Inventory losses to continue amid PVC price correction

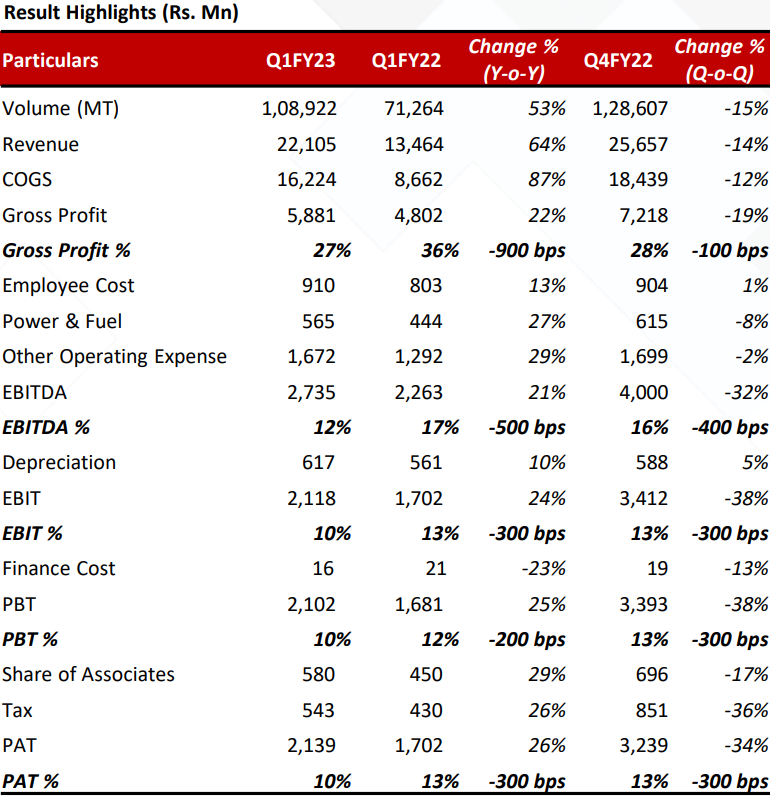

As expected on a low base, Supreme Industries Ltd. (SIL) registered a solid Yo-Y volume growth of 53% in Q1FY23. The main driver of performance was

the Plastic Piping segment, which enjoyed its peak season after being

affected for two years. Revenue on a Y-o-Y basis grew by 64%, whereas

EBITDA only increased by 21% resulting in margin correction from 17% in

Q1FY22 to 12% in Q1FY23. This is because of inventory loss due to a sharp

fall in PVC prices since Dec’21. Inventory loss is further likely to continue in

the next quarter as well. Margin correction is expected to be seen across

peers.

Company Data

| MCAP (Rs. Mn) | 2,38,315 |

|---|---|

| O/S Shares (Mn) | 127 |

| 52w High/Low | 2,689/1,669 |

| Face Value (in Rs.) | 2 |

| Liquidity (3M) (Rs. Mn) |

110 |

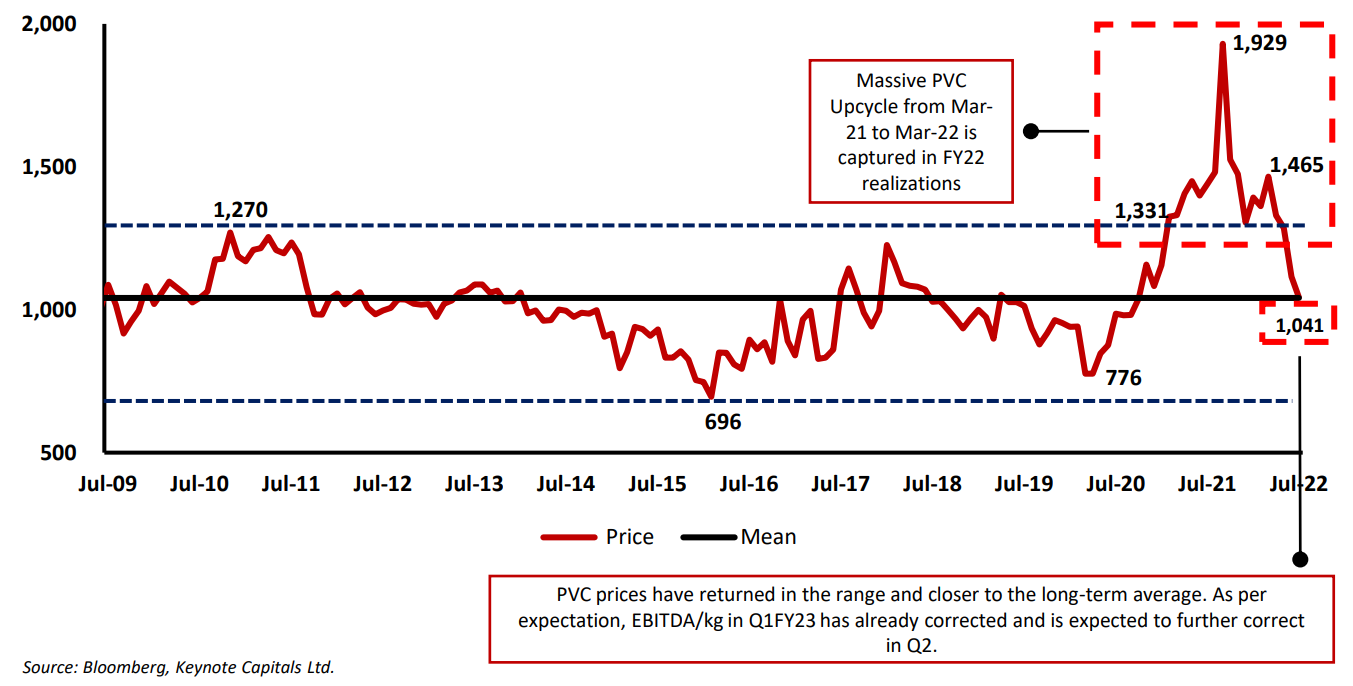

PVC price fall expected in Q2FY23 as well leading to further inventory losses

PVC prices saw a steep correction of Rs. 46 per kg or 32% since the beginning

of the year. Even other raw materials like PP, LDPE, etc. have sharply corrected

during the same period. Management expects inventory losses to continue in

the next quarter and expects PVC prices to bottom out around the end of

August. This will further hit profitability for the company in Q2FY23.

Shareholding Pattern %

| Mar 22 | Dec 21 | Sep 21 | |

|---|---|---|---|

| Promoters | 48.85 | 48.85 | 48.85 |

| FIIs | 15.79 | 16.16 | 16.16 |

| DIIs | 19.70 | 19.65 | 19.70 |

| Non-Institutional | 15.67 | 15.34 | 15.29 |

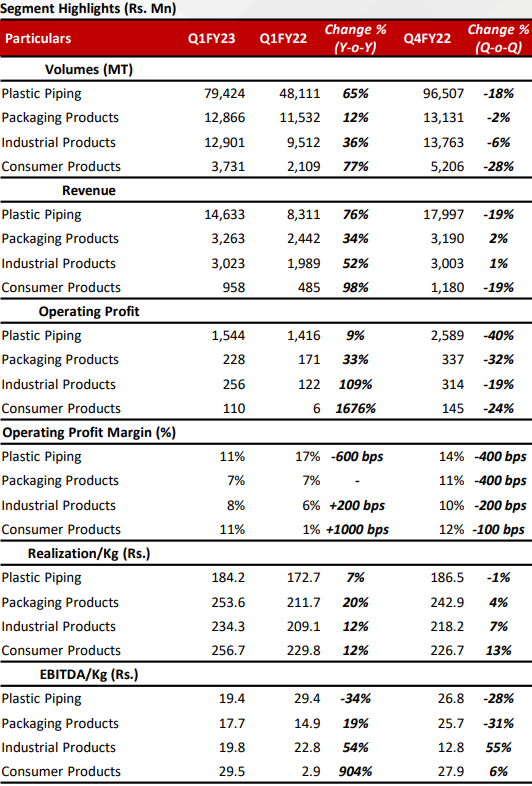

Sharp correction in the contribution of value-added products

SIL disappointed this quarter with a sharp correction in the contribution of

Value-Added Products (VAP) to total sales. VAP from a 38%-40% range

materially came down to 34% during Q1FY23. This number will be key to

watch out for in the future as VAP has a crucial role to play in future growth.

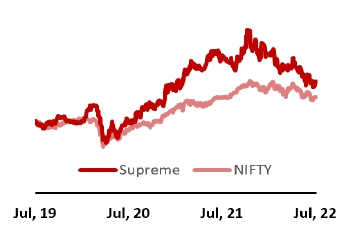

Supreme vs Nifty

Source: Keynote Capitals Ltd.

Launch of new Value-Added Products during the quarter

SIL achieved a much-needed breakthrough in the composite LPG cylinders

(value-added product) business in FY22. During the quarter, SIL launched

some new value-added products like Electrofusion Fittings, PP Compression

Fittings, etc., which received an encouraging market response. According to

the management, these products have the potential to clock Rs. 100 cr. in

Revenue for SIL within a matter of a year. This indicates a move in the right

direction by the company

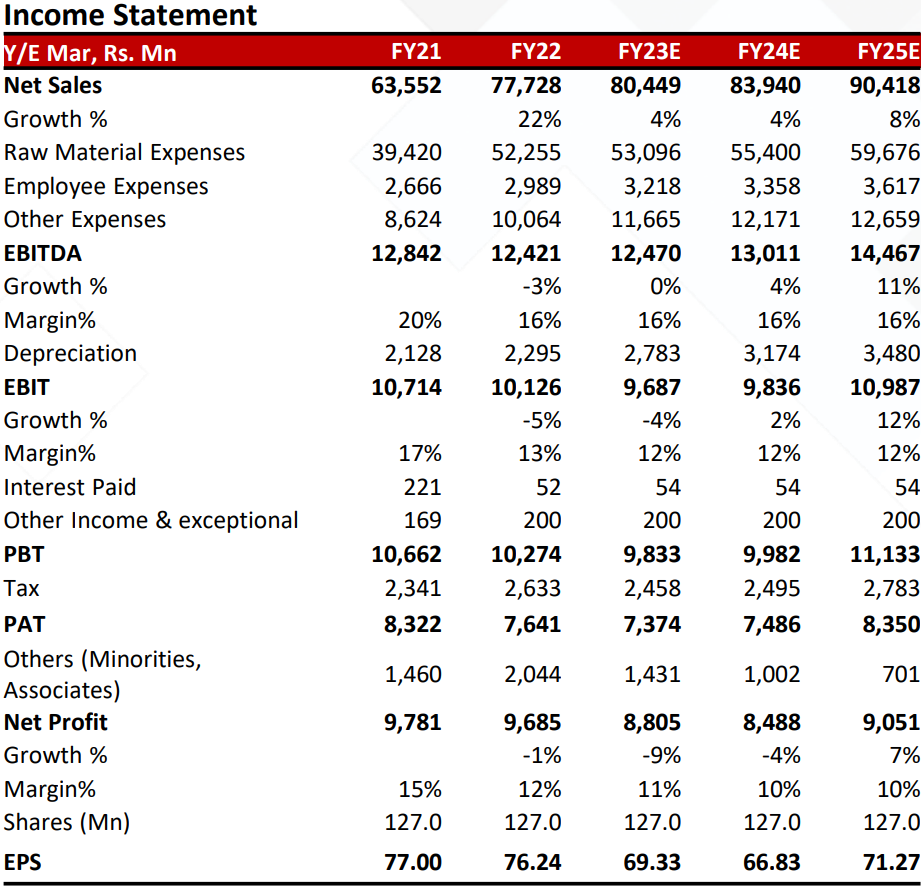

Key Financial Data

| (Rs mn) | FY22 | FY23E | FY24E |

|---|---|---|---|

| Revenue | 77,728 | 80,449 | 83,940 |

| EBITDA | 12,421 | 12,067 | 12,591 |

| Net Profit | 7,641 | 7,073 | 7,172 |

| Total Assets | 52,607 | 58,298 | 64,599 |

| ROCE (%) | 27% | 21% | 17% |

| ROE (%) | 28% | 21% | 17% |

Source: Company, Keynote Capitals Ltd.

View & Valuation

We maintain our view on Supreme Industries with a NEUTRAL rating and a

target price of Rs. 1,951 (28x FY23 revised earnings). PVC prices have seen a

steep fall since Dec’21 which has resulted in a sharp correction in EBITDA/per

kg for Supreme Industries Ltd. on account of inventory losses. These losses will

further continue in Q2FY23 as per the guidance given by the management

which will result in the normalization of both profitability levels and valuation

multiple.

Supreme Industries Ltd. | Quarterly Update

Q1FY23 Conference Call Takeaways

General Highlights

– Volume growth during the quarter was mainly on account of a low base in

the previous year’s same quarter due to COVID impact

– Prices of PVC have fallen further in July’22. Therefore, there will be further

inventory loss in Q2FY23

– SIL holds 30-45 days of inventory depending upon season and time. Fiveyear anti-dumping duty on China got over in Feb’22. Therefore, China has

again become competitive in selling PVC in India

Plastic Piping Business

– New unit at Guwahati has commenced commercial production. Units at

Cuttack & Erode are likely to go into production by Sep-Oct’22 which will

take the total piping capacity of the Company to ~5,90,000 MT

– Demand for PVC pipes in India grew by 27% in volume and increased by

55% for SIL. The company claims to have a 15% organized market share in

the plastic piping business

– SIL has increased market share in the CPVC business also. Claims to have a

20%+ market share

– Channel inventory is shallow due to fear of further fall in PVC prices.

Restocking will start as soon as there is an uptick in PVC prices.

Management expects the segment to clock a 10-12% volume growth in the long run

– Each newly introduced value-added product like electrofusion fittings and

olefin fittings can potentially become Rs. 100 cr in size within a year

Packaging Product Business

– Cross laminated film business is impacted by fierce competition from lookalike products

– Focus will be on exports and non-tarpaulin applications to bring back

margins. Products are now sold in 28 countries.

Industrial Product Business

– Business is improving gradually. Buoyant demand is expected from sectors

like washing machines, ACs, coolers, etc

Consumer Business

– Premium furniture continues to remain a focus area for SIL

Other Businesses

– LPG cylinder, a value-added product, is manufactured at full capacity.Augmented capacity will become operational by Nov’22

Supreme Industries Ltd. | Quarterly Update

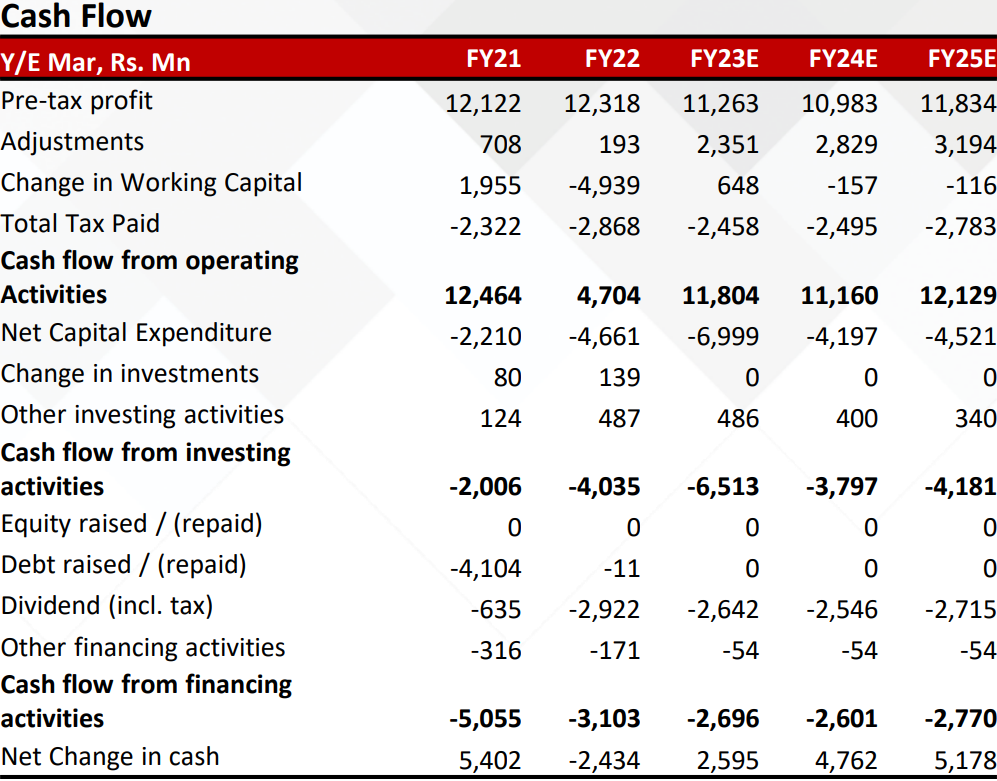

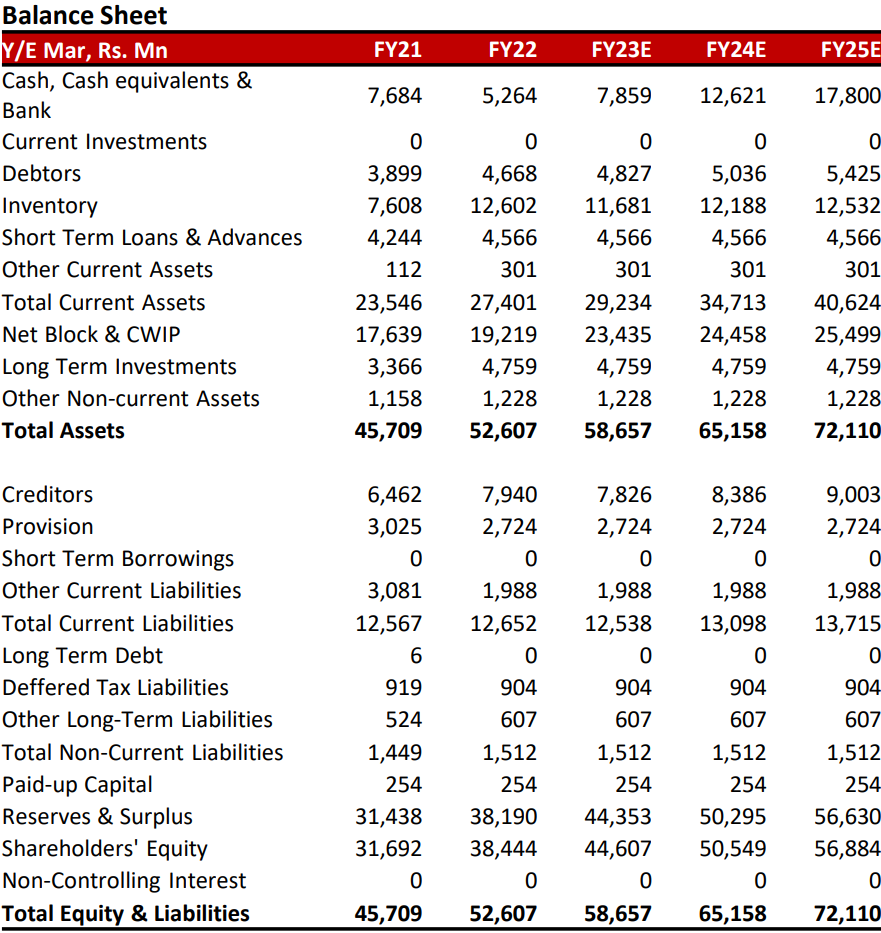

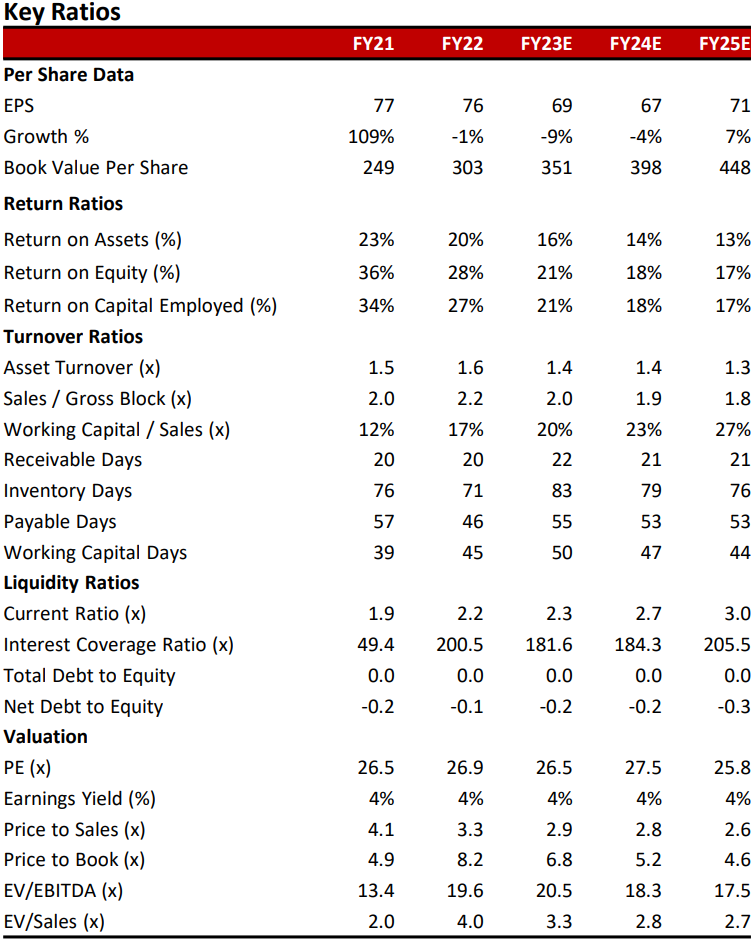

Financial Statement Analysis

Long term PVC price (in USD/Ton) analysis

Supreme Industries Ltd. | Initiating Coverage Report

Financial Statement Analysis

Supreme Industries Ltd. | Quarterly Update Report

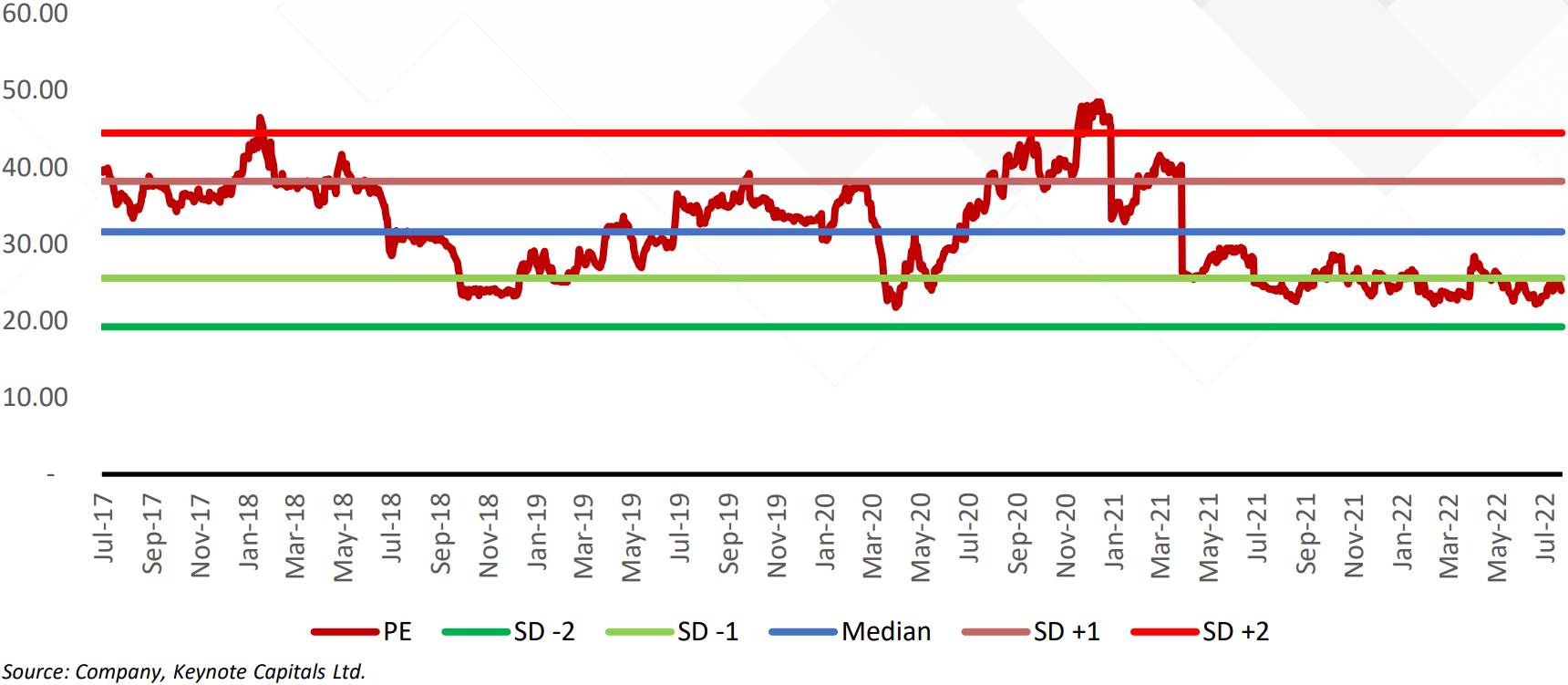

Valuations

5-Year Trailing PE – Supreme continues to look optically cheap due to abnormal earnings over the last 2

years. Actual multiple will be seen once the share of Supreme Petrochem and PVC prices normalize.

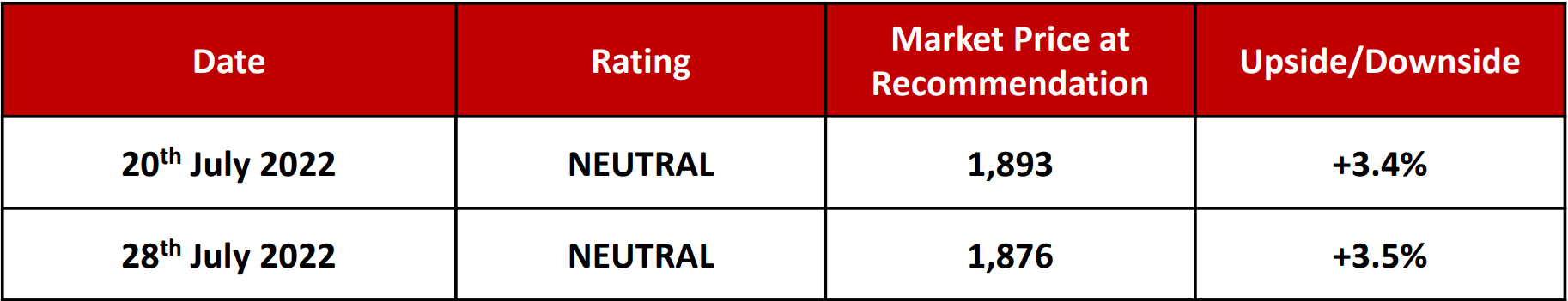

KEYNOTE Rating History

Supreme Industries Ltd. | Quarterly Update

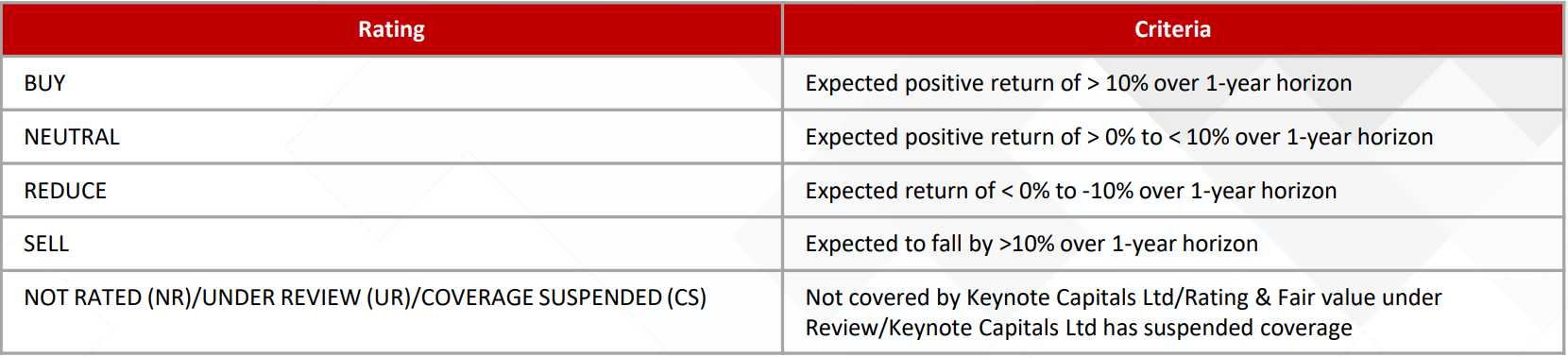

Rating Methodology

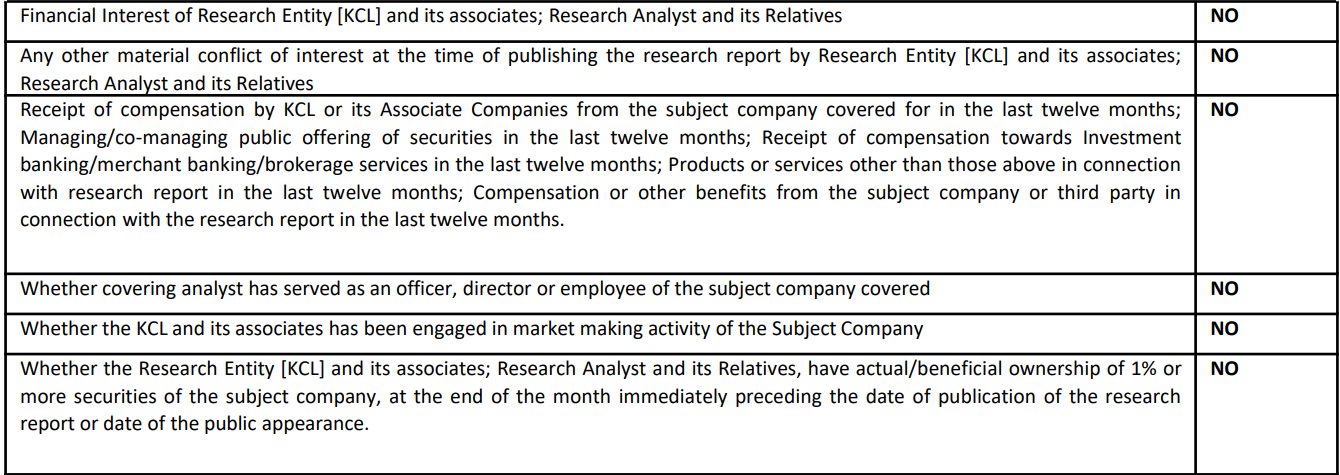

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the

Regulations).

Keynote Capitals Ltd. (KCL) is a SEBI Registered Research Analyst having registration no. INH000007997. KCL, the Research Entity (RE) as defined in

the Regulations, is engaged in the business of providing Stock broking services, Depository participant services & distribution of various financial

products. Details of associate entities of Keynote Capitals Limited are available on the website at https://www.keynotecapitals.com/associate-entities/

KCL and its associate company(ies), their directors and Research Analyst and their relatives may; (a) from time to time, have a long or short position

in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies)

discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to

any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific

recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the

associates of KCL even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report.

KCL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the

recipients of this report should be aware that KCL may have a potential conflict of interest that may affect the objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

Details of pending Enquiry Proceedings of KCL are available on the website at https://www.keynotecapitals.com/pending-enquiry-proceedings/

A graph of daily closing prices of securities is available at www.nseindia.com, www.bseindia.com. Research Analyst views on Subject Company may

vary based on Fundamental research and Technical Research. Proprietary trading desk of KCL or its associates maintains arm’s length distance with

Research Team as all the activities are segregated from KCL research activity and therefore it can have an independent view with regards to Subject

Company for which Research Team have expressed their views.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject KCL & its group companies to registration or

licensing requirements within such jurisdictions. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain

category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

Specific Disclosure of Interest statement for subjected Scrip in this document:

Supreme Industries Ltd. | Quarterly Update

The associates of KCL may have:

– financial interest in the subject company

-actual/beneficial ownership of 1% or more securities in the subject company

-received compensation/other benefits from the subject company in the past 12 months

-other potential conflict of interests with respect to any recommendation and other related information and opinions.; however, the same shall

have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are

completely independent of the views of the associates of KCL even though there might exist an inherent conflict of interest in some of the stocks

mentioned in the research report.

-acted as a manager or co-manager of public offering of securities of the subject company in past 12 months

-be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial

instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies)

-received compensation from the subject company in the past 12 months for investment banking / merchant banking / brokerage services or from

other than said services.

The associates of KCL has not received any compensation or other benefits from third party in connection with the research report.

Above disclosures includes beneficial holdings lying in demat account of KCL which are opened for proprietary investments only. While calculating

beneficial holdings, it does not consider demat accounts which are opened in name of KCL for other purposes (i.e. holding client securities,

collaterals, error trades etc.). KCL also earns DP income from clients which are not considered in above disclosures.

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part

of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed

by research analyst(s) in this report.

Terms & Conditions:

This report has been prepared by KCL and is meant for sole use by the recipient and not for circulation. The report and information contained herein

is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the

media or reproduced in any form, without prior written consent of KCL. The report is based on the facts, figures and information that are believed to

be true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from publicly

available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation of offer to buy or

sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers simultaneously, not all

customers may receive this report at the same time. KCL will not treat recipients as customers by virtue of their receiving this report

Disclaimer:

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions,

based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise

of independent judgment by any recipient. Each recipient of this document should make such investigations as it deems necessary to arrive at an

independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and

should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be

suitable for all investors. Certain transactions -including those involving futures, options, another derivative product as well as non-investment

grade securities – involve substantial risk and are not suitable for all investors. No representation or warranty, express or implied, is made as to the

accuracy, completeness or fairness of the information and opinions contained in this document. The Disclosures of Interest Statement

incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed

in the report. This information is subject to change without any prior notice. The Company reserves the right to make modifications and

alternations to this statement as may be required from time to time without any prior approval. KCL, its associates, their directors and the

employees may from time to time, effect or have affected an own account transaction in, or deal as principal or agent in or for the securities

mentioned in this document. KCL, its associates, their directors and the employees may from time to time invest in any discretionary PMS/AIF

Fund and those respective PMS/AIF Funds may affect or have effected any transaction in for the securities mentioned in this document. They may

perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred

to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account

before interpreting the document. This report has been prepared on the basis of information that is already available in publicly accessible media

or developed through analysis of KCL. The views expressed are those of the analyst, and the Company may or may not subscribe to all the views

expressed therein. This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on,

directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for

distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would subject KCL to any registration or licensing

requirement within such jurisdiction.

Supreme Industries Ltd. | Quarterly Update

The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction. Neither the Firm, not its directors, employees, agents

or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost

profits that may arise from or in connection with the use of the information. The person accessing this information specifically agrees to exempt KCL

or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold KCL or any of its affiliates

or employees responsible for any such misuse and further agrees to hold KCL or any of its affiliates or employees free and harmless from all losses,

costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

Keynote Capitals Limited (CIN: U67120MH1995PLC088172)

Compliance Officer: Mr. Jairaj Nair; Tel: 022-68266000; email id: [email protected]

Registered Office: 9th Floor, The Ruby, Senapati Bapat Marg, Dadar West, Mumbai – 400028, Maharashtra. Tel: 022 – 68266000.

SEBI Regn. Nos.: BSE / NSE (CASH / F&O / CD): INZ000241530; DP: CDSL- IN-DP-238-2016; Research Analyst: INH000007997

For any complaints email at [email protected]

General Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.keynotecapitals.com; Investment in securities market are subject to market risks, read all the related documents carefully before investing.